For decades, the 60/40 portfolio—60% stocks and 40% bonds—was touted as a reliable foundation for individual investors. It was simple. It was diversified. And for the most part, it worked.

However, the model has its limitations. Namely, that it is 100% focused on public markets.

Meanwhile, institutions and most all professional investors have for years relied on a more sophisticated investment model, whereby at least 20% of their portfolio is allocated to alternative assets, aka the private markets.

Why? Because the data has consistently shown that over long hold periods, a portfolio with private market alternatives has produced not only better returns but also greater stability.

From the beginning, we created Fundrise with the basic notion that individuals deserved access to these same alternative assets. Our mission was to democratize access to the private markets. However, most people in the financial industry didn’t believe it was possible.

Today, we see those same critics starting to wake up to the reality that financial markets are changing. They’ve evolved, become more complex, and the basics of the 60/40 portfolio are beginning to fall short.

As a result, we are beginning to see a wave of traditional incumbents start to focus, for the first time, on the potential value of giving individuals the opportunity to invest in alternatives. And with it a new and much deserved level of attention on the industry.

As more and more people wake up to the benefits of private markets, we expect to see the 60/40 portfolio be replaced by the new and more dynamic 50/30/20 portfolio that Fundrise investors have been adopting over the past decade.

What's changed

Two major shifts stand out.

First, the structure of the financial markets has changed.

Public markets have grown more concentrated, more correlated, and—arguably—more reactive. Indexing, passive flows, and algorithmic trading have made diversification within public markets more difficult to achieve. A notable change: stocks and bonds, which historically moved in opposite directions, now more often than not, move in tandem—undermining a core principle of the 60/40 model.

