REITs offer investors of all sizes an easy way to add the historically strong investment class of real estate to their investment portfolios. Today, more than 87 million Americans are estimated to own REIT shares.

What are REITs exactly? A REIT (real estate investment trust) is a company that makes investments in income-producing real estate. Investors who want to access real estate can, in turn, buy shares of a REIT and through that share ownership effectively add the real estate owned by the REIT to their investment portfolios. This investment provides investors exposure to all of the properties owned by the REIT.

What makes a REIT unique? A background on REITs.

Why were REITs created?

REITs were invented in the United States in the Cigar Excise Tax Extension of 1960 under President Eisenhower. They were intended to offer ordinary investors an affordable way to afford to invest in diversified portfolios of income-producing real estate. Ownership through a share-based model makes it similar to the way a mutual fund sells shares and pools many different investments in a single place.

REITs are unique in many ways, and are required by law to follow a specific set of operating requirements in order to qualify for designation as a REIT. One major distinction from other investment vehicles is that REITs are required to derive at least 75% of their gross income from real estate-related sources and invest at least 75% of their total assets in real estate. REITs are also required by law to distribute at least 90% of income earned from their real estate investments directly to investors. The funds from operations (FFO) measurement is typically one of the most helpful measurements when comparing performance among REITs.

Real estate can prove a valuable addition to a traditional stock-and-bond portfolio in many ways. Real estate can earn both long-term returns via appreciation and regular yields through dividends. Additionally, real estate has the power to diversify an investor’s overall portfolio. Thanks in part to these operating requirements, REITs offer investors an easy, affordable, relatively low-risk way to invest in real estate. However, as we examine below, not all REITs are created equal. Attributes such as a REIT’s investment strategy, or how a REIT is traded can impact many things, including its earning power and diversification potential.

How do REITs work?

Once a fund successfully qualifies as a REIT, investors can buy shares in a variety of ways. The REIT pools this capitalization to make investments in different kinds of real estate investments. Investments can include the REIT’s direct ownership of real estate, real estate loans, or both.

REITs can be classified in three fundamental ways:

- By the types of investments they pursue (i.e. equity or debt, such as a mortgage REIT).

- By the way in which their shares are traded (i.e. exchange-traded REITs or non-listed REITs).

- By the real estate sectors on which they focus (i.e. healthcare REITs or industrial REITs).

As with a mutual fund, each share of a REIT represents partial ownership of all the individual assets held by the fund. Therefore, any change in the value and price of a REIT’s shares reflects the change in the value of the overall collection of individual real estate properties the REIT holds.

Also like a mutual fund, REITs are professionally managed by one or more fund managers, who determine and implement the REIT’s investment strategy.

How does a REIT earn returns?

Income

In equity investments, income is often generated from sources such as rental payments from tenants, typically on a regular basis. These might include:

- Individuals paying for living space.

- Businesses paying for retail space.

- Organizations paying for office space.

In debt investments, income is earned from loan interest payments, which are also typically along a consistent and predetermined timeline of amortization.

Appreciation

If a REIT owns a property directly (equity ownership), then any increases, or appreciation, in property value can impact the value of the REIT itself. Therefore, the value of the individual shares of a REIT may appreciate in value as the properties the REIT owns appreciate – or, alternatively, of course, the share values may depreciate as the properties lose value.

How do REIT investors realize returns?

Just as REITs can earn returns in the form of income or appreciation, REIT investors can also realize the same types of returns. For income-generating investments, REIT investors typically realize returns through dividend distributions, which represent the income earned by individual real estate properties. Dividend distributions are typically paid to investors by the REIT in proportion to their share of ownership of the entire fund on a regular basis.

Meanwhile, in order to realize appreciation-based returns, an investor generally must sell his or her REIT shares. Unlike income, which can be distributed to an investor on a regular basis, appreciation is generally realized upon sale of shares in a single, lump sum return. That said, when a REIT sells an underlying property, capital gain dividends can be distributed to investors without requiring those investors to divest of their shares. Typically, any appreciation realized in this way by an investor on an equity investment (REITs included) is categorized as a capital gain.

