Over the past 15 years, global financial markets have witnessed an era of historically low-interest rates and lenient monetary policies, making public securities an attractive investment option due to their strong performance and liquidity. However, with the onset of the COVID-19 pandemic in 2020, everything changed, leading to widespread disruption and uncertainty in public and private markets.

As people adapted to the new norm, investments began to rebound, and public securities once again became the most attractive asset class. However, that started to change again in mid-2022 when concerns about high inflation prompted the Federal Reserve to raise interest rates and shift to a tightening monetary policy, closing the era of record-low interest rates. These abrupt changes destabilized public financial markets and resulted in widespread dislocations, leading to a substantial decline in public securities as crucial liquidity began to drain from the public markets. This trend was further accelerated in early March 2023 when several banks collapsed, causing shockwaves across the financial system that triggered a banking crisis that drained even more liquidity from the public markets.

As a result, institutional investors are once again gravitating towards lower-risk assets and uncorrelated strategies that can potentially offer protection from inflections in economic trajectories. This has led to an increased focus on private markets, which have historically offered protection against market volatility and helped mitigate market risk.

In this article, we will explore what we have identified as the most exciting trends fueling growth in the private markets over the next year, broken down into three categories: Technology Private Equity and Venture Capital, Private Credit, and Real Estate.

The Key Drivers of Success in Technology Private Equity and Venture Capital

The tech industry is constantly evolving and presents exciting opportunities for private equity and venture capital investments. Currently, the most promising growth trends in this industry fall into two vectors. The first is the development or refinement of new, cutting-edge technologies such as Artificial Intelligence (AI) and blockchain. The second is the development of tools that assist organizations in managing and navigating their vast amounts of data through infrastructure organization, storage, and security. Companies that are at the forefront of these technological advancements are potentially some of the most lucrative investment opportunities for those looking to add high-growth tech to their portfolios.

Laying the Foundation for Exponential Growth

The rapid evolution of data usage and technological tools in recent years has presented profitable investment opportunities for businesses and investors alike. These essential tools enable companies to efficiently analyze vast amounts of data, leading to valuable insights that enhance operations and improve customer experiences. In today's highly competitive business environment, it is imperative for businesses of all sizes, from small startups to large corporations, to adopt these tools in order to remain competitive in their respective industries. This fosters innovation and efficiency throughout the value chain, making it an indispensable element for sustained success.

The twenty-first century has been marked by a rapid and transformative technological revolution that is reshaping industries across the global economy. The cost of computing power has dramatically decreased in recent years, while broadband and mobile connectivity have become ubiquitous, giving rise to an array of new technologies and business models that have quickly permeated every aspect of modern life. This digital transformation created new opportunities for businesses to enhance their operations and improve customer experiences, driving innovation and efficiency across the value chain.

The COVID-19 pandemic further accelerated the pace of innovation and drove a rapid increase in technology investments, with particular emphasis on fields such as artificial intelligence (AI), blockchain, data infrastructure, development operations (DevOps), financial technology (FinTech), machine learning (ML), real estate and property technology (PropTech), and remote work and virtual collaboration technologies and tools.

While these fields collectively cover a vast range of tech, each one holds significant potential for innovation, disruption, and transformation across various industries, making them attractive targets for private equity and venture capital investors — even as other parts of the tech ecosystem have lost steam in recent months, as casualties to the past year’s shift in interest rates and credit availability. To achieve success, it is essential to identify the most promising technological trends that will continue to reshape industries and drive growth opportunities for businesses in the years to come.

Modern Data Infrastructure

The ongoing evolution of data usage can be traced back to the early 90s, with the explosion and widespread adoption of the internet that changed not only the volume of data collected and created but also the ease with which it could be captured, stored, and analyzed. Then, over the last decade, two parallel innovations have unlocked a second explosion in the space of data storage and management: mobile devices and the cloud. In fact, according to Forbes, 90% of all the data in the world was created in just the last two years, and it's estimated that by 2025 the global pace of data creation will reach roughly 465 exabytes of new data every day. This exponential growth is both a challenge and an opportunity for companies as they seek to capture, store, and analyze this data to gain valuable insight.

Therefore, it's clear that the success of modern businesses, from small early-stage companies to large Fortune 500 companies, is increasingly tied to their ability to capture and extract valuable insights from data. With modern cloud databases, companies can load massive amounts of raw data into a warehouse and perform a nearly unlimited number of powerful transformations extremely quickly, all without an extravagant or expensive infrastructure.

As technological innovation continues to break down technical barriers to using data, companies are increasingly realizing the value of data infrastructure as fundamental to accelerating product innovation, optimizing financial management, and decoding customer insights. This allows these companies to build flexible and nimble operations that can outmaneuver the competition and succeed in today's data-driven world. Those that can effectively leverage data will have a significant advantage over those that cannot. In short, having a robust data infrastructure is becoming a necessity for businesses that want to stay competitive in the modern era.