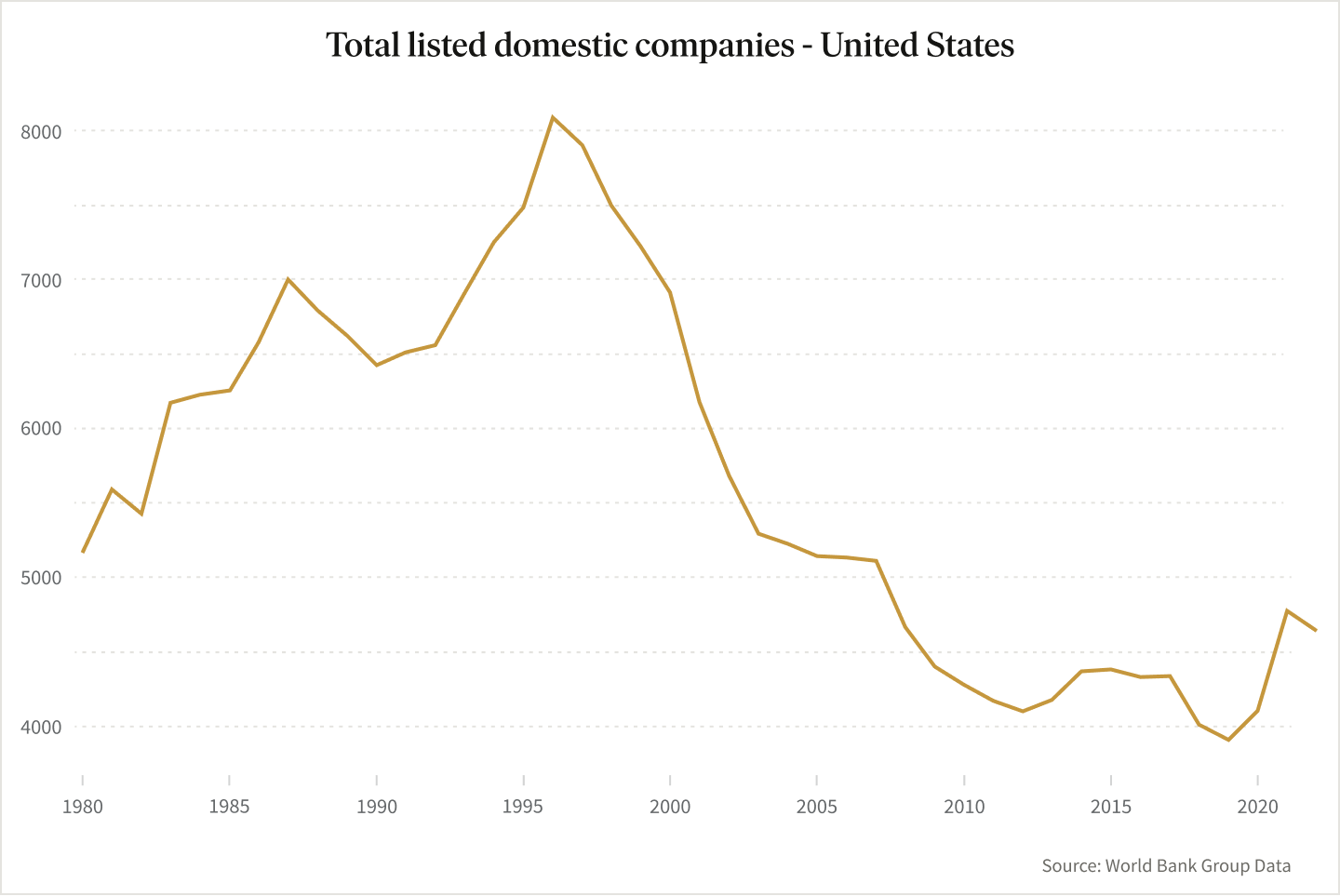

At the same time, the globalization of financial markets has led to increased synchronization between U.S. and international equities. As the U.S. economy continues to influence global capital flows, even international markets increasingly track with U.S. indices. Geographic diversification, once a dependable hedge, has become less effective. All the while, the number of public companies have steadily declined.

Second, the role of private markets has expanded significantly.

Companies are staying private longer, and much of the value creation once captured by public market investors now occurs behind the scenes. Simultaneously, banks have stepped back from traditional lending—due to capital requirements and regulatory shifts—leaving a gap that private lenders have moved quickly to fill. Private credit has become a vital and growing part of the modern financial system.

Institutional investors have taken notice. Over the past 20 years, public pensions, endowments, and sovereign wealth funds have steadily increased their allocations to private markets. According to recent research, U.S. public pensions have grown their exposure to alternatives from 14% to nearly 40% of risky assets since 2001.

This shift hasn’t been driven by speculation—it’s based on data. Studies by Cambridge Associates and the World Economic Forum show that portfolios with meaningful allocations to private markets have historically produced better risk-adjusted returns than portfolios relying solely on public stocks and bonds.

These are not fringe experiments. They are deliberate moves toward building more resilient portfolios—ones better equipped to withstand inflation, policy shifts, or interest rate whiplash.

From 60/40 to 50/30/20

The conventional 60/40 model made sense in an era of falling interest rates and predictable globalization. But we no longer live in that era. Today’s economic landscape is shaped by supply chain rewiring, labor shortages, rising construction costs, and shifting monetary regimes. It’s not that bonds no longer have a role—they do. It’s that they may not hedge equities in the same way they once did.

That’s why a growing number of investors—and increasingly, individual investors—are adopting a different approach: 50% equities, 30% bonds, and 20% alternatives.

We believe this 50/30/20 model better reflects where value is being created—and how risk is distributed—across the modern financial system.

The role of alternatives

We’ve long viewed private market alternatives not just as a complement to public markets, but often a counterbalance to them.

- Real estate offers consistent income and serves as a natural inflation hedge, particularly in supply-constrained, high-growth regions.

- Private credit — such as our preferred equity strategies—can generate fixed, attractive yields (13–16% in recent examples) that remain compelling even in lower-rate environments.

- Venture capital offers long-duration exposure to technological innovation, often before those companies ever reach the public markets.

Individually, each has its own role. But collectively, they offer what we believe is true diversification: assets that are fundamentally uncorrelated to each other, and to the broader public markets.

Why this matters now

As we noted in our Q1 2025 investor letter, the majority of Fundrise clients—across real estate, credit, and venture—experienced positive performance during a quarter when public markets broadly declined. That’s not an accident. It’s a function of the inherent structural difference between public and private markets. Private markets are less correlated with public markets. Private markets are driven more by asset-level fundamentals than by market sentiment. Public markets are constantly digesting and pricing in new information, private markets have the benefit of having more time to see how changes in macroeconomic conditions or policy shocks affect and impact their business.The positive performance of our portfolios during recent market volatility underscores the distinct behavior and diversification value of these private strategies.

We continue to see institutional capital reallocating into alternatives. What was once considered “niche” is increasingly becoming standard. What’s changed is that the infrastructure now exists to bring the same long-term strategies once limited to pensions and endowments into the hands of individual investors who share the same goals.

That said, private markets are not without tradeoffs. They require longer investment horizons. While Fundrise’s registered interval funds do update their share values daily, they are intentionally not as liquid as public market investments, with redemptions typically processed quarterly. This of course is part of what allows them to behave differently—and potentially perform more steadily. In a world where volatility is increasingly driven by headlines and high-frequency trading, we believe there’s value in investments that don’t flinch at every market twitch.

Looking ahead

This broader shift towards investing in alternatives will likely seem all too familiar to Fundrise investors, it of course is not only the very premise on which we built this company more than a decade ago but also the primary reason most of our investors say they sought us out in the first place.

It is little surprise to us that our Fundrise investors will end up looking like the early adopters of what has the potential to be a structural shift in financial markets similar to what index investing did in the early 2000’s.

As a company that believes fundamentally in the importance of creating more equal access to these types of investments, we welcome this slow but now growing change in broader awareness and expect that it will only serve to create more opportunities for both Fundrise investors and all individual investors alike.

As always, thank you for your continued trust. If you have any questions, we welcome hearing from you via investments@fundrise.com.

Onward.