This article is part of our larger real estate investing guide available here.

All investment portfolios – even the strongest – are likely to experience some periods of loss. You can mitigate those losses by diversifying your portfolio allocation, which can increase your portfolio’s total return potential. But not all diversification strategies are created equal, and choosing the right one is crucial to your investment success.

Most investors understand the risk that comes with investing in a single stock, asset type, or industry. But what about the risk that comes with investing in only one market? Many investors are diversified across and within asset classes, sectors, industries, and more – but, usually all within the stock market, which is a public market. With the public market shrinking, and control of stocks becoming more consolidated, publicly traded investments are becoming increasingly correlated. This makes meaningful diversification increasingly difficult to achieve in the public market alone.

Wider accessibility to private market investments offers individual investors new options outside of the stock market. Private market investments – particularly real estate – is now far more accessible for most investors than it has ever been. The benefits of real estate, including little performance correlation with the stock market, a history of long-term appreciation, and the potential for regular income may make it a strong diversifying investment option for your portfolio.

What makes an investment portfolio diversified?

Diversification is used to improve the stability and return potential of an investment portfolio by reducing the risk of loss. When risk is mitigated using diversification, a portfolio’s volatility is also reduced. The lower the volatility, the more diversified an investment portfolio is likely to be. And its earning potential also likely becomes more consistent and predictable. Rather than riding the waves of public stock exchanges or segments of them, diversified investors are generally able to follow a quieter and steadier investment path thanks to their portfolios.

So, what does a diversified portfolio look like?

There are many diversification strategies, but strong ones usually try to maximize a portfolio’s risk-adjusted returns. In other words, they advocate choosing investments that offer the highest possible return at your given risk level. Your risk tolerance for your investment portfolio is likely closely linked to your goals and investment horizon. These factors should be taken into account when determining your risk tolerance.

Once you know your risk tolerance, you can begin to figure out your portfolio allocation. By investing in assets with low or no correlation, you can reduce unnecessary risk in your portfolio. When investments are correlated, they share some or all of the same set of risks. So, if one investment experiences a loss, then a correlated investment is also at risk of loss. On the other hand, if your portfolio holdings are spread across uncorrelated assets, the performance of one or more investment could mitigate losses in your portfolio when another asset underperforms. This is because uncorrelated assets are mathematically far less likely to lose value in tandem than correlated investments.