Artificial Intelligence and Machine Learning

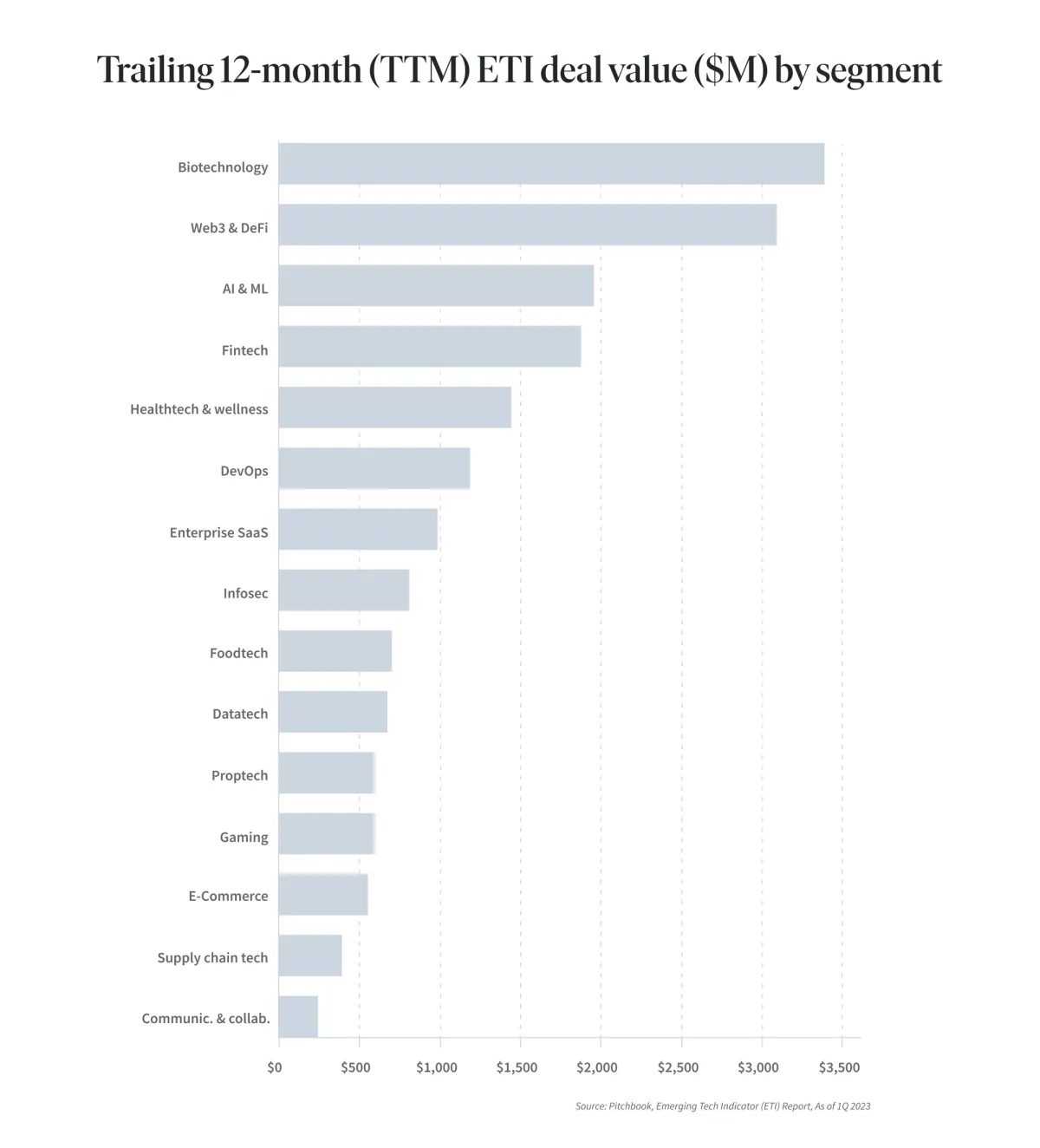

According to Pitchbook's emerging tech indicator report for the first quarter of 2023, AI and ML are predicted to overtake all other areas of investment by the end of the year. This trend is being driven by the rapid increase in investments in AI technologies as businesses recognize its potential for automation, data analysis, predictive analytics, and improved decision-making. With AI’s ability to process vast amounts of data quickly and accurately, AI has the potential to revolutionize the way businesses operate, leading to increased efficiency, productivity, and profitability.

This cutting-edge technology has become a critical tool for users and is being applied across a wide range of sectors, including healthcare, finance, customer service, manufacturing, and more. As a result, AI is expected to continue to be a key driver of innovation and growth in the years to come, transforming industries and creating new opportunities for businesses to enhance their operations and improve customer experiences.

The scope of the technology’s potential impact is evident in the remarkable adoption rates of consumer-focused AI systems like ChatGPT, which attracted one million users in just five days, and one hundred million users in two months, surpassing the adoption rates of popular technologies like the iPhone, TikTok, Instagram, Facebook, and Uber.

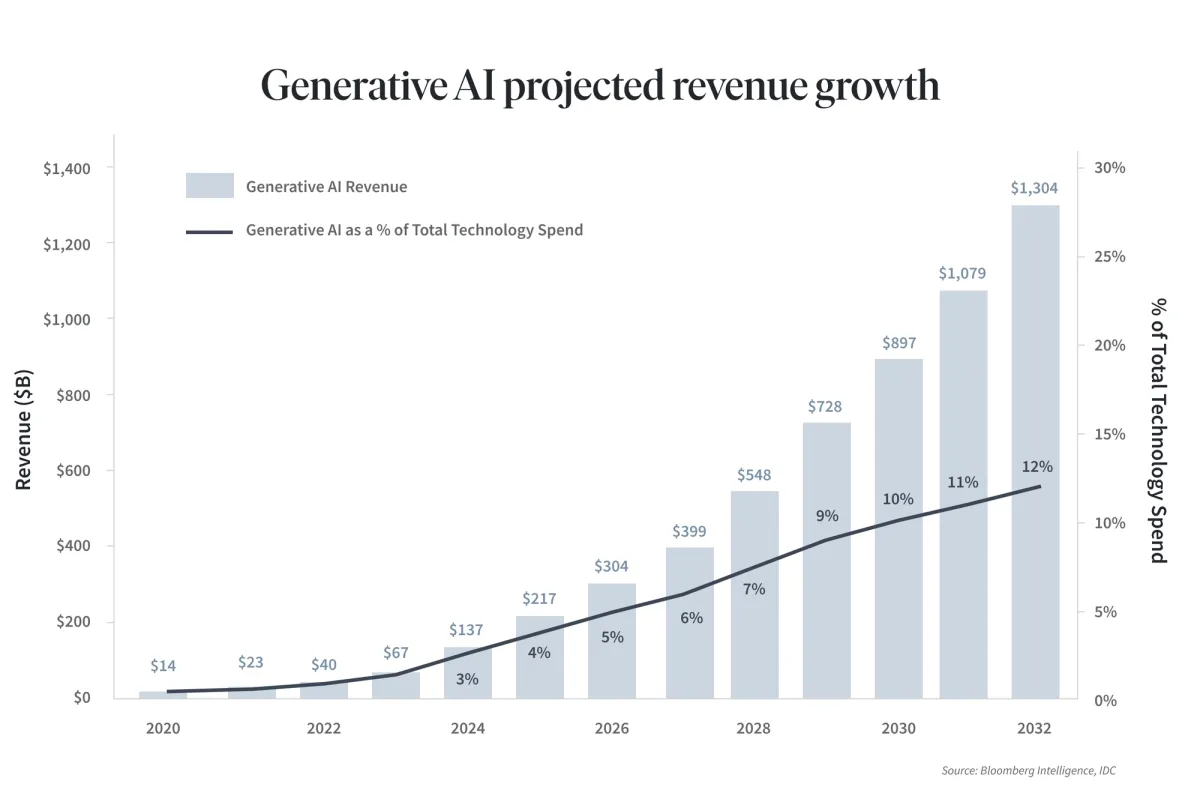

According to a recent report by Bloomberg Intelligence, the market for AI is projected to grow at a staggering 42% rate over the next ten years. This growth is expected to generate $1.3 trillion in revenue by 2032, fueled in part by the release of consumer-focused AI systems that will have important use cases across a number of applications and industries.

In addition, Pitchbook's latest ETI report indicates that AI and ML dominated emerging tech investments in the second quarter of 2023, by securing $646.3 million and $533.0 million, respectively. This underscores the growing importance of AI as a driver of innovation and growth across various industries and highlights the significant potential for businesses to enhance their operations and improve customer experiences through the use of cutting-edge AI technologies. As a result, AI is expected to continue to be a key area of investment and growth in the years to come, creating new opportunities for businesses to stay competitive and drive value for their stakeholders.

Blockchain Technology

Similarly to AI, blockchain technology is one of the most innovative technologies that has emerged in the last decade. With its secure and transparent decentralized digital transaction and record-keeping solution, blockchain has the potential to revolutionize the way businesses and industries operate. In addition, blockchain and AI have already shown their potential value when combined, as blockchain can be used to secure AI algorithms and ensure that they are not tampered with or compromised. Together, these two technologies can create a powerful combination that can work together in tandem to solve complex problems in fields such as cybersecurity, supply chain management, and FinTech. The two technologies’ tandem growth introduces the potential for mutual developmental acceleration, as an improvement in each drives new possibilities for the other.

Financial Technology (FinTech)

FinTech innovation is a powerful force that has already deeply disrupted — and is clearly poised to continue the disruption of — the financial services sector, led by non-bank entities that aim to deconstruct the barriers that have long surrounded the traditional banking, investment, and money transfer systems, plus many others. Driven by the convenience of mobile wallets, cashless payments, and peer-to-peer lending, the FinTech industry has seen enormous growth over the past few years, which has been further accelerated by the e-commerce explosion caused by the pandemic lockdowns.

