As part of our broader strategy to invest in emerging urban areas, we’ve acquired a property in the Jefferson Park neighborhood of South Los Angeles for approximately $1.5 million.

Thanks to a variety of factors, including tech companies opening major offices, an expansion of the LA Metro system, and prospective homebuyers being priced out of more established neighborhoods, we believe that this area is poised to undergo outsized growth over the next seven to ten years.

Business plan

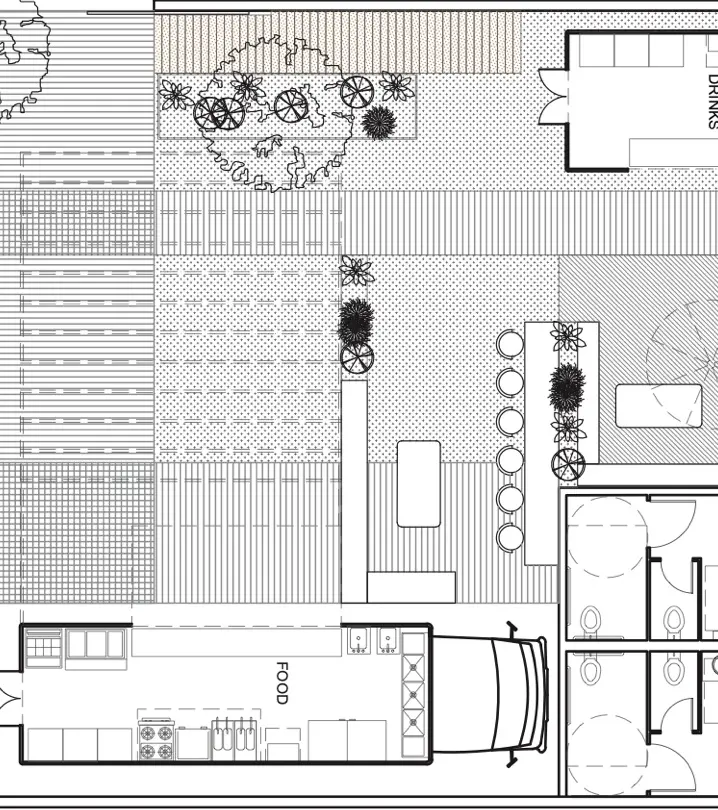

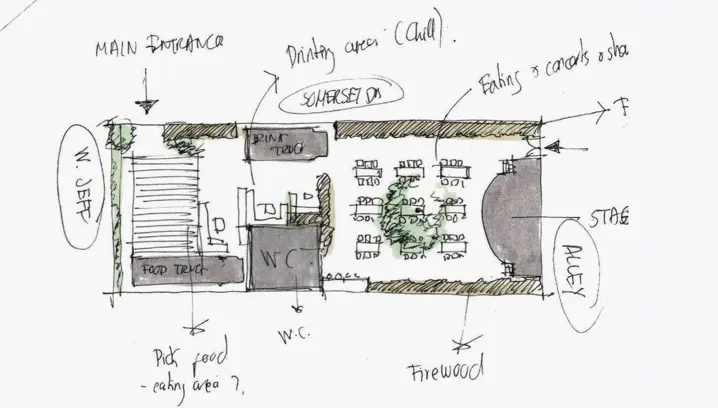

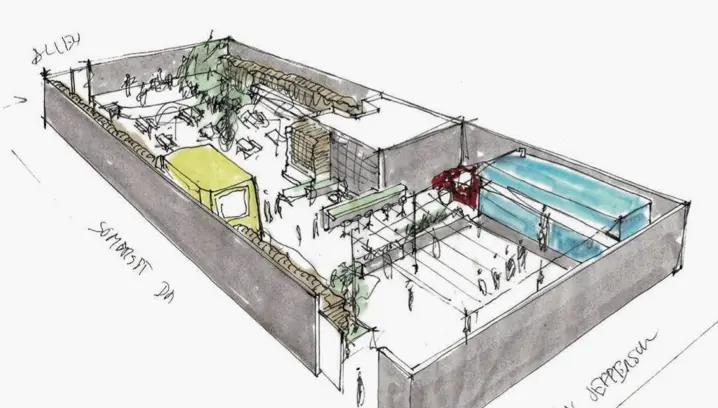

At the time of our acquisition, there were no existing structures on the property since it was previously used for industrial storage.

We paid roughly $1.5 million for the 6,250 square foot (0.14 acre) parcel of land, and anticipate spending an additional $900,000 on construction costs over the next year to build a semi-permanent “pop-up” retail space which we plan on leasing out while we evaluate longer-term potential business plans.

With this investment, we aim to earn consistent cash flow from rent payments in the short term, while capturing what we believe will be strong price growth in South LA over the next seven to ten years.

Why we invested

- Major tech boom in South LA: The property is located about four miles east of Culver City, where Amazon Studios, Apple, and HBO are in the process of opening major offices. We expect that a substantial number of the thousands of tech employees who will work in these offices will also want to live, dine, and shop nearby, driving a major increase in overall property values.

- Steps from transit: The property is within walking distance of the Expo / Crenshaw Station on the LA Metro, offering accessibility to downtown and Santa Monica.

- City-wide housing shortage: LA housing prices have grown much faster than incomes in recent years, resulting in a major affordability crisis within the city. With large sections of the city simply out of reach for many renters and homebuyers, we believe that smart investments in up-and-coming areas will deliver attractive long-term returns. See our LA market analysis.

As always, please don’t hesitate to reach out to investments@fundrise.com with any questions or feedback.