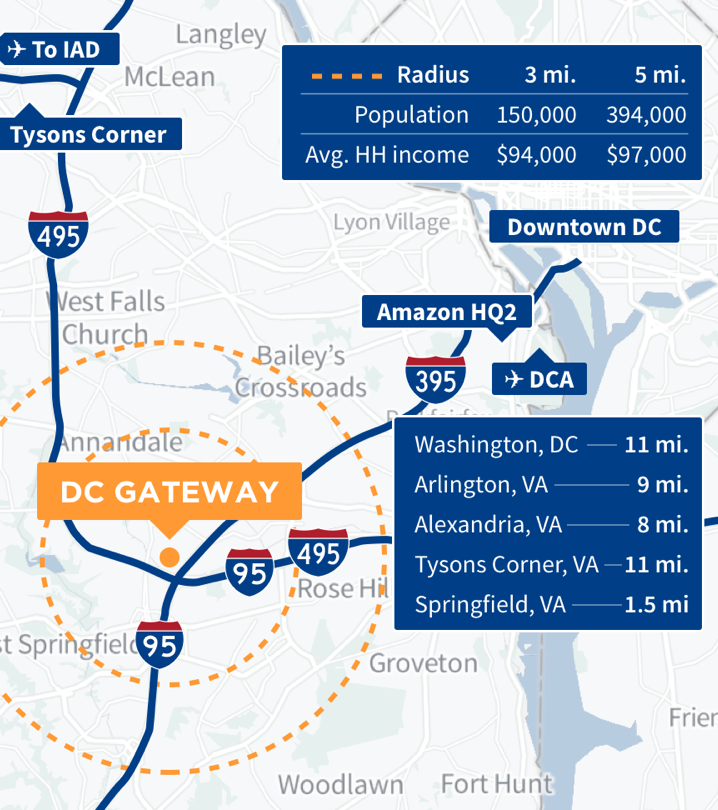

We recently acquired an industrial property in Springfield, Virginia, for approximately $15.7 million, with plans to develop a new class-A distribution center on the site. Located less than 30 minutes from downtown Washington, DC, at the intersection of two major highways, we believe this is an attractive location for online retail businesses seeking to efficiently serve customers with short delivery times across the national capital region.

Business plan

The 7.7-acre property has two existing older industrial buildings that no longer meet today’s needs. We aim to secure the necessary permits to demolish the existing structures and build a new “last-mile” distribution center on the site.

A “last-mile” distribution center, also referred to as a terminal building or sorting center, acts as a handoff point to connect large 18-wheeler trucks, which typically carry goods in bulk across longer distances, with the smaller vehicles that make the final leg of the journey to drop off packages at individual homes and businesses.

It’s important that these facilities are located close to major population centers while at the same time easily accessible to key highways leading in and out of the areas. Led by Amazon, e-commerce companies are heavily focused on leasing this type of real estate.

Our goal is to earn regular rental income once the property is leased up, and eventually to sell the finished product for more than we spent on the acquisition and development.

How might the impact of COVID-19 affect this investment?

We believe that the existing long-term trend of more and more shopping moving online has the potential to be further accelerated by the current pandemic. While consumer spending more broadly is likely to decrease in the short term, the percentage of that spending that is occurring online is likely to increase substantially. This trend may maintain itself over the long term as customers who adopted online delivery for many household items, or groceries end up not going back to their previous routines.

Despite current social distancing requirements, we expect to be able to make steady progress on this project over the next several months, as most of the initial work (architecture, permitting, etc.) can be done remotely. Once we’re ready to begin construction, we may find that we’re able to actually decrease our budget, as construction costs have historically come down during a downturn.

As is the case with the majority of our other equity investments in development, we own this property outright with no debt. In the event of a protracted economic downturn, the risk of losing the property due to foreclosure (one of the primary ways that real estate investors risk losing principal during a financial crisis) is essentially non-existent since there is no lender.

Why we invested

- Prime location: The property is located at the interchange of the Capital Beltway and I-395, two primary local road arteries (a.k.a. the Mixing Bowl). From the site, delivery vehicles would be able to reach most of the DC metro area within a one-hour drive.

- Growing e-commerce demand: Same-day and short-term delivery is becoming not just essential, but the expected norm from customers. In order to fulfill increasing demand, companies ranging from online grocery delivery to e-commerce retailers need space in highly specific locations with access to regional transportation.

- Strong, stable local economy: With over 30% of residents employed by the government, the DC market is uniquely insulated from national economic downturns. In addition to federal workers, demand is driven by private-sector employees that support the government, such as consultants, lobbyists, and lawyers. For more information, please see our DC market analysis.

As always, please don’t hesitate to reach out to investments@fundrise.com with any questions or feedback.

————

A brief note about how we’re navigating the coronavirus (COVID-19) pandemic

Though black swan events like the current coronavirus pandemic are impossible to predict, nearly every decade has experienced some form of significant economic disruption. Recognizing this, we’ve spent the last several years structuring our investments to withstand a sudden and prolonged period of distress. Given today’s extreme uncertainty, we have begun taking decisive action aimed at further fortifying your portfolio.

In the immediate term, we expect to limit most new acquisitions and instead anticipate holding more cash in reserve. We plan to focus on pushing our existing projects forward and, in rare instances, look to deploy strategically into properties — like this one — that we feel are particularly well suited to withstand near term stress or even benefit from the current disruption in the market. As we continue to monitor the ongoing effects of this disruption, we expect that over time having additional cash reserves on hand may allow us to capitalize on new opportunities that begin to present themselves.