The global FinTech industry is estimated to grow by 6% annually, from $245 billion to $1.5 Trillion by 2023, according to BCG, which is a clear indication of the industry's potential. With innovative new technologies and business models, FinTech companies are changing the way people think about financial services and creating a radical shift in customers' experience by providing an interactive approach to financial and banking services. This shift is enabling customers to access financial services in new ways, making it easier and more convenient to manage their money. Moreover, with the help of data networks and smartphones, FinTech innovations are progressively increasing access to financial and banking services, as well as liquidity, to a wider range of people worldwide. This is a significant development that has the potential to promote financial inclusion and provide opportunities for economic growth in underserved communities.

Real estate and property technology (PropTech)

As with FinTech, financial and strategic investors continue to fuel a rapid expansion of PropTech, which is transforming the real estate and construction industry through a wide range of technological advancements and innovative solutions. By harnessing the power of digital platforms, data analytics, IoT, and automation, PropTech is driving efficiency, transparency, and sustainability across the real estate value chain.

This transformation is primarily driven by consumer behaviors, which demand a more seamless and personalized experience, as well as efficiency enablers, such as cost savings and time optimization. Additionally, technological advancements have enabled real estate professionals to access and analyze large amounts of data, allowing for more informed decision-making and better risk management. As a result, PropTech has the potential to revolutionize the future of real estate by creating a more connected, efficient, and sustainable industry. By leveraging PropTech solutions, real estate professionals can enhance their business operations, improve tenant experiences, and optimize property performance, leading to increased profitability and growth opportunities. This sets the stage for the PropTech market to reach a projected value of $86.5 billion by 2032.

Remote Work and Virtual Collaboration Technologies and Tools

As with everything else, consumer behaviors and the COVID-19 pandemic have greatly accelerated the demand, development, and adoption of remote work and virtual collaboration technologies and tools. This has resulted in a significant revolution that has enhanced productivity and facilitated growth for businesses. The demand for a range of solutions, including video conferencing platforms, project management tools, cloud-based storage and sharing solutions, cybersecurity systems, and communication software, has increased as a result. As remote work and virtual collaboration trends continue to become more prevalent, businesses will need to invest in these technologies to remain competitive and enhance productivity and collaboration among remote teams.

As a result, the demand for these technologies is increasing, and so is the demand for capital by these businesses as they strive to stay competitive and agile in today's fast-paced market. The adoption of these technologies is likely to continue to grow, and businesses that can effectively leverage them will be better positioned to succeed in the future.

Private Credit as a major investment opportunity within Commercial Real Estate

Largely due to the economic challenges posed by the onset of the COVID-19 pandemic, rising interest rates, and recent bank collapses created an environment that could present some of the most lucrative opportunities for credit investments in this generation. For investors, it is an opportune time to step in and act as liquidity providers, filling the void left by small and regional banks that face liquidity constraints.

One year after the widespread emergence of the COVID-19 pandemic, inflationary concerns re-emerged for the first time since the Great Inflation period.

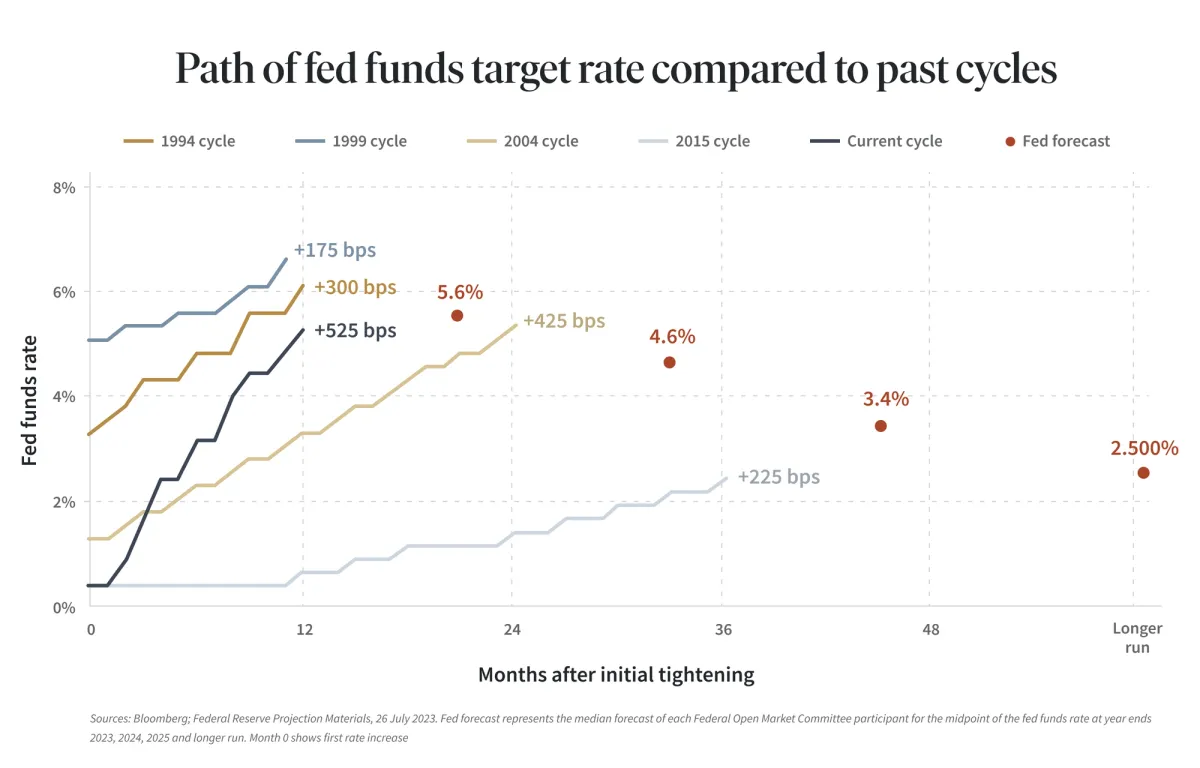

Inflation initially rose slowly, reaching moderate levels before surging into high territory by the fourth quarter of 2021. This prompted the Federal Reserve to reverse its previous expansionary monetary policy and launch its most aggressive tightening campaigns in decades in an effort to curb runaway inflation. Consequently, the Federal Reserve started raising the Federal Funds rate aggressively in March 2022, resulting in a cumulative hike of 5.25% as of July 2023, marking the highest level since the Great Financial Crises. Additionally, the Federal Reserve implemented a quantitative tightening monetary policy to further drain money from the financial system.

However, the sudden surge in interest rates, coupled with quantitative tightening, had a detrimental impact on credit and capital liquidity in the financial markets, depleting the markets of vital liquidity.

