This article is part of our larger real estate investing guide available here.

Hard assets, sometimes referred to simply as real assets, can encompass several different types of assets but typically include precious metals, commodities, natural resources, and real estate.

Hard assets are a unique group of investments with the power to hedge inflation. With increases in inflation in 59 of the last 60 years in the US, the ability to hedge these increases is a valuable trait in an investment. Real estate specifically is a unique hard asset because unlike others, it can earn income while hedging inflation.

What are the characteristics of a hard asset?

Hard assets are distinct from “soft assets,” such as stock and bonds, because they hold intrinsic value. This intrinsic value is what enables these investments to hedge against rises in inflation.

An asset holds intrinsic value if it is naturally limited in supply (or scarce), and if it can be used to produce or buy a good or service that serves a fundamental, basic human need. For example, gold and diamonds can be used to both buy goods and services or to produce goods. Likewise, oil and natural gas can be used to barter or to produce goods. But, the value of paper money can be devalued to the point of zero. Likewise, it can’t be used to produce a product that serves a fundamental need.

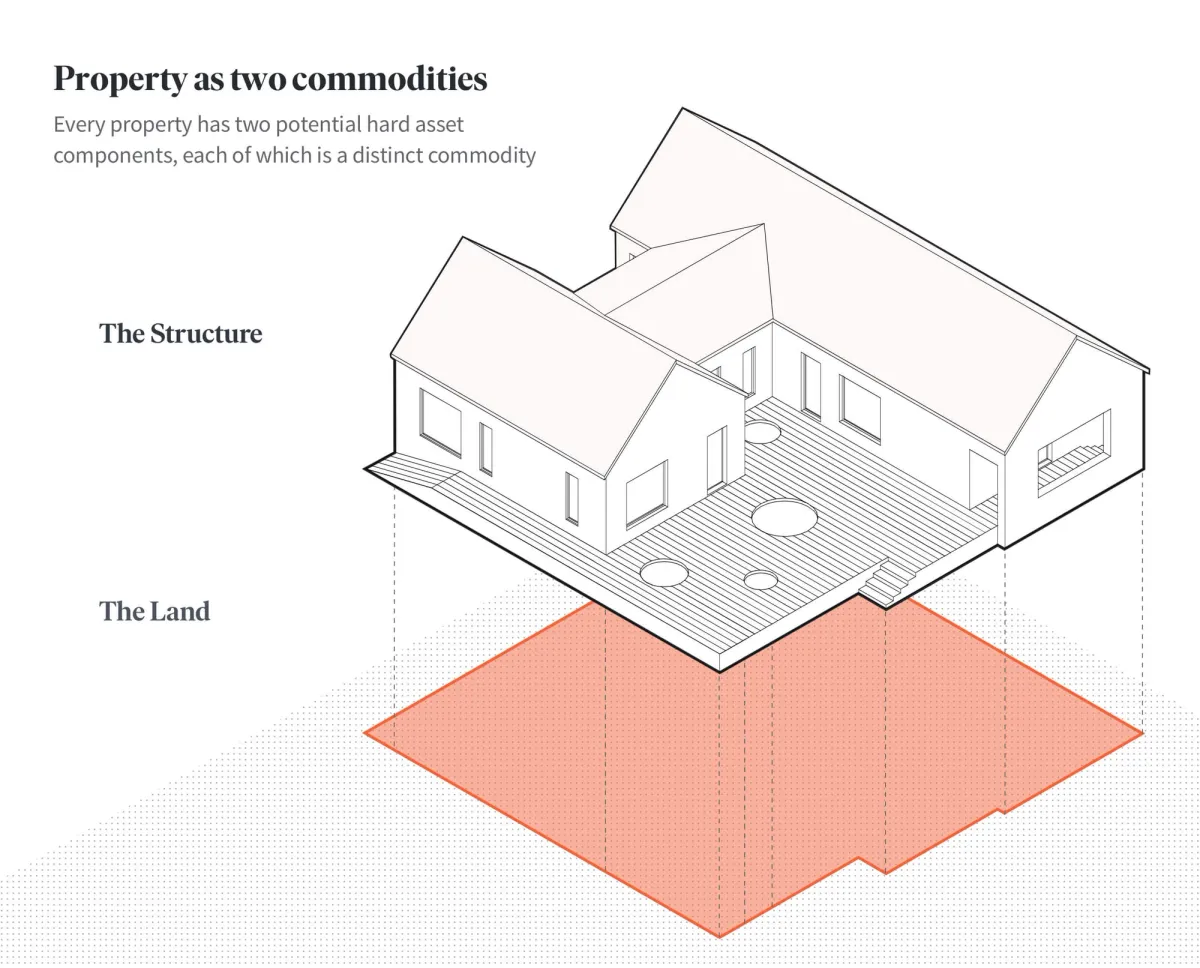

In the case of real estate, both land and any structures on it can serve basic needs, and they’re both naturally limited in supply. Therefore, a property can be viewed as two different commodities. The land itself is one commodity and structure on the land is a separate commodity.

In terms of land, there’s a limited amount in the world – but not all land is of equal value. Some land is in higher demand due to location, and supply can become scarcer more quickly. That’s why an acre of land in New York City is more scarce (and therefore more costly) than an acre of land in rural Montana.

Any structures on a plot of land are naturally limited in both quantity and size by the dimensions of the land. Therefore, a building can be viewed as a separate commodity in and of itself, composed of a combination of raw materials. If the price of those materials increases, then the cost to build a comparable building, or replacement cost, would also increase. This would, in turn, make the value of the existing building more valuable (as long as the quality and utility are comparable).

The power of natural limitations

As assets naturally limited in supply with valuable applications, hard assets have the ability to retain value when inflation rises. In other words, hard assets frequently see their values rise as the general price levels for goods and services rise.

In comparison, most publicly traded stocks and bonds have a much harder time keeping pace with general inflation. These investment types — especially bonds and similar fixed-income debt instruments — typically lose value as the Consumer Price Index increases. Because hard assets have low correlation with many stocks and bonds, they are capable of adding strong diversification power to a portfolio.

Inflation and changes in values

There are two primary drivers of inflation: economic growth and monetary debasement.