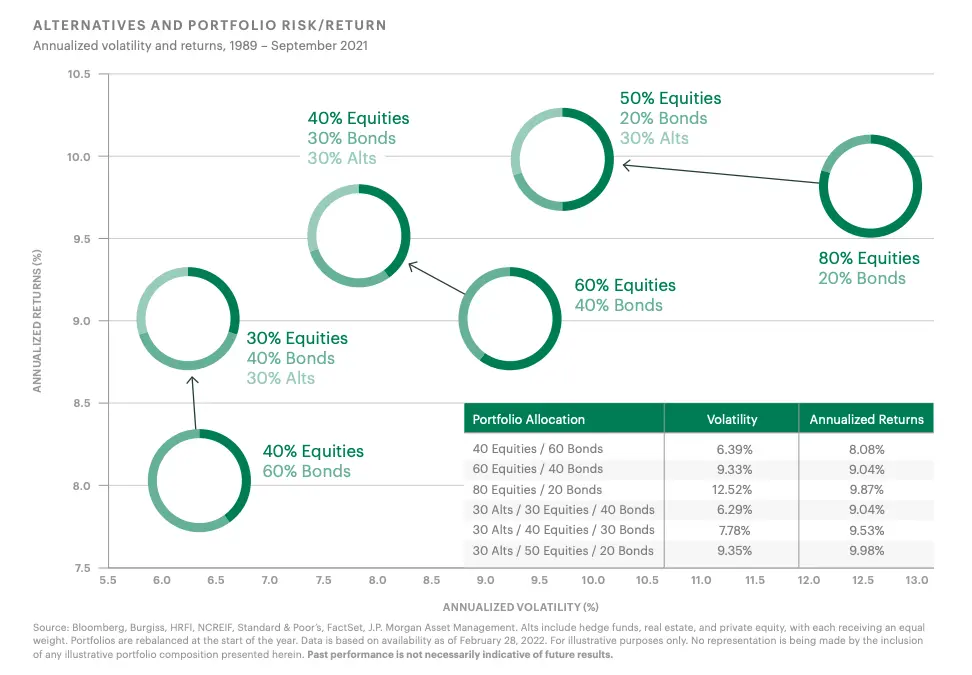

The 30+ rule

The “30+ rule” is one of the most useful and important pieces of financial insight for investors today. It’s simple: more than 20 years of data show that an individual portfolio that’s at least 30% invested in “alternative assets” — like private real estate — have handily outperformed portfolios of just stocks and bonds. Data collected from Bloomberg, S&P, J.P Morgan, and more, make it clear:1 traditional stock and bond portfolios deliver lower returns and have higher volatility than portfolios that introduce alternatives like real estate and venture capital.

And for investors who are even bolder, decades of data support allocating as much as 40% into alternatives, to more closely mimic world-class portfolios like those of the Yale and Harvard endowments. Why? You guessed it: better returns and more stability. While these kinds of allocation rules were simply impossible for many investors in the past, the investing landscape has changed, thanks to platforms like Fundrise making “alts” accessible. Now, “alternatives” are no longer alternative — they’re a must-have for any portfolio seeking strong, consistent returns. And the data show at least 30% allocation as the sweet spot investors are looking for.