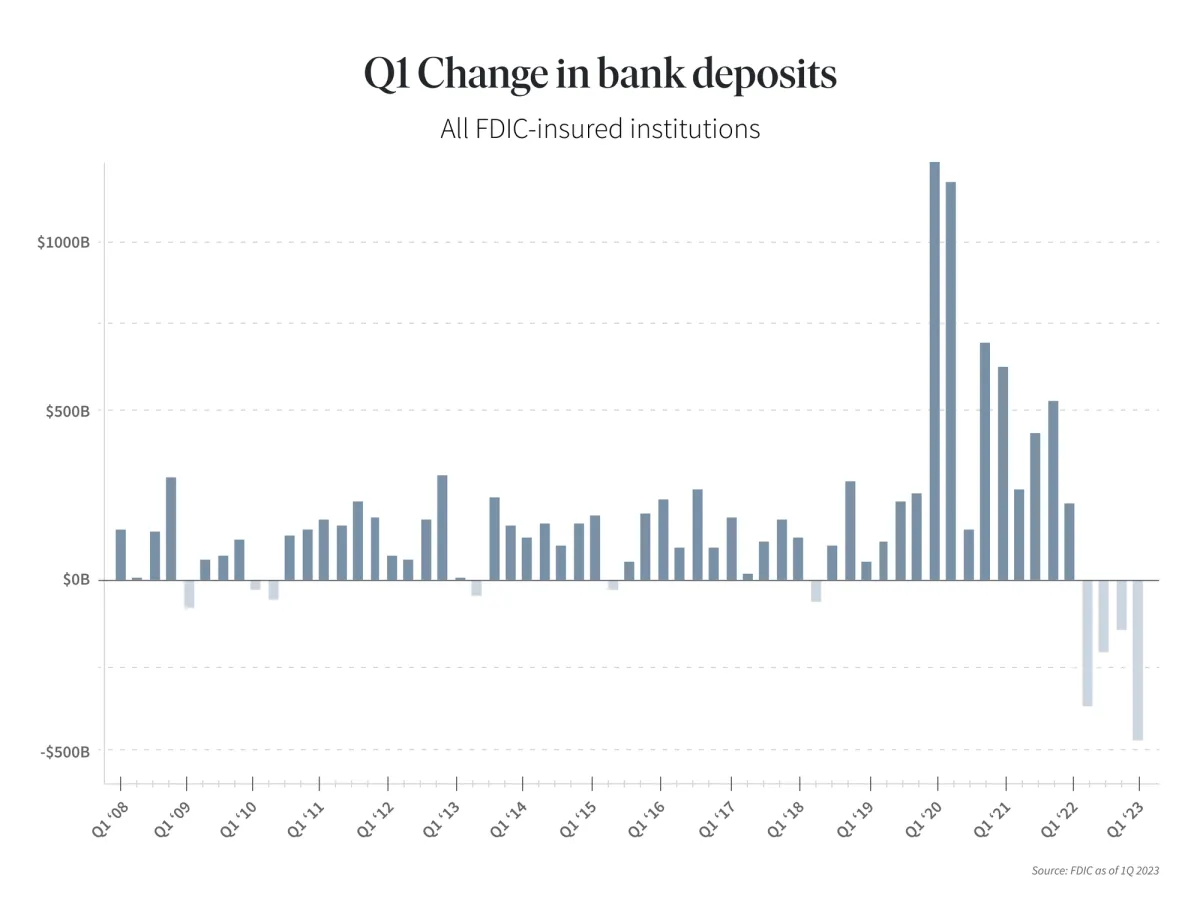

In the second quarter of 2022, banks started to face yet another set of challenges. As interest rates rose, they were forced to pay more money to win deposits, and consumers and companies started to take more money out of banks to invest it in short-term securities like money market funds and Treasury notes. This caused a substantial outflow of deposits from small and regional banks as depositors sought higher returns in short-term securities, further compounding liquidity constraints for some banks and raising additional liquidity concerns over the banking system’s capacity for new loans. In addition, the deposit outflows caused a significant asset-liability mismatch for banks as they were forced to close out of long-term fixed-income securities, resulting in unrealized losses of roughly $620 billion across the industry by the end of 2022, according to the Federal Deposit Insurance Corp.

These events led to what we’ve deemed “The Great Deleveraging”: a liquidity crisis that our CEO identified as early as November 2022 in our Onward podcast, now sending shockwaves through the U.S. banking system, as evidenced by the quick demise of three regional banks in 2023 at Silicon Valley Bank, Signature Bank, and most recent First Republic Bank.

The aforementioned events caused (or, in some cases, exposed) significant cracks in the financial markets, leading to widespread dislocations and liquidity constraints that destabilized the banking system, further complicating matters for industries such as segments of commercial real estate, as banks have dominated the commercial real estate lending market. This has led to a shortage of credit in the commercial real estate sector, which could have significant implications for developers and property owners looking to refinance.

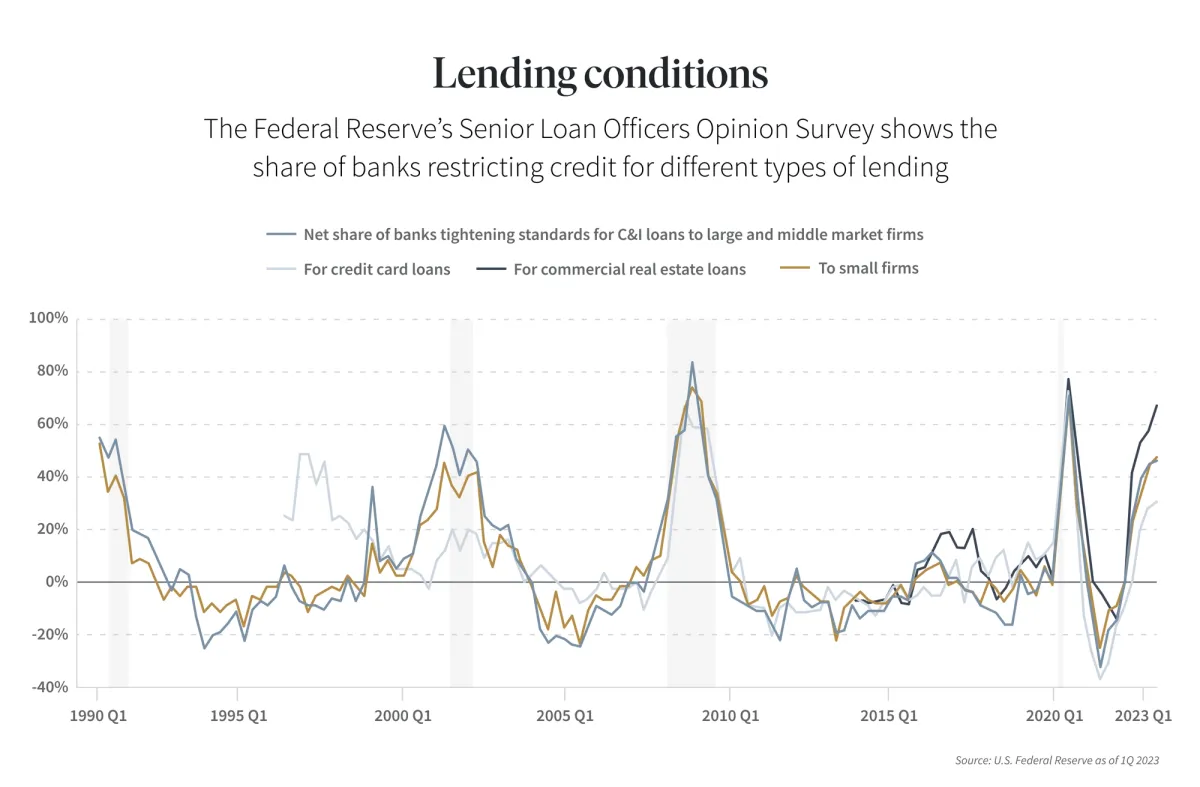

One residual effect of the banking crisis has been banks’ quick inclination to become more cautious with lending, putting even greater emphasis on the sponsor, sector, asset quality, and lending at lower loan-to-value average ratios, now tempered to levels comparable to those of the Global Financial Crisis. The Federal Reserve's Senior Loan Officer Opinion Survey revealed that as of July 2023, lending standards have tightened further, with a net 50.8% of banks reporting increased restrictions on loan approvals compared to a net 46.0% in May 2023. As a result, it has become increasingly difficult for businesses to secure financing through traditional channels, creating a void in the real estate lending market.