For many investors, one major attraction of REITs is their potential to offer returns in the forms of both appreciation and income. Furthermore, both kinds of returns have the potential to grow in parallel; Unlike many other investment types, real estate is a hard asset, naturally limited in supply and imbued with intrinsic value. As demand for real estate increases, the underlying value of a property can increase at the same time as its rental income potential. This is a major reason why real estate is a historically high-performing asset class.

Why are REITs popular?

On top of offering wide access to an asset class that would typically be out of reach of most individual investors, some REITs can offer this access at a lower investment minimum and risk level than other investment methods. And, importantly, they make accessing real estate easier.

How do REITs accomplish this suite of benefits? For one, they offer everyday investors exposure to real estate, both commercial real estate and otherwise, without the high levels of risk that come with direct ownership. Direct ownership requires many upfront and ongoing resources from an investor, including a large initial sum of capital for a down payment. Additionally, a great deal of real estate expertise, financial acumen, and ongoing property management are needed to ensure that a direct property investment runs smoothly and earns a net positive return.

Beyond those hurdles, direct ownership often requires an investor to tie up a large amount of capital in a single asset for the duration of ownership. Depending on an investor’s access to capital, that naturally limits the number of investments that most investors can make, therefore concentrating risk to only one or a handful of assets. REITs, on the other hand, generally hold a portfolio of assets, providing shareholders with inherent diversification across multiple pieces of real estate. This reduces the risk of any single investment and improves the portfolio’s total risk-adjusted return potential.

Similarly, REITs give investors the opportunity to invest in many kinds of real estate, as they may not be able to otherwise. A property might fall into one of many sectors of real estate, such as commercial buildings, healthcare spaces, residential developments, industrial projects, and more. A REIT can offer diversification in both number and category.

Finally, unlike most direct ownership options, the shares of some REITs can be bought in a few clicks of a mouse. However, as previously mentioned, it’s still important for an investor to do all appropriate due diligence, educate themselves, and develop the capability to assess investment opportunities before taking steps toward actual investment.

What tax advantages do REITs offer?

In addition to the standard tax benefits available to investors who choose to access REITs through traditional tax-advantaged accounts (such as retirement accounts), REIT investors have the potential to enjoy several additional, important upsides.

The first and most well-known tax advantage is actually related to a fund’s basic ability to be classified as a REIT.

