For many investors, the ability to create consistent cash flow is one of the most attractive aspects of real estate investing. That’s often true for Fundrise investors, too. That’s because Fundrise gives investors the potential for creating cash flow through quarterly dividends.

But what are Fundrise dividends? And how do they work?

In short, Fundrise dividends are the payment of your share of the income that your Fundrise investments generated during the prior quarter from sources like loan interest and rental payments.

Unsure what that means? Let’s break it down further:

- Dividends are generally the distribution of income earned from investments. Real estate can generate returns in two main ways: income and appreciation. Dividends are the distribution of this income, and can also include other sources such as a return of capital. Appreciation is earned and paid differently, as explained later on.

- Investors can earn returns in proportion to their share ownership. The returns that an investor can earn are proportional to the amount of the investment that they own. For example, if one person owns 100 shares and another person owns 1,000 shares of the same investment, the person with 1,000 shares is entitled to a greater portion of the return.

- Dividend returns are prorated for the duration of ownership. An investor is entitled to their share of any income earned by an investment while they own it. In the case of a Fundrise investment, if an investor owns an investment for an entire quarter, they get their portion of any income earned by that investment during that entire quarter. But, if they bought their investment halfway into a quarter, they are entitled to their share of any income that the investment earned only from the point that they bought their investment.

Now that we’ve established how an investor can earn a dividend, let’s look at the next logical question: How can Fundrise investments earn the income that’s behind a dividend payment?

How can Fundrise investments earn income to create a dividend?

Fundrise-sponsored funds can generate income through both debt and equity investments in a few ways, but they both can provide consistent streams of income for Fundrise investors. First, let’s look at how real estate debt investments typically work.

