Every few decades a new real estate asset class is born. In the 1960s, the mass adoption of cars led to the expansion of malls and strip centers nationwide. In the 2000s, the internet and mobile phones created data center and cell tower REITs. In the 2010s, traditional single-family rental (“SFR”) came out of the Great Financial Crisis while a rise in e-commerce drove the need for new types of last-mile industrial logistics facilities.

Now, in the 2020s, build-for-rent has emerged as the next major asset class in the real estate industry expanding rapidly and garnering a disproportionate share of attention from large institutional investors.

What is Build-for-rent (aka BFR)?

Build-for-rent (“BFR” for short) properties are communities of newly constructed single-family homes that have been purpose built with the intention of operating them as one large rental community. Think of it like a spread out apartment building where each home operates like its own rental unit but it is still part of a larger community with shared amenities and professional management.

New real estate sectors tend to only emerge every few decades when a series of major trends come together all at once to create a systemic shift. Historically, investing in these trends and capturing the broader rising tide has been a reliable way to earn above average returns.

For BFR, the major megatrends coming together include:

- Technological: The pandemic radically changed adoption of remote work, which increased to 30% of all workers. Not only is it impacting the office industry and downtown business districts across the country, it also transformed the calculus on how people live – from commute times, expectations for what they want from a home, and even where in the country one can live.

- Demographic: Millennials, the largest generation in history at more than 72 million individuals have entered the age when they start forming families and look for a different lifestyle and location to live. This group that drove the rapid expansion of apartments in big urban cities are now moving to the suburbs in search of more space, better schools, and family friendly communities.

- Affordability: The demand for single-family-home living is at a high, but the cost to buy is also greater than ever. Renting is much less expensive than owning today with a monthly rent now much lower than mortgage payments.<sup>1</sup>

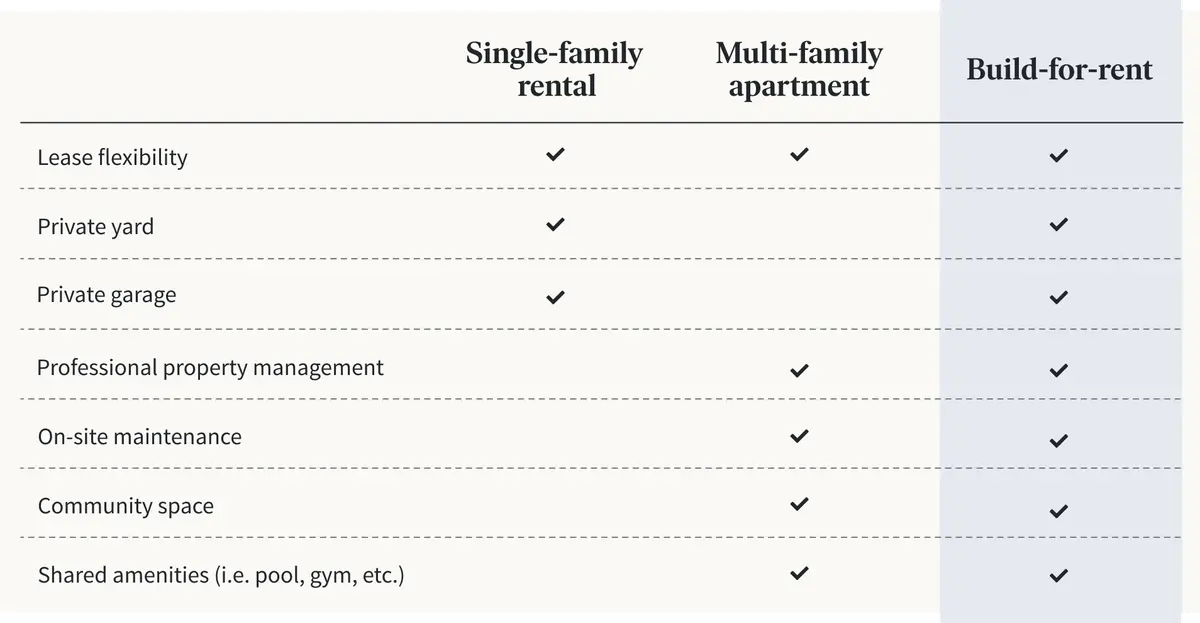

What makes BFR different?

The definition of BFR is still evolving (with some also referring to it as build-to-rent or BTR). But what generally is consistent is that BFR communities differ from traditional SFR in a few ways:

- BFR homes are all located within a single stand alone community vs. scattered amongst other homes owned by individuals

- BFR homes are newly constructed vs. SFR which tend to be older pre-owned homes

- BFR communities are purpose built for rent vs. SFR homes which often are previously owned homes purchased off the MLS

- BFR communities typically offer a suite of shared amenities including pools, gyms, clubhouses, dog parks, and co-working space

In many ways, BFR communities are a hybrid that combine both the benefits of single-family housing and multifamily buildings. Like SFR, residents get many of the same qualities of living in an actual home with backyards, more living space, and a suburban lifestyle while also benefiting from having on-site professional management, dedicated maintenance teams, and again the shared infrastructure and amenities one would typically expect in a luxury apartment building.