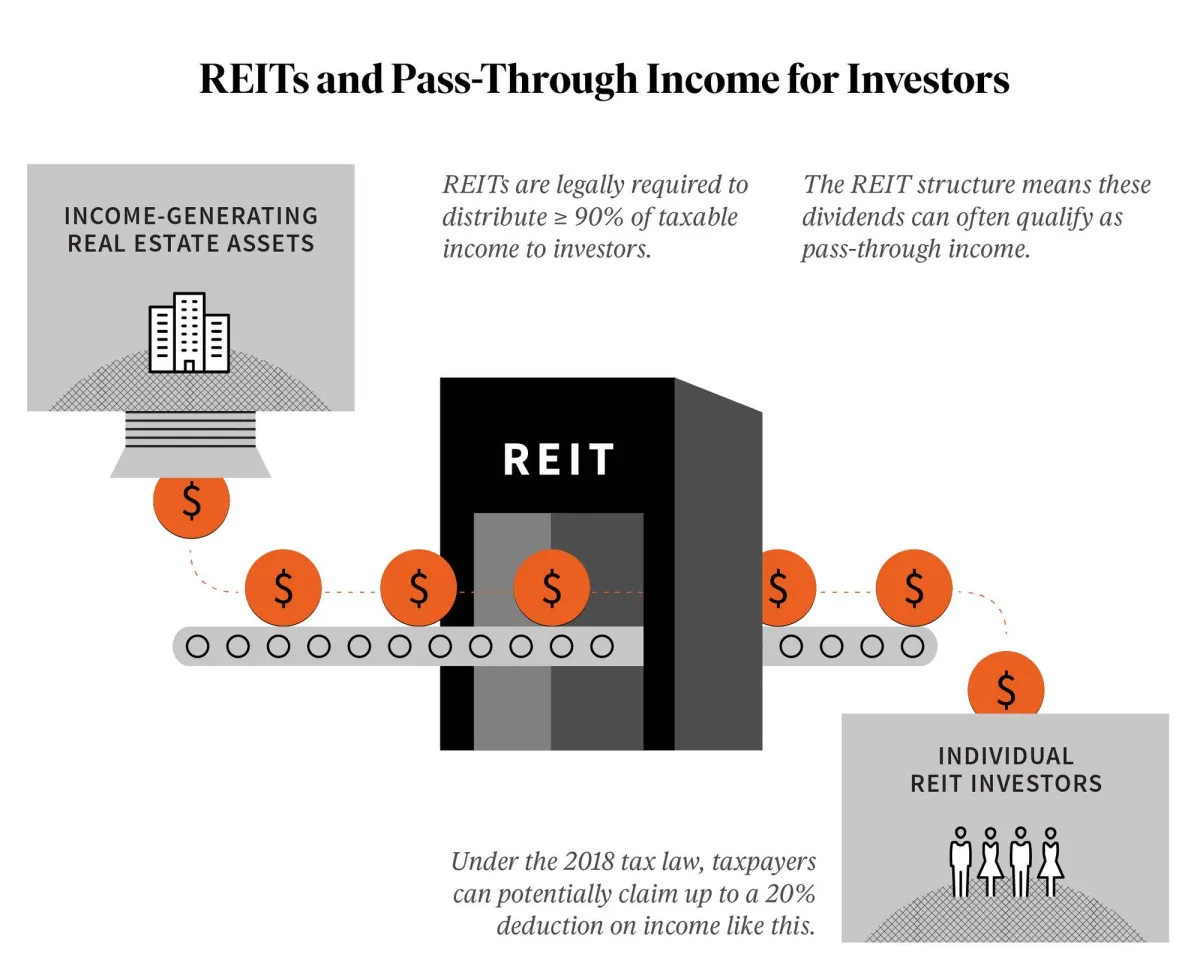

- In order to receive the official REIT designation, one of the requirements is that a fund must distribute at least 90% of its taxable income every year to its shareholders through dividend distributions.

- If a fund successfully meets the requirements to qualify as a REIT, then these earnings are not taxed at the company level.

- Instead, earnings are distributed to investors and only taxed at the individual investor level. This removes the burden of double taxation that many investors face with traditional company stocks. The absence of a company level tax enables investors to keep a larger portion of their overall returns. And, again, if the real estate owned by a REIT is generating taxable income, the vast majority of those yields (90% or more) will reach investors’ hands within a year.

On top of these basic, categorical tax benefits, a significant REIT tax advantage was introduced as part of provisions included in the Tax Cuts and Jobs Act (TCJA) of 2017. Beginning in 2018, REIT investors have enjoyed additional substantial tax deductions on the taxable income they receive from REITs (that is, as dividends).

The tax law introduced by the TCJA stated that qualified business income paid to owners or investors of pass-through businesses is privileged to a deduction of up to 20%.

Let’s break it down further. Here are the main changes made in the TCJA that improve the tax treatment of REIT investments:

- The lion’s share of the deductions come as a direct result of the law’s treatment of pass-through businesses, which nearly all REITs are. Most REIT income is considered pass-through because, as mentioned above, REITs are required by law to distribute at least 90% of their income from their real estate investments directly to investors.

- Under the law, a deduction of up to 20% is now available for qualifying business income, which can apply to the REIT income an individual receives. The exact deduction potentially varies, depending on the taxpayer’s total taxable income.

- For additional information on the details of this determination, potential exceptions, and how exact amounts are calculated, read more here.

Types of REITs

Let’s now take a closer look at the many characteristics that categorize REITs and can potentially distinguish one REIT from another. There are many different ways to classify REITs, but there are three fundamental factors. We go into each category and its sub-categories in depth below, but this chart offers the overall breakdown at a quick glance:

| Equity | Debt | Hybrid (equity + debt) | |

| Advantages |

|

|

|

| Disadvantages |

|

|

|

| Publicly Traded | Public Non-Traded | Private | |

|

|

| |

| There are some REITs that focus on real estate assets within a real estate sector or particular industry. There are sector-focused REITs for virtually every specialized kind of real estate. Health care REITs may focus on hospitals, and retirement homes while office REITs may focus on office buildings and skyscrapers. Likewise, hospitality REITs can focus on hotels, motels, and resorts. Retail REITs can focus on storefronts and restaurants and residential REITs focus on single-family homes, multi-family apartment buildings, student housing, or senior housing. | |||

Investment Type

There are three main ways to categorize REITs based on the financial structures of their underlying holdings:

- Debt;

- Equity;

- A hybrid of both.