Loan Interest Payments

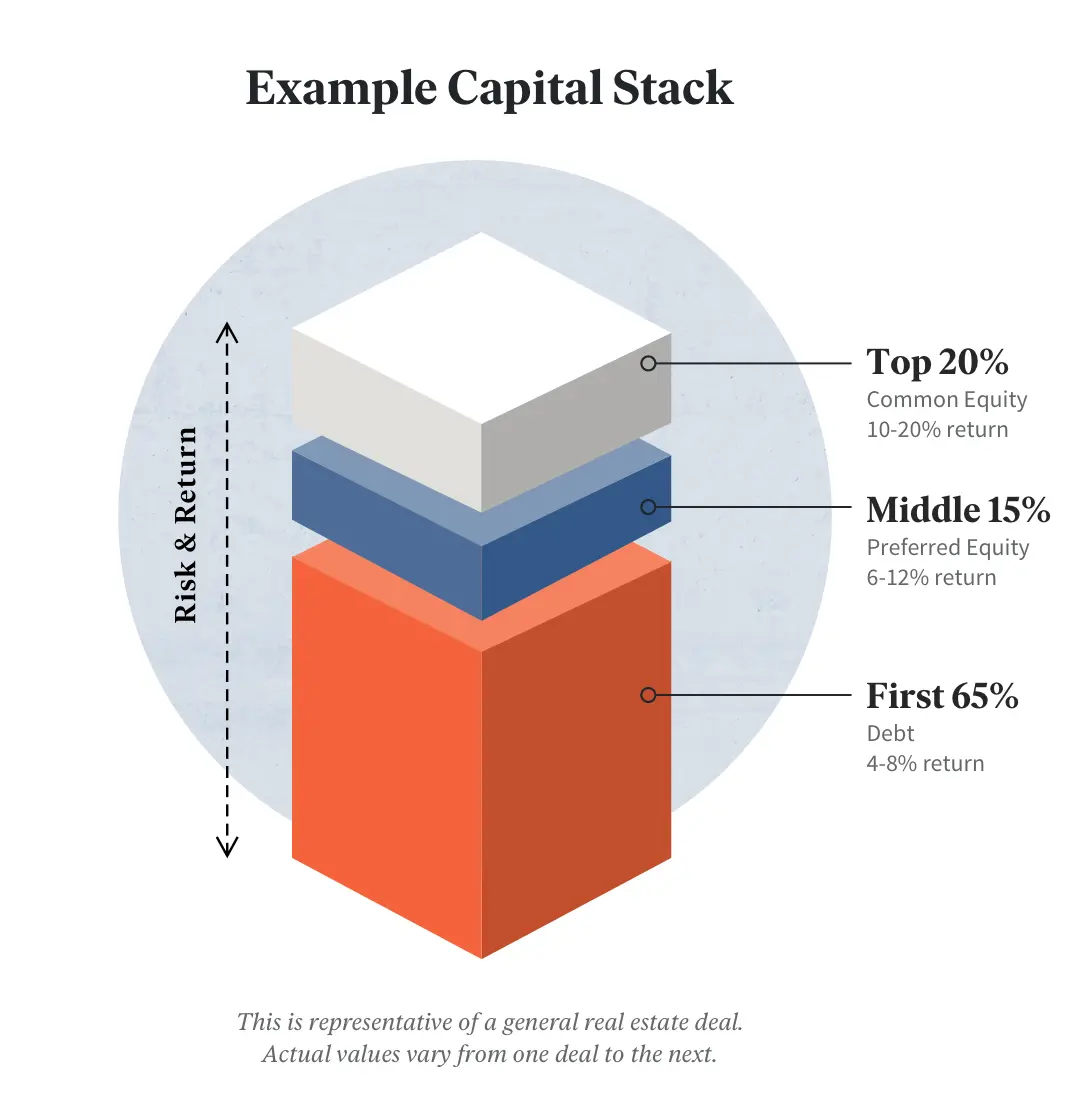

Under a real estate loan investment (a debt investment), money is lent to a real estate developer who pays interest on the principal lent. Loans generally carry a fixed interest rate that is paid on a monthly basis, which make them useful sources of income. In the capital stack, debt is the most senior component, which means that debt investors are given priority to be paid first.

Within the debt tranche of the capital stack, there’s a division of seniority among loans, which determines which loans receive repayment first. Senior lenders generally have priority over junior debt holders and mezzanine debt holders. On top of seniority, debt can be further divided by secured and unsecured positions, which determine rights and priority of repayment in the event of loan default.

At Fundrise, our real estate private equity team only considers debt investments that offer our investors strong positions both to potentially earn income and safeguard against losses. In terms of debt investments, we pursue senior secured debt and mezzanine debt. In senior debt investments held by the funds, investor capital is senior to the sponsor or borrower, so Fundrise investors can receive payment priority.

Equity Income Potential

Loans aren’t the only investment type that can earn income. Traditional equity investments can give investors certain rights, including the right to rental income when the property is leased to tenants. As a long-term investment, real estate investors with equity ownership rights can earn significant income over time from rental payments.

When you become a Fundrise investor, you become the partial owner of dozens of properties. Regardless of whether the real estate is residential or commercial, an investor with equity ownership has the potential to collect a consistent income from the tenants who rent it.

In addition to traditional equity, preferred equity investments can also offer investors regular income. Similar to loan interest payments, preferred equity investments offer a fixed rate of return commonly referred to as “preferred return.”

Fundrise Dividend Distribution

Many of Fundrise’s offerings take the form of a real estate investment trust (REIT), which is legally required to derive at least 75% of its gross income from real estate-related sources, invest at least 75% of their total assets in real estate, and distribute at least 90% of their taxable income to shareholders every year in the form of dividends in order to avoid double taxation.

Fundrise makes dividend payments to investors in cash. Many investors choose to automatically reinvest their dividends back into their Fundrise account via our dividend reinvestment program.

It’s important to note that the payout of your dividends is not dependent on the value of your funds’ shares themselves. And to receive dividends, you do not need to sell any shares. In fact, you don’t have to do anything at all after the initial purchase of shares. When a dividend is issued, you will receive it automatically without any added effort. That’s why we often refer to the stream of money that investors receive as dividends as “passive” or “residual” income.