How real estate can improve portfolio diversification

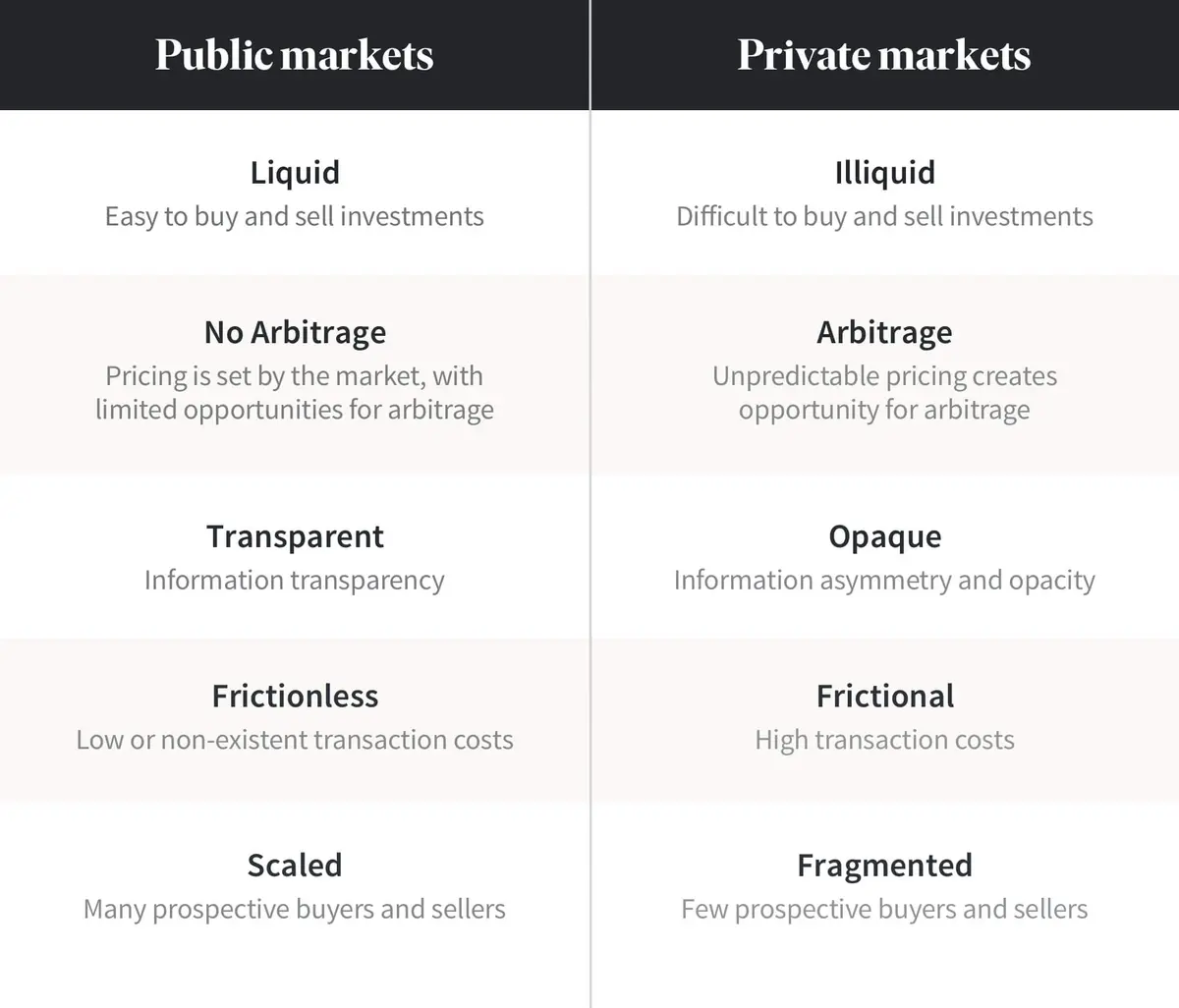

The private market operates under very different buying and selling dynamics than the public market and these differences significantly lower an asset’s volatility potential – and therefore its diversification potential. Let’s look at the attributes of private market real estate and why this asset class can act as a complementary diversifier in a portfolio composed largely of traditional investments.

Separate markets with low correlation

The biggest difference between private market real estate and traditional public investments is the fact that they are traded in different markets. Traditional investments, such as stocks, bonds, and commodities are traded on a public exchange, such as the New York Stock Exchange. On the other hand, private market real estate trades in, as you may guess, the private market.

Public market investments each have their own individual sets of advantages and disadvantages, but because these investments are traded within the same public market, there is a correlation in performance at the market level. Overall they share the same marketwide strengths and weaknesses. They may also share more correlation at other closer levels as well.

On the other hand, because private market investments are traded in a separate market, which is subject to a different set of driving forces and structural features, they don’t share the same sets of risks as public investments. Therefore, private market real estate has a low correlation with traditional publicly traded investments at the market level.

For instance, expectations of a future federal interest rate increase, or an actual increase, typically cause the stock market to decline, because higher interest rates make credit and loans more expensive, which can reduce both business and consumer spending. So, expected or actual interest rate hikes can have a depressing effect on publicly traded real estate investment trusts (REIT) share valuations, because higher interest rates reduce the risk-free to capitalization rate spread thereby driving down real estate values.

By contrast, an expected or actual hike in the federal interest rate should have minimal impact on an investor’s equity stake in a commercial real estate asset as long as the senior debt financing secured for that investment is a long-term loan with a fixed-rate. In fact, an interest rate hike could make the asset more valuable, because it now offers an interest rate hedge, and stands to benefit from the likely positive macroeconomic market conditions that typically precede federal interest rate hikes.

Overall, the changes in the value in most stocks and bonds likely won’t cause the value of an existing home, apartment building, retail building, or warehouse that’s traded in the private market to change. However, private market real estate may experience its own, separate market dynamics in response to an expected or actual interest rate hike.

Distinctive investment structures by market

Along with low correlation at the market level, private market real estate shares low correlation with public market real estate at the asset class level. Real estate is traded publicly through REITs and mutual funds, and private market real estate investments may be structured in many ways. REITs, themselves, whether private REITs or public non-traded REITs, are structured differently in the private market. This structural difference gives REITs different diversification potential based on the market in which they’re traded.

In general, these different structures carry different sets of risks, fee structures, return structures, and varying return potential. Therefore the differences in investment structures between public and private market vehicles further reduce the relationships between private market real estate and traditional investments.