Economic growth can lead to inflation in rapidly growing economies as companies begin to raise prices for their goods and services. Because demand for these products increases, production increases, and production costs can increase, too.

The two major inputs in production costs are materials and wages. With higher production, more materials and employees are needed. This can raise competition for both materials and employees.

Higher competition for materials can raise the price of those materials, which increases production costs, and this increase in cost is typically passed on to consumers in the form of higher prices.

Likewise for employment, as companies hire more employees, unemployment falls. With lower unemployment, workers can lobby for higher wages and employers can also offer higher pay to compete for the most desirable employees.

This adds to the cost of production, which also raises the price of production and ultimately the price consumers pay.

It’s important to note that increases in prices of raw materials (which includes hard assets) can increase the production costs. The value of soft assets will rise in relation to increases in the price of hard assets as well as inflation. But hard assets, on the other hand, can both increase in price during economic expansion and resist decreases in economic contractions.

Monetary debasement occurs when a country prints more money, also known as quantitative easing, which lowers the purchasing power of the currency, making it less valuable. This may occur during a financial crisis when a central bank attempts to lower interest rates to make it easier to lend money among other tactics.

Purchasing power, or how far a dollar can go, is measured in the US most often with the Consumer Price Index (CPI) or Personal Consumption Expenditures (PCE). Both CPI and PCE measure the change in expenditures of households on a basket of goods and services, such as food and transportation over time. Both measurements are used to evaluate the change in prices that consumers directly pay over time to determine any aggregate rises or falls, which would indicate inflation or deflation.

As mentioned, there’s been a rise in inflation for the past 59 out of 60 years with the purchasing power of the US dollar diminishing with its rise. In general, the US Federal Reserve aims for a 2% annual increase in inflation for the PCE rates.

Overall, as the price of goods, such as groceries, increases, the price of hard assets will likely keep pace with inflation, preserving its intrinsic value.

The value of real estate

Real estate is a unique asset among an already unique group of assets. Not only does real estate have the ability to preserve value during periods of inflation like other hard assets, it also has the ability to earn income through rental payments for leased spaces.

Rental income potential can increase with scarcity in the same way that real estate values can. For these reasons, real estate has historically been attractive to investors seeking protection from periods of inflation.

Are you interested in investing in real estate? Fundrise offers a simple, low-cost way to invest in real estate whether you’re investing $1,000 or $100,000. You can now invest, according to your goals, in diversified investment portfolios containing real estate assets. Learn more about how Fundrise works here.