Debt and equity investments each present their own potential upsides, and each has its own implications on an investor’s potential return profile. This can include how frequently an investor will receive returns and the mechanism through which an investor will eventually realize returns.

Equity

An equity REIT participates in the direct ownership (and often the operation and development) of the real estate assets that it owns, which can include both commercial real estate and/or for-sale housing. Equity REIT managers often define their investment strategies based on how much physical work and capitalization they believe is needed to raise investment properties to their highest value and potential for producing income.

Within the broad category of equity REITs, there are REITs that focus on specific kinds of equity strategies. For example, an opportunistic equity REIT focuses on assets that will need to have value added through renovations or development in order to increase in value and rental income potential. Other equity REITs may only acquire fully occupied, income-producing stabilized properties, which require less hands-on work and capital over the long term. Rental income from equity investments can often be substantial, with particularly smart investments in fast-growing areas producing the most potential cash flow.

Typically, the greater the amount of work required to make a property profitable, the greater the return potential, but also the higher the risk.

Because equity real estate investments are well-suited for long-term investment horizons, they often fit naturally with an investment strategy meant to support individual retirement or to build a lasting foundation for an investor’s finances.

Advantages of Equity REITs

- High potential for long-term growth, including larger relative returns and opportunistic strategies.

- No predetermined cap to potential returns.

- Potential income generation through rental payments from tenants leasing the properties owned by the REIT.

Disadvantages of Equity REITs

- Equity investments can require more ongoing costs, as property management and/or improvements demand.

- Higher return potential is accompanied by higher risk.

- Fewer safeguards are available than with debt investments.

Debt

While some REITs only invest in equity, other REITs instead invest exclusively in debt. The value of debt vs. equity can often depend on the current state of the economy and, specifically, trends in interest rates.

- Unlike equity real estate investments that include property ownership, debt (or mortgage) investments are loans made to equity owners in exchange for ongoing repayments of principal with interest.

- Unlike equity investments, debt investments typically have defined terms specifying the amounts of payment and the schedule of those payments from the borrower to the lender. Amortization schedules can have strict end dates or they can be open-ended.

- While return potential from debt investments is often not as high as the return potential from equity investments, debt’s relative consistency and cash flow potential offer benefits of their own.

Advantages of Debt REITs

- Many debt or mortgage REITs (also known as mREITs) are considered to have high yield potential. These distributions are often treated as income and paid to investors as dividends, as discussed above.

- Debt REITs can be relatively low risk, thanks to their investments’ positions within the capital stack. The capital stack is the mechanism that prioritizes which investors get paid back first in the case of a security defaulting. Advantageous capital stack positioning makes mortgage REIT assets attractive to investors with lower risk tolerance.

Disadvantages of Debt REITs

- No open-ended growth potential.

- The earning potential of loans is largely dependent on interest rates.

Hybrid REITs

As implied by the name, hybrid REITs invest in a blend of both equity and debt real estate investments.

Advantages of Hybrid REITs

- Hybrid REITs can support both long-term growth via equity investment appreciation and income generation via debt investments and rental income.

- With a blended approach that takes advantage of both debt and equity investments, a hybrid REIT can pursue any real estate investment that appears attractive.

- A hybrid REIT is better suited to withstand external market forces thanks to its portfolio of assets comprising a mixture of investment structures.

Disadvantages of Hybrid REITs

- Without a strong focus on either equity or debt, a hybrid REIT may not deliver either income or long-term appreciation exceptionally well.

Market Type

REITs can also be categorized based on the market in which they’re traded, which ultimately determines how investors can access them. This distinction is crucial for individual investors, because a REIT’s market can determine who is able to access it as well as investment minimums.

First, REITs are broadly divided between whether or not they’re regulated by the Securities Exchange Commission (SEC) and, secondly, by whether their shares are traded on an exchange.

- Publicly traded REITs are registered with the SEC and listed on a public stock exchange, just like the shares of a publicly traded company.