Small and regional banks are the primary source of credit to the commercial real estate industry, and they have traditionally extended lines of credit to the roughly $20.7 trillion U.S. commercial real estate sector. According to J.P. Morgan’s latest report, these banks have roughly 4.4x more exposure to commercial real estate compared to their larger peers.

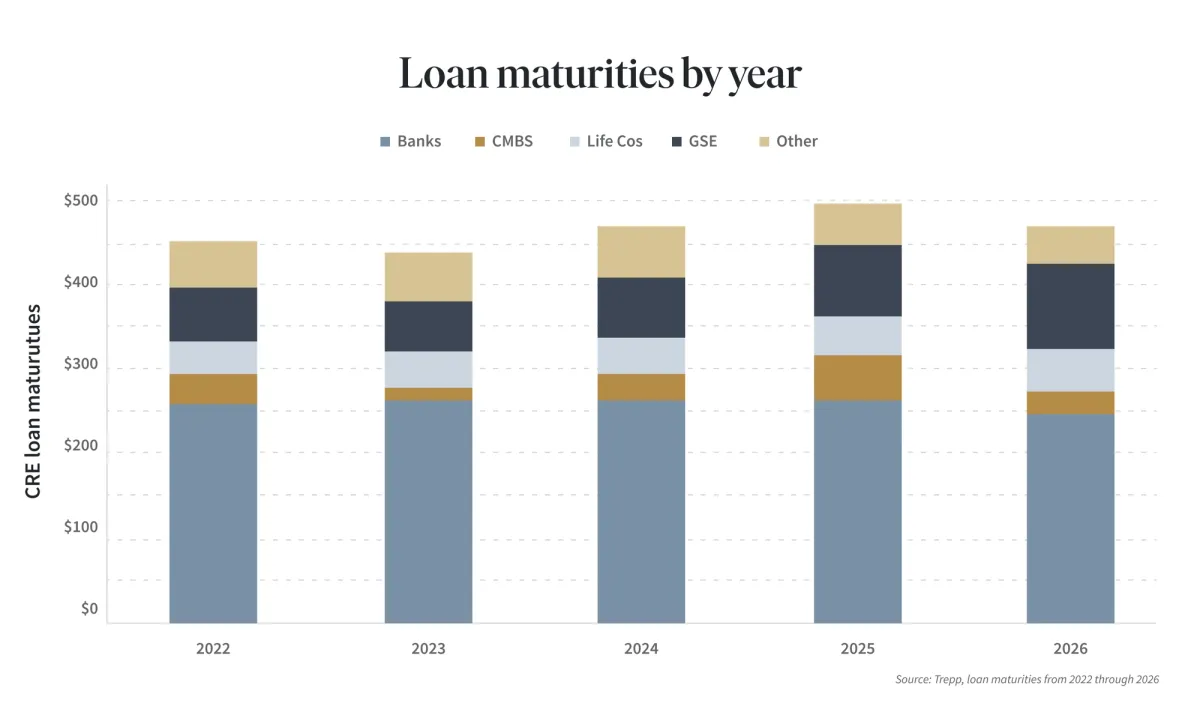

Now, as liquidity dries up, a “wall of maturity” is approaching fast. According to Trepp, $448 billion of commercial real estate loans will mature in 2023, with $270 billion originated by banks. Between 2023-2027, a staggering $2.56 trillion in loans will mature, with $1.4 trillion coming from banks. However, against a backdrop of rising interest rates and tightening credit conditions, refinancing these loans may become more costly, potentially leading to lower property values and larger losses for both lenders and borrowers. As debt service payments increasingly exceed the net operating income of properties, borrowers may find themselves facing significant challenges as they are forced to pay out of pocket to cover the difference. This trend is likely to create hurdles for refinancing all types of debt, which could be further exacerbated if banks and other lenders reduce their commercial real estate exposure, resulting in fewer lenders originating new loans.

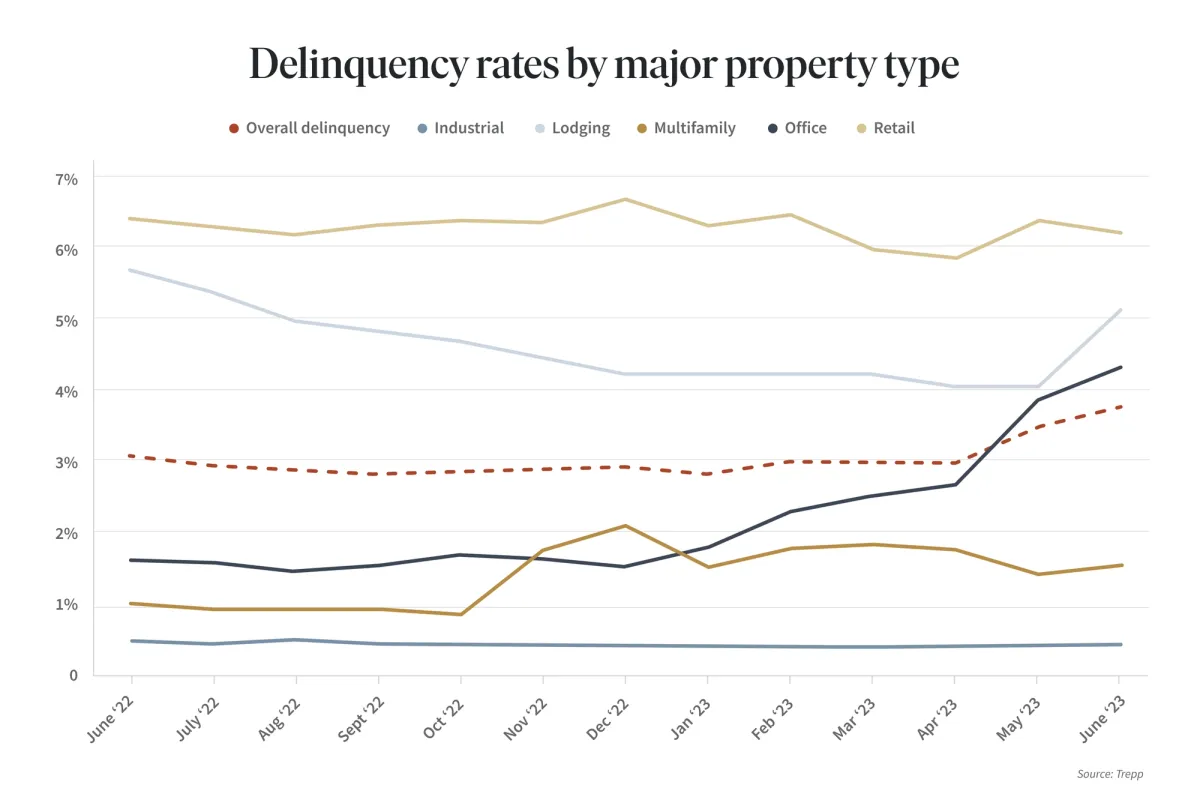

The impact of the liquidity crisis on the commercial real estate industry is evident in the most recently reported delinquency rates for commercial properties. As of June 2023, the overall CMBS delinquency rate increased by 28 basis points month-over-month to 3.90%, the highest since June 2020, when delinquencies surged more than 3% in the midst of the first wave of the pandemic. The increase in this past June’s CMBS delinquency rate was mostly driven by a significant increase in office and lodging delinquency rates, resulting in a 47 basis point and 111 basis point increase, respectively.