Differences in access to liquidity

One of the greatest benefits of public market investments is the high level of liquidity that they offer. Stocks and bonds can easily be bought and sold on a daily basis. Because of this, public market investments offer a high degree of accessibility and flexibility.

However, it’s important to note that this daily access to liquidity comes at a price. The liquidity premium is a built-in cost innate to public market investments that investors pay whenever they buy an investment. For long-term investors who follow the “buy-and-hold” strategy, this can be an expensive feature that goes largely unused. Those who are building a portfolio to support their retirement plan are usually long-term investors whose portfolios are compatible with long-term investments. Avoiding costly features that go mostly unused can make a noticeable difference over the long term.

Private market real estate, on the other hand, is generally illiquid with return potential maximized over time through income and/or appreciation. Liquidity options for both public and private investments each have their advantages and disadvantages, but their differences can make private market real estate a good fit for long-term investors.

Market inefficiencies offer opportunities

The public market is highly efficient with prices set by the market. Information concerning public investments is widely disseminated, which makes it difficult for one party to gain more information than another on an investment. Transaction costs are also low, which results in more frequent buying and selling. In fact, more than five billion shares are publicly traded each trading day on US stock exchanges.

In contrast, the private market is highly inefficient. Buying and selling private market real estate generally comes with higher transaction costs with fewer buyers and sellers participating. These differences in buying and selling dynamics in the private market offer add the characteristics that make private market real estate a diversifying investment option.

While these market dynamics may seem unfavorable, they are actually potentially more favorable to investors. That’s because whereas the market sets prices in the efficient public market, there’s room for negotiation between the buyer and seller in the inefficient private market. With fewer buyers and sellers participating in the market, and with information unequally shared, the market doesn’t necessarily set the price of the asset, giving investors a greater chance to “beat the market” in a way that isn’t possible to do on a consistent basis in the public market.

Essentially, limited competition and unequal information distribution in private markets gives those with the necessary knowledge, skills, and resources a competitive advantage to earn above-market returns, or alpha.

An investor who holds common stock in a publicly-traded company doesn’t have the ability to earn outsized returns because they have more knowledge, resources or skills than another common-stock holder. An investor could spend hours daily researching Apple, but this would likely not change their return potential from their Apple shares. In other words, your returns will be the same as those earned by any other shareholder with the same class of stock who buys and sells those shares at the same time.

How to diversify into private market real estate

There are several ways to diversify into real estate in the private market, each of which requires different amounts of time commitments, expertise, and money. Broadly speaking, real estate investing breaks down into two categories: active and passive.

Active investing

Active real estate investing for individuals includes options, such as rental properties, and house-flipping. Return potential for each of these options is limited to rental income and appreciation. These methods typically require a significant amount of personal knowledge of real estate, and hands-on management or delegation to experts, who may come with hefty fees. Additionally, large capital commitments are required upfront and for the duration of the investment.

For example, if you buy a rental property, any money that goes toward buying the property in the form of a down payment or mortgage payment will be tied up in the property for the duration of the lifetime of the investment. Only upon selling can you access your principal and any appreciation that you’ve earned. As the owner, you can earn income from your investment in the form of rental payments usually on a monthly basis. A rental property is usually a long-term buy-and-hold strategy and can last for several years.

House-flipping is usually completed in a shorter timeframe than a rental property but it also usually comes with a lot more responsibility and risk. It requires an investor to buy a property and then add value to it within a target budget in order to be able to sell it at a profit within a given timeframe. Any missteps can reduce or even eliminate return potential.

Diversification potential

Because active investments typically require large capital commitments potentially for long periods of time, it’s usually difficult for investors to diversify within the asset class by investing in multiple active investments at once. For those who diversify this way, it usually takes many years to achieve or a large amount of money to begin with.

But, by investing in only one or a few active investments, risk within the asset class is concentrated among those few investments. Active investments are subject to the same market and asset class risks. And because investors typically invest locally, they’re subject to the same geographic risk.

