Fundrise today released new findings from its inaugural Retail Investor AI Sentiment Report. The results show that retail investors are optimistic about the state of the economy overall in 2024, with 85% of respondents saying they think this year will be the same, or better, than 2023, and 93% saying they plan to expend more capital into investment opportunities throughout 2024. With nearly 50% of retail investors considering or planning to allocate away from cash and into investments, many are in search of lucrative market segments where they can enter on the ground floor, including artificial intelligence.

While it is clear retail investors are eager to get exposure to the explosive growth in AI, Fundrise’s data paints a clearer picture of how retail investors are weighing AI’s value propositions, market potential, and economic factors. 68% believe AI has high growth potential – more than any other category, including climate tech, Web 3.0, and e-commerce. When asked what would make them more likely to invest in AI, 66% said the ability to invest in companies before they went public, and many acknowledged that these opportunities seem limited at present with high-net worth individuals and insiders still occupying much of the space.

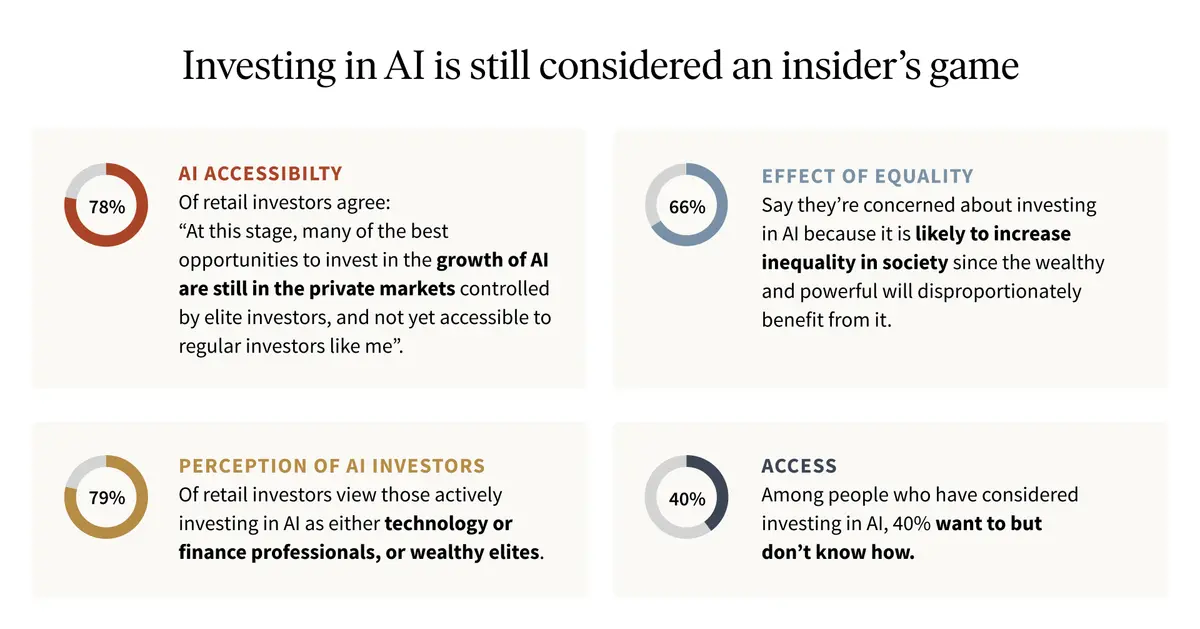

“Amid the huge focus around AI and its potential economic impact, we wanted to understand what retail investors’ felt about the sector, particularly as many of the most noteworthy AI companies are privately held,” said Ben Miller, Co-Founder and CEO of Fundrise. “Our data shows that retail investors largely feel that the AI sector is an insider’s game. While they are excited about the potential of AI and are bullish about the market for 2024, they acknowledge that AI could further increase inequality especially as investment into these technologies has been limited to a select few companies and ultra high-net worth individuals.”

Since the launch of ChatGPT - viewed by most as the jumping off point for the AI boom - over $150 billion of wealth has been created, though largely among a small group of ultra-wealthy investors like Mark Zuckerberg, Bill Gates, and Larry Ellison. While individual investors have been able to participate in the market through more mature companies like Nvidia - whose share price was up by over 200% in 2023 - opportunity is ripe among an emerging crop of high growth potential AI companies that have yet to go public.

Fundrise’s data shows that retail investors recognize the moment they are in and see 2024 as the time to make the jump.

Key Takeaways Include:

- Among people who have considered investing in AI, but have not yet done so, 40% want to but don’t know how

- 78% of retail investors believe that the best opportunities to invest in AI are in the private markets controlled by elite investors

- 77% of retail investors think investments supporting the growth of AI could be positive for their portfolios

Additional Findings:

Retail Investors are excited about AI from both an investment aspect as well as the overall economy:

- 74% believe AI will improve the average person’s quality of life

- 77% believe AI will help grow the economy overall

- 68% believe AI has high growth potential – more than any other category including climate tech, Web 3.0, and e-commerce

When retail investors were asked what would make them more likely to invest in AI they replied:

- 84% said learning more about it

- 78% said having access to the best investment opportunities

- 71% said access to funds that diversify risk

- 66% wanted the ability to invest in AI companies before they went public