- Private REITs are neither registered with the SEC nor listed on an exchange for trading.

- Public non-traded REITs are registered with the SEC but not listed on a public exchange. They’re also sometimes referred to as non-listed REITs. (As discussed below, Fundrise’s eREITs are unique funds and do not fall into any traditional REIT classification. However, they operate most similarly to public non-traded REITs.)

Publicly Traded REITs

Publicly traded REITs offer investors the benefits of SEC regulation, public reporting, and open trade on a public exchange. Trade on a stock exchange offers investors an easy way to access liquidity with no minimum holding period. However, this access to daily liquidity comes at an intrinsic cost known as the “liquidity premium,” which lowers an investment’s earning potential.

Many investors default to desiring liquidity, because it’s a common feature of the stock market. But paying a “liquidity premium” is often not in an investor’s best interest, especially if they’re pursuing long-term growth where trading is minimal, such as building retirement savings accounts.

Another public, liquid way to invest in REITs is through ETFs (exchange traded funds). REIT ETFs, such as the Vanguard REIT ETF, invest in several public REITs through a single publicly traded fund. REIT ETFs make multiple public REITs accessible in a single diversified offering, similar to securities held by an index fund.

Possibly the largest downside of publicly traded REITs is that their performance is highly correlated to the broader public market. This correlation causes volatility, and with that, share prices are prone to move in tandem with the rise and fall of the stock market. This can happen regardless of whether or not anything has materially changed in respect to the underlying properties owned by the REIT.

As a result of this correlation with public markets, publicly traded REITs offer little in the way of true diversification beyond standard public market assets — something normally expected when investing in a new asset class like real estate.

Private REITs

As the name suggests, private REITs are neither registered with the SEC nor traded on an exchange. As a result of not being listed on a public exchange, private REITs typically offer low liquidity. However, this feature also means that their performance is not correlated with that of the stock market. This means that private REITs can offer strong asset class diversification as a genuine alternative investment.

As a result of not being registered with the SEC or traded on an exchange — and pursuant to regulations — private REITs are only available to institutional investors and accredited individual investors. They also tend to carry higher minimum investment amounts, plus high fees, which can be prohibitive for many investors who are eligible to invest.

Public Non-Traded REITs

Non-traded REITs (or non-listed REITs) have grown in popularity recently because of the wider access they can offer thanks in large part to the JOBS Act of 2012, their diversification potential, and the historical performance of some non-traded REITs delivering consistent double-digit returns to investors.

Because public non-traded REITs are regulated by the SEC, they are governed by similar standards as traditional public REITs. This means that they provide considerable transparency, including public reporting. But because they’re not listed on a public exchange, non-traded REITs don’t offer their investors a way to sell their shares on a secondary market and therefore offer lower liquidity.

However, like a private REIT, because non-traded REITs are not publicly traded, their performance is not correlated to the performance (and therefore volatility) of a public market investments. Like private REITs, these characteristics make public non-traded REITs a legitimate option as an “alternative investment,” to diversify your investment portfolio by adding a new asset class.

It’s important to note that, much like a private REIT, the accessibility and investment minimum of public non-traded REITs can vary from REIT to REIT, again because they aren’t sold or traded on an exchange.

Sector Focus

Equity REITs are further categorized by the types of property in which they invest. This is where REIT strategies really potentially diverge. The types of available REIT sectors are varied and wide-ranging. There are REITs that focus on every type of property imaginable, from apartment buildings to data centers to self-storage facilities. There are REITs like healthcare REITs that focus on healthcare properties, residential REITs that focus on homes, retail REITs that focus on shopping, and so forth.

If there is a particular class of property you’re interested in holding, there’s a chance that there’s a REIT specializing in that kind of real estate.

How to Invest in REITs

Investors have several options for investing in REITs, ranging from very simple access on a public exchange, to new online investment platforms, such as Fundrise.

Private Market

As explained above, private REITs are typically limited to institutional investors and accredited investors who can find and access the funds directly or through private networks. Private REITs are inherently exclusive — and usually require substantially higher minimum investments than the public market or new tech-driven investment options. These barriers naturally limit private market investments to the more experienced, well-connected, wealthy investors.