Despite these challenges, there is some good news. The conservative lending standards that emerged after the financial crisis provide some protection from falling values for borrowers and lenders. And, even more importantly for private market investors, our analysis shows that the current environment is already giving way to the most lucrative opportunities for credit investments in this generation. For anyone with the means and liquidity to provide rescue capital for cash-strapped operators, lucrative rates and attractive investment terms should follow, as small and regional banks can no longer play the role so many borrowers had begun to take for granted.

Where Real Estate is Poised to Grow in the Near Term

Despite the current economic climate, certain defensive sectors in real estate with strong fundamentals, such as rental housing and industrial properties, will continue to offer attractive investment opportunities for developers and investors. These two sectors are particularly promising due to their growth potential, which is largely driven by factors such as consumer behavior, basic consumer needs, and technological advancements. This makes them attractive options for those investors looking to capitalize on their potential for growth and solid fundamentals, despite other parts of the real estate sector stalling and struggling.

Although the media has recently drawn much attention and scrutiny to the challenges of the office commercial real estate sector, it's important to recognize that commercial real estate encompasses far, far more than just offices. While it’s true that the office sector is currently grappling with unprecedented challenges. The shift towards the work-from-home trend continues to increase office vacancy rates, and when combined with high refinancing costs — as discussed in the prior section on private credit — are adding to the sector's challenges. Additionally, news that some prominent real estate managers have defaulted on trophy office-backed loans due to being hopelessly underwater has added to the sector's concerns.

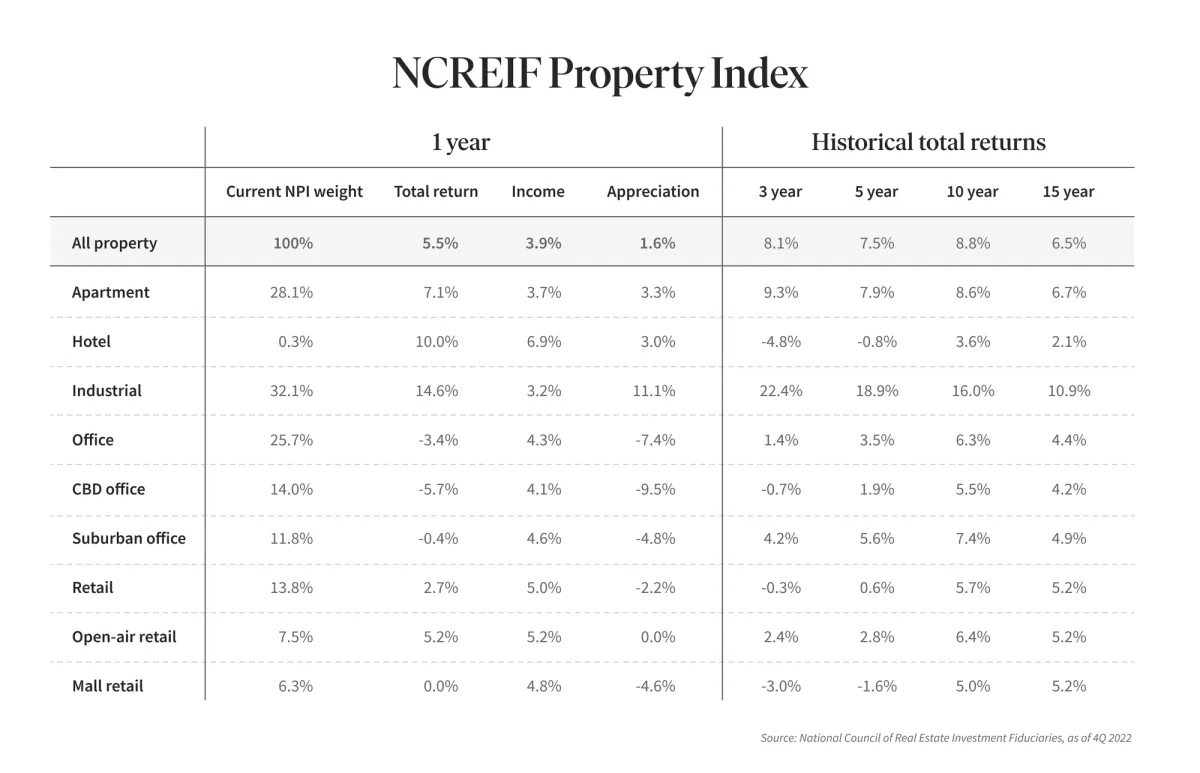

But beyond the office sector, commercial real estate offers defensive sectors with stronger fundamentals and healthy occupancy levels, such as industrial (warehouses, distribution centers, and data centers) and rental residential (build-for-rent single-family housing and multifamily) properties. While there are certainly risks in the commercial real estate market, it's important to take a nuanced approach and consider the unique characteristics of each sub-sector. Despite the challenges posed by economic uncertainty and a more conservative lending environment, property-level fundamentals remain strong for rental housing and industrial properties. This is evidenced by the annual returns reported by the NCREIF Property index and the attractive investment opportunities created by yields that are often higher than cap rates in the current environment. As a result, rental housing and industrial properties are likely to remain attractive investment opportunities for developers and investors looking to capitalize on the growth of these sectors.

Booming Demand for Rental Housing: Apartments and Build-for-Rent Single-Family Homes

The COVID-19 pandemic unleashed an explosion in pent-up demand for housing, as early lockdowns changed residents’ relationships with their living spaces, resulting in a surge of new leases. This unusually strong demand allowed landlords to increase rents by 25% in the two years following the emergence of the COVID-19 pandemic. At the same time, the surge in demand for housing also led to the priciest housing market in history, forcing many would-be homeowners to enter the rental pool. This trend has resulted in the inventory of single-family homes available for purchase to remain at less than half the historical average, reinforcing elevated prices and making the market more competitive.