Dividends Are Just One Way that Your Investment Can Earn Money

Real estate investing holds the unique potential for generating both cash flow and long-term appreciation. While a property collects a steady stream of income from paying tenants, the real estate itself might gain value too. So when the property is eventually sold, it can generate gains for its equity investors in addition to any of the income that it earned previously over the course of the investment’s lifetime.

But unlike dividends, which are typically paid quarterly throughout the lifetime of an investment, some part of appreciation is only realized at the property level at the end of an investment’s lifetime. Why? While appreciation can be captured through a return of capital during an investment’s lifetime, some is captured at the property level only when an equity investment is sold. Investors can also realize appreciation at the fund level if the Net Asset Value (NAV) per share increases over time. Depending on which eREIT investments you hold, that may mean that a limited or significant portion of your return potential may be reaped at the end of each project’s lifecycle.

Dividends and Fundrise Investment Plans

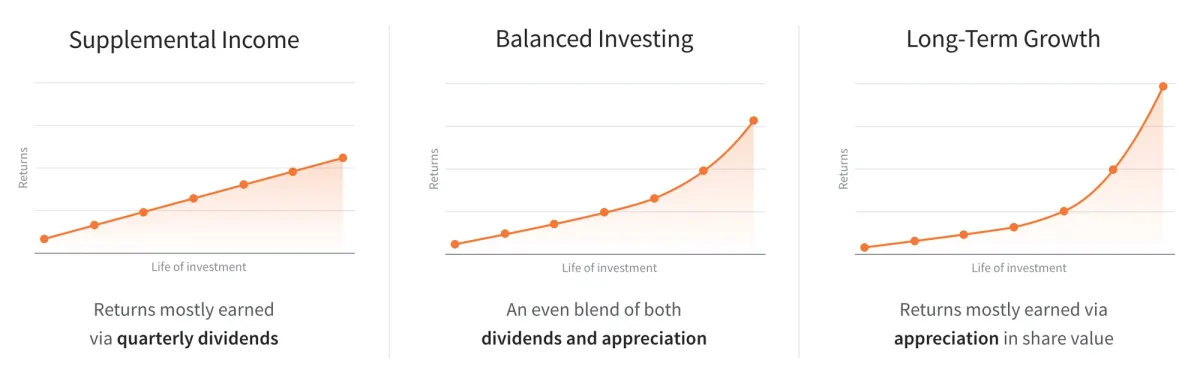

We’ve designed each Fundrise Investment Plan to achieve different goals. To meet these goals, each Investment Plan is allocated across different funds, each of which makes debt and equity investments. This gives each portfolio a different ratio of earning potential across income and appreciation.

For example, our Income Plan is designed to earn more income than appreciation. With that return profile, return potential is expected to be captured mostly through income paid through dividends. This plan is allocated more heavily in debt than equity, but the equity investments that the eREITs in this plan hold still offer the potential to capture some potential appreciation. The Income Plan will generally be expected to have larger regular dividend payments than other plans, but its potential lump sum payment at the end of each project (capturing any appreciation) will likely be smaller than other plans.

Alternatively, our Growth Plan is built to capture returns more from property appreciation over the long-term than regular income payments via dividends. This plan is weighted towards funds that allow investors to capture gains through potential increases in property values over the long term, but which also hold some debt investments, so the plan can provide regular dividends as well. In general, the Growth Plan will be expected to have smaller dividend payment potential than the other plans, but it holds the most potential to capture the greatest returns from appreciation at the end of each investment’s lifetime.

Now that you have a better understanding of dividends and how they fit into the return profile of Fundrise investments, you’re better prepared to understand and evaluate each Fundrise Investment Plan, and determine how the earning potential of real estate can fit into your investment portfolio.

And beyond that, if you’re interested in creating your own custom investment plan, you can. As a Fundrise Pro member, you have the option to shape your portfolio to your preferences by setting a target allocation across our various investments.

If you ever have any additional questions about dividends, though, feel free to reach out to our team at investments@fundrise.com.