Public Market

On the opposite end of the spectrum, traditional public markets allow investors to access publicly traded REITs the same way they can buy shares of stocks, mutual funds, ETFs, index funds, or other securities. Because publicly traded REITs are listed on a public exchange, investors are able to buy shares of these funds easily through a broker service. Publicly traded REITs also offer the benefit of high liquidity. However, as the performance of public REITs is highly correlated with stocks, bonds, commodities, and other securities traded in the stock market at the market level, public REITs can’t offer meaningful diversification for investors heavily invested in traditional publicly traded assets.

New Investment Platforms

One of the most exciting developments in the world of REIT investing in the last decade is the creation and growing adoption of new online real estate investment platforms that provide investors access to real estate through REITs.

This is a major development, because prior to the introduction of online platforms, many REITs (both private REITs and some public non-traded REITs), had strict limitations for investors. However, regulation advancements made possible by the JOBS Act lowered the barrier to some REITs and ultimately made it possible for more investors to access the asset class of real estate.

The direct access model of many of these online REITs avoids the stringent exclusivity of the private market, while still striving to be powered by fundamentally sound and high-opportunity real estate. Still, some real estate investment platforms only offer access to REITs that require five-digit lump minimums to get started, but others, such as Fundrise, offers access to REITs to non-accredited investors with an investment minimum as low as $10.

In summary, real estate investment platforms give investors access to a quality of real estate that public REITs simply cannot, and they do so with a low barrier of entry, as private REITs are unable to do. As a result, online real estate investing has the potential to offer the best of both worlds to many investors. As with all investments, important factors like fees, the details of access, investment minimums, and liquidity vary from platform to platform.

Fundrise and eREITs

Fundrise is the first real estate investment platform to create a simple, low-cost way for anyone to invest in private market real estate for as little as $10, and access its historically consistent returns in the form of dividends and appreciation. Fundrise has reinvented REITs for the internet age with Fundrise eREITs that contain diversified portfolios: the first-ever fully online real estate investment trusts.

As a result, Fundrise eREITs offer unique advantages not previously available to most investors:

- As private market investments, Fundrise eREITs offer meaningful diversification to most investors, because their performance is substantially less correlated to the volatility of public market investments than public counterparts.

- Fundrise eREITs are low-cost and low-fee thanks to Fundrise’s online platform, which offers direct distribution. This approach removes the middlemen that many traditional investment methods still rely on, eliminating the layers of costs and fees that ultimately diminish an investment’s return potential.

- Unlike other private market investments, investments in the Fundrise eREITs can offer liquidity on a limited basis through our redemption plans.*

- eREITs are unique funds and do not fall into any traditional REIT classification, though they operate most similarly to public non-traded REITs. They’re regulated by the SEC and are required to follow strict reporting requirements including annual audits and regular financial reporting.

- Fundrise is available to non-accredited and accredited investors alike.

You can find out more about opening your own investment account filled with a diverse range of Fundrise real estate here.

Putting it all together

As you’ve seen, REITs come in a wide variety of types and specializations. However, in one significant way, all REITs represent a major opportunity for many investors: the chance to add real estate to an investment portfolio in the form of a managed fund, without the hassle and expense of direct ownership.

Real estate has long been acknowledged as a historically important investment class, potentially offering increased portfolio diversification, low volatility, and superior risk-adjusted returns. REITs make it easy to not just invest in real estate, but to instantly invest in a multitude of real estate assets through the simple purchase of a single REIT’s shares. While not all REITs are easy to access or particularly affordable, many are. Thanks to that accessibility, a REIT can often present the most appealing route for an individual to become a real estate investor.

Ultimately, it’s up to each investor to determine their own circumstances and personal preferences. For instance, some investors will find that the financial and regulatory restrictions of fully private REITs present no problems, and they might consider the upsides of private REITs to be worthwhile. For many other investors, open accessibility and affordability will make public REITs — either traded or non-traded — the clear choice. And finally, for many investors, new alternatives like Fundrise’s eREITs may prove to be the most compelling option. Whatever your experience is as an investor, there’s a good chance that there’s a REIT investment option suitable for you.

Through REITs, real estate investing can be simple and relatively low-cost. Any investor looking to access real estate should explore the option of doing so through a REIT with their tax advisor.