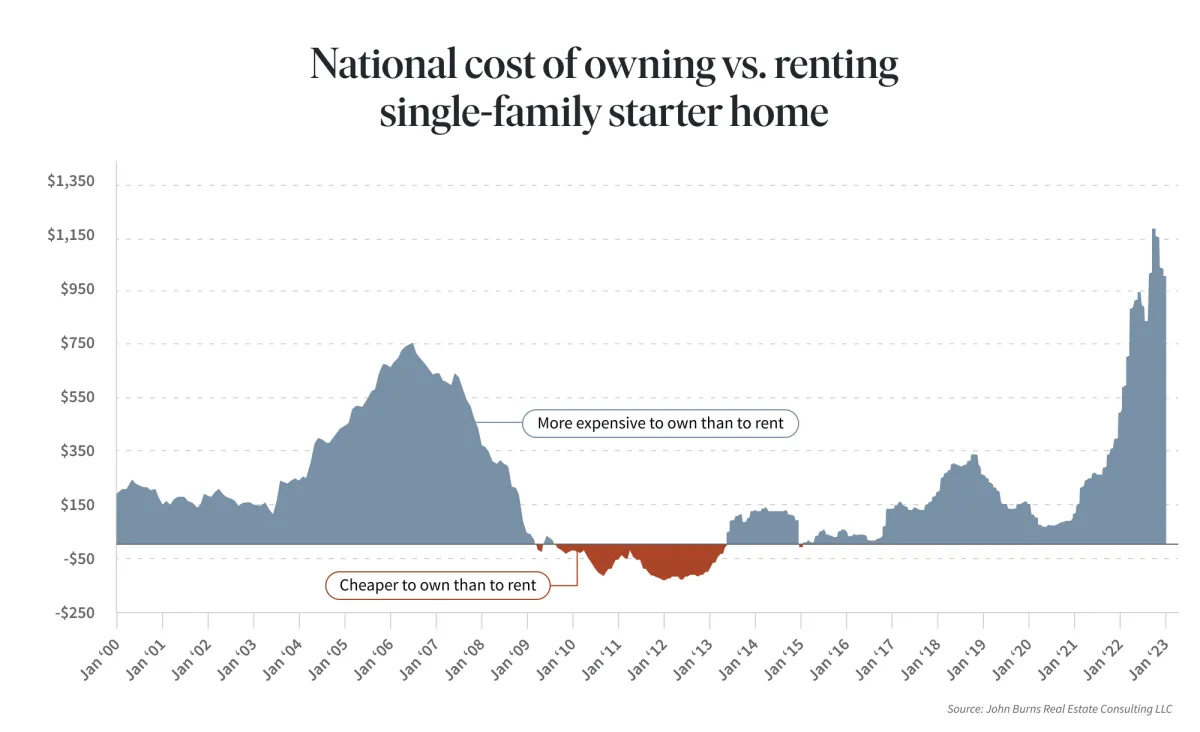

Moreover, the combination of rising construction expenses and increased interest rates is further straining affordability, with the average 30-year mortgage rate climbing by roughly 200 basis points from the same time last year. This has led to higher borrowing costs, reducing the incentive for current homeowners to sell their properties as they may be reluctant to give up the low-interest rates they secured previously.

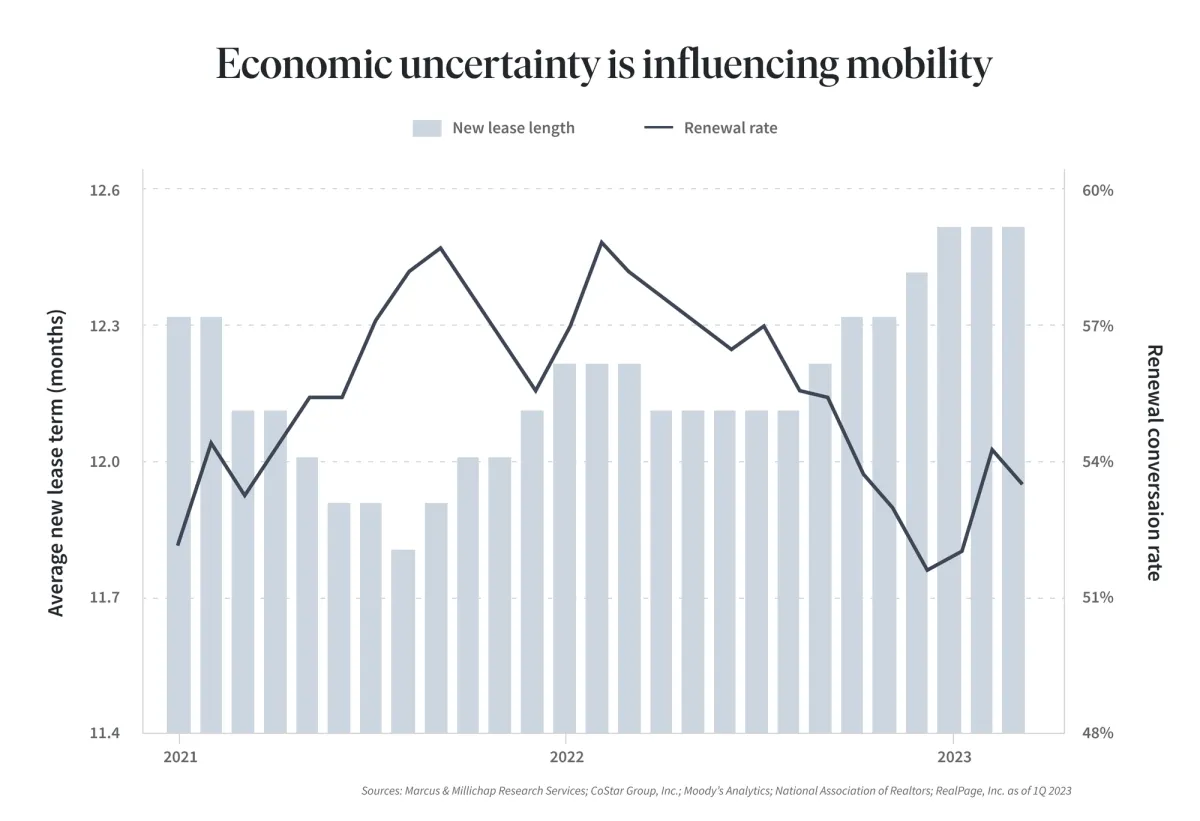

It is unlikely that any of these obstacles faced by prospective homebuyers will abate in the near future. This, coupled with economic uncertainty, is causing residents to adopt a wait-and-see approach, as evidenced by longer leases and a dearth of homes being listed for sale.

With the national monthly mortgage payment for a typical single-family home exceeding monthly rent payment by over $1,000, it is easy to see why the current trend of limited housing supply and escalating home prices are fueling the demand for new multifamily units and build-for-rent communities, as people strive to find more living space. This presents an opportunity for developers to cater to this growing demand by providing high-quality rental options that offer the benefits of living in a spacious, detached home, such as privacy and a yard, without the upfront costs and long-term commitment of a traditional mortgage and maintenance expenses.

Over the past five years, there has been an acceleration in the growth of build-for-rent communities within the rental sector. Although still modest compared to other more mature commercial real estate asset types, the favorable fundamentals of build-for-rent single-family homes have captured significant attention from institutional investors. MetLife Investment Management estimates that institutional investors owned roughly 700,000 single-family rental homes in 2022, which accounts for about 5% of the 14 million single-family rental homes nationally.

By 2030, institutional investors are projected to increase their investment in single-family rental homes to 7.6 million homes, representing over 40% of all single-family rental homes nationally.

The rental housing market continues to thrive as homeownership wanes, with an impressive 44 million households fueling demand for rental properties across the U.S. CBRE projects occupancy rates to stay above 95%. As significant long-term demographic shifts continue to take place, there is an urgent need for new rental units nationwide as the U.S. is already struggling with a housing shortage of over 6.5 million units. A recent study commissioned by the National Apartment Association (NAA) and the National Multifamily Housing Council (NMHC) found that by 2035, approximately 4.3 million new rental units must be built to meet this growing demand.

The majority of the new rental housing supply that is under construction is concentrated in Sunbelt markets that have strong foundations for sustained, long-term economic growth due to job availability, cost of living, and quality of life. These markets, including Dallas-Fort Worth, Phoenix, Austin, Houston, and Atlanta, account for over one-fourth of the units currently under construction nationwide. According to the latest report by Marcus & Millichap Research Services, these same metropolitan areas are also expected to make up nearly 20% of the U.S. total household creation over the next five years.

Booming Demand for Industrial: Warehouses, Distribution Centers, and Data Centers

The industrial sector is being driven by the digital technology surge, e-commerce sales, and the "Made in America" push, which aims to reduce our reliance on foreign countries for essential supplies (medical equipment, drugs, semiconductors, robotics, etc.). By sourcing products closer to consumers, it not only significantly impacts sustainability initiatives positively but also reduces transit times when speed to the customer matters. All these trends combined will boost interest in industrial real estate for years to come; according to a recent report by JLL, the industrial market is expected to maintain its robust position through 2023 due to high demand.