For example, if a rental property requires unexpected repairs, or sits empty for several months at a time, as the only or one of the few active real estate investments held by the investor, the investor will suffer a large loss. And as the sole owner of the investment, he will bear the loss entirely.

Passive investing

Passive private market real estate investments are closer to what’s found in public market investments in terms of the investor’s risk and participation in the investment. As in the stock market, passive real estate investors typically provide only capital and allow professionals to invest in real estate on their behalf. With the arrangement, investors are only responsible for their own investments.

Passive investments usually offer investors a portfolio of real estate, which offers greater diversification potential than active investments in one or a handful of properties. And unlike active investments, which earn returns primarily through rental income and appreciation only, passive investment portfolios can hold debt investments, which can also earn returns through loan interest payments. On top of these benefits, some passive investment options carry lower investment minimums, which offers greater accessibility to investors of all sizes.

Private equity fund

A private equity fund is an investment model where investors pool their money together into a single fund to make investments. A designated manager or management group usually manages the operations of the fund, while investors aren’t required to participate on a daily basis. Real estate-oriented private equity funds typically hold multiple real estate investments at once, but volume depends on the dollar size of each investment as well as the investment capacity of the fund.

Due to the fact that the investment capacity of each private equity fund is different, each one offers different diversification potential within the asset class of real estate. In order to invest wisely and to understand how these investments can impact the risk and return potential of their portfolios.

Access to private equity funds is generally limited to accredited and institutional investors with high net worths. Investment minimums can vary, but are usually not less than $100,000. These investments are also generally illiquid. Additionally, private equity funds typically use a “two and twenty” model, in which they charge a 2% annual management fee and an additional 20% fee on any profits that the fund earns. Due to the high investment minimums and fees entailed in private equity investing, it is important for investors to have the financial and real estate knowledge necessary to understand the risks and potential value of each investment.

Private REITs

Like public REITs, a private REIT typically offers a wide portfolio of real estate investments. By law, a REIT must earn at least 75% of its gross income from real estate and invest at least 75% of its assets in real estate. Additionally, it must distribute at least 90% of its taxable income to shareholders each year.

Private REITs are similar to private equity funds in many ways. They are usually limited to accredited investors, and while minimums are subjective, they are usually quite high. Investments are typically illiquid, and the REIT structure also generally carries high fees, sometimes as much as 15% in the form of upfront formation fees, ongoing management fees, and in some cases carried interest fees.

Due to the similarities with private equity funds, the diversification potential of private REITs varies by each individual REIT. Therefore, in order to be able to assess the risk and value of each investment held by the REIT, and to determine the impact on an investor’s portfolio, it’s important that investors have the required financial and real estate knowledge before investing.

Online real estate investment platforms

Online real estate platforms offer a new way to invest in single investments or a diversified portfolio of real estate. Some platforms focus on debt investments or rental properties, while others focus on specific geographic locations. Platforms that limit real estate investments by geography or asset class concentrate along those lines, which inherently limits their diversification potential. Platforms that diversify real estate investment along the lines of investment type (debt, equity) and property type (residential and commercial), as well as by geography, stand to offer investors stronger diversification potential.

Investor access can also vary by platform. Some platforms are restricted to accredited investors, and others available to non-accredited investors can still carry high investment minimums. However, this isn’t the case for all real estate investment platforms.

For example, Fundrise offers access to portfolios of real estate diversified across dozens of debt and equity investments, commercial and residential real estate, as well as geography. This provides investors exposure to private market real estate, but also critical diversification within the asset class. Unlike other restrictive real estate investments, Fundrise is open to both accredited and non-accredited investors with a low investment minimum of only $10.

Evaluating your options

It’s up to each investor to determine which asset classes and diversification strategies suit them best. But, no matter how you choose to diversify, the traditional barriers that once restricted access to useful diversification have fortunately been lowered, giving investors the power to construct truly diversified, risk-mitigated portfolios like never before.

Fundrise is the first investment platform to create a simple way for anyone to invest in diversified portfolios containing institutional-quality private real estate. This exposure provides many investors access to a new asset class along with its historically consistent earning potential, and diversification power.