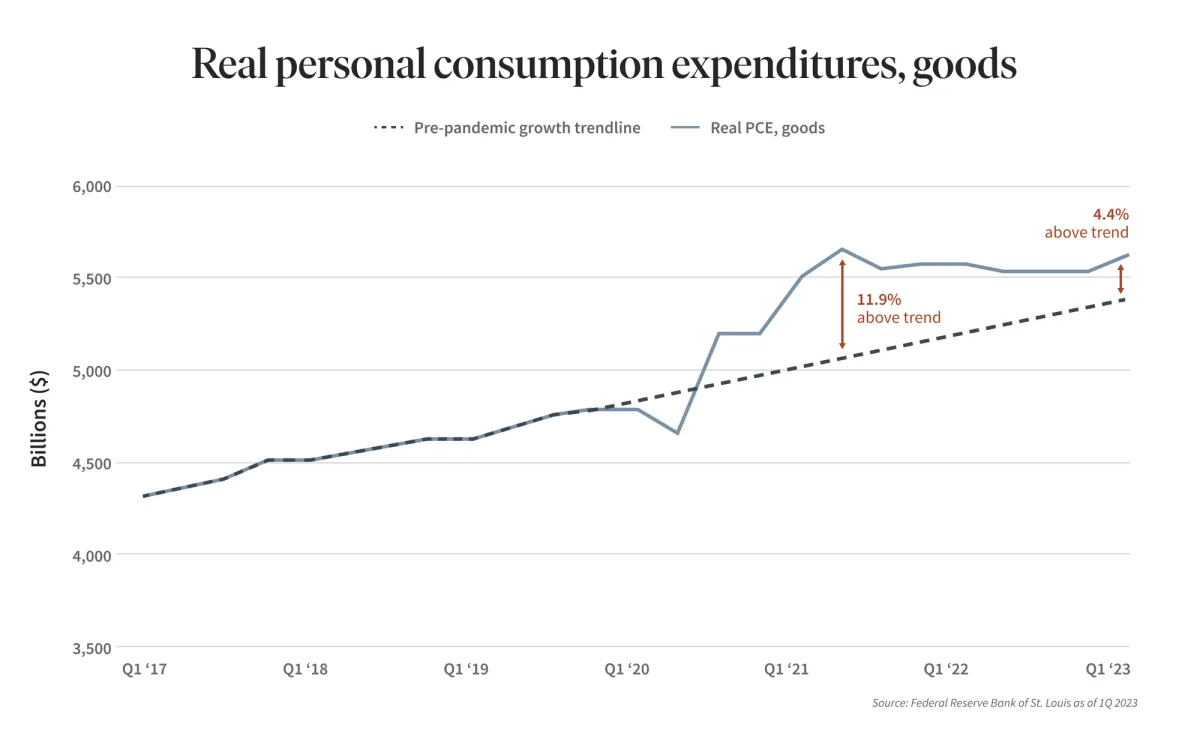

Although consumer spending decelerated in the first quarter of 2023 compared to 2021, inflation-adjusted spending on goods increased by 80 basis points since July 2023, driven partially by persistent wage gains, which continued to trend above average. Despite the overall slowdown in consumer spending, the sustained wage growth has helped to buoy the demand for goods and support the economy. As the labor market continues to tighten and wages continue to rise, we will continue to see growth in consumer spending on goods, which will help to drive economic growth and support the demand for industrial warehouses and distribution facilities.

In addition to consumer spending driving the demand for industrial warehouses and distribution facilities, the data center industry continues to thrive due to the surge in digital technology innovation and the rapid development of AI tools like ChatGPT and Bard. JLL's latest report reinforces this fact, as it shows how the potential of generative AI to transform industries across the globe will accelerate the demand for data centers.

As the hidden infrastructure underpinning all digital activities, data centers are becoming increasingly important, leading to a growing demand for hyperscalers and edge data centers. Hyperscalers are catering to the increasing demand, while edge data centers allow for diversification and improved latency, making them a critical component of the digital ecosystem. In addition, the server computer density required by AI generates a tremendous amount of heat, creating a need for innovative cooling solutions. However, these solutions can add to the already high cost of developing data centers, which can be exorbitant. As a result, the supply and absorption rate of data centers is closely tracked as the demand for data centers continues to grow, driven by the increasing importance of AI in the digital economy and the growing demand for data-intensive applications.

To date, this demand has resulted in record-low vacancy rates and unprecedented rent growth across industrial warehouses, distribution facilities, and data centers. According to Marcus & Millichap, industrial rents have increased by 14% between the first quarter of 2021 and 2022 and further rose by 16% between the first quarter of 2022 and 2023. In addition, the strong demand has led to a positive fifty-two consecutive quarters of net absorption, with many markets across the U.S. maintaining a sub 2.0% vacancy rate in the first quarter of 2023.

Despite the challenges posed by economic uncertainty and a slowing economy, the industrial sector continues to outperform other commercial real estate property types, particularly in the Sunbelt. This is due to the sustained demographic and population growth in the region, and demand for markets with port infrastructure, e-commerce, and supply chain transformation. Additionally, with the rise of urbanization and strong population growth in the Sunbelt Region, there is a growing need for modern distribution space to ensure the quick delivery of online orders. These trends are expected to continue, driving a high demand for last-mile distribution facilities, particularly in densely populated and growing areas. As more consumers expect quick delivery times, businesses must adapt and invest in last-mile facilities to meet these expectations.

The net result is a continued trend of low vacancy rates, higher rents, and higher property prices for industrial assets. Furthermore, port cities are expected to experience sustained high demand and rent growth, making them attractive investment opportunities for developers and investors looking to capitalize on the growth of the industrial sector. Therefore, despite the challenges faced by certain segments of the real estate sector, such as office, others — like the industrial sector — are thriving. This reframes the private real estate market as an adynamic and transforming sector with significant growth and diversification potential rather than the unfortunate and beset asset class that current media coverage might suggest.

Amid the uncertainty, identifying private market trends is a key prerequisite for wealth preservation and continued portfolio growth

In summary, the pandemic and banking crises have caused significant disruption to the financial markets and increased the likelihood of an impending recession. In this environment, it's more important than ever to remain vigilant and rethink your portfolio construction. While there may be a lot of surface-level chatter about imminent investment trends, it's crucial to understand the historical context and current factors driving the long-term demand and growth of each sector.

Research spanning over 20 years indicates that a portfolio with at least 30% invested in alternative assets has consistently outperformed traditional stock-bond portfolios. Therefore, for investors looking to diversify their portfolio beyond traditional public market assets, private market investment allocations can potentially address some of the challenges posed by the prolonged period of elevated inflation by providing stability and positioning a portfolio for long-term growth. This makes private market investments an ideal option for investors who are seeking long-term growth and wealth preservation in the face of uncertainty.

But unlike the investment environment of recent years, characterized by low-interest rates and free-flowing credit buoyed fast and frequent growth across various industries, today’s investment environment is much less forgiving, demanding that investors understand why one sector is better positioned than another. And yes, that means studying the trends and the investments they support, from the ways that venture capital cash deployment can help develop solutions for the world’s future exabyte daily data production needs, to how a real estate investment can fund new build-for-rent communities, giving thousands — if not millions — of people the opportunity to escape overpacked cities and enjoy fresh air and a grassy backyard.