Fundrise expands into BFR

As earlier as 2017, we began to focus on the changing demographics of millennials. Those that had driven the boom in apartments in big cities like New York, San Francisco, and Washington, D.C. were starting to get older and looking for more space. We believed this “aging” dynamic would transition the demand from smaller urban apartments to larger more suburban homes.

Then the pandemic happened and overnight created a sea change in how people wanted to live and work. Within our own organization, we transitioned from in person to remote work and watched as many team members moved from Washington, D.C. to other cities like Charlotte, Atlanta, Dallas, or Orlando.

At the same time, the pandemic had halted the home building industry with many builders having tens of thousands of houses they couldn’t sell. We saw this as an opportunity and so during the summer of 2020, contracted with several large builders to purchase about $500M of new homes that they would build and deliver to us over the next 12-24 months.

However, we quickly realized that we had another problem - there was no existing real estate company that we could partner with to implement this new build-for-rent strategy. Although there were many apartment owners and operators, as well as many traditional SFR players, there was not anyone who specialized in or really understood how to build, own, and operate a community of purpose built rental homes.

We decided that we had no choice but to build our own BFR operating platform, which meant creating a new department, hiring a specialized team, and building a new technology infrastructure.

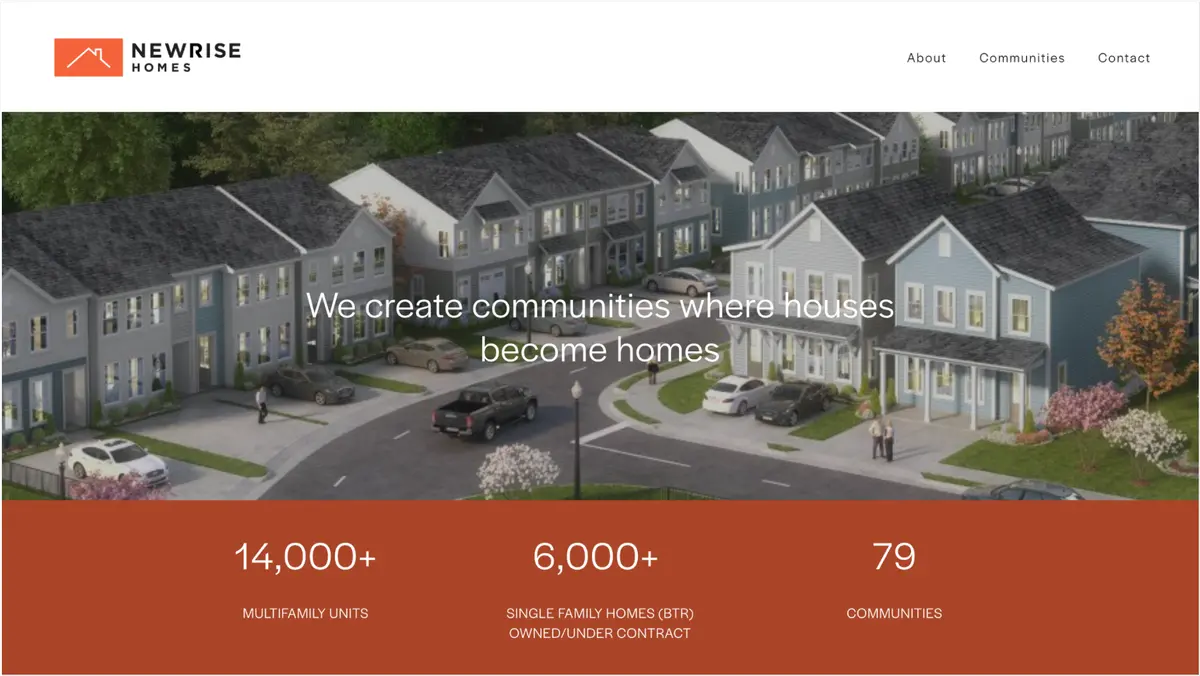

Today, Fundrise’s Newrise Homes is one of the largest BFR platforms in the nation. We own more than fifty communities worth well over $1.25 billion in total value. We’ve received financing from Goldman Sachs, MetLife, Hartford Insurance, Prudential Investment Management, and JP Morgan among many others. Our BFR team alone consists of more than thirty real estate and technology professionals. We built our own proprietary technology platform called Basis<sup>TM</sup> that has enabled us to manage so many homes efficiently at scale, and have been able to deliver strong performance for our investors.

Looking ahead

We believe build-for-rent is well on its way to becoming the next major institutional asset class. As a product type it offers individuals and families a goldilocks solution with the benefits of living in a single-family home combined with providing many of the desirable attributes of a luxury apartment community and all at a much more affordable and lower entry price than buying a similar home that today.

From a broader economic perspective, build-for-rent communities add critical new housing supply to a market that continues to be significantly undersupplied and particularly helps provide a solution to the “missing middle” problem - the gap between small one and two bedroom apartments and much larger 5 bedroom plus home, where very few affordable or entry level homes exist today.

And as an investment asset it we believe it combines many of the benefits of traditional multifamily but with greater return potential. There are tens of millions of apartment units across the country and likely only a few hundred thousand BFR homes. This large demand / supply imbalance, paired with the strong demographic tailwinds, and more efficient operating costs in comparison to traditional SFR make BFR poised to be one of the big winners in real estate over the next decade.

As we continue to grow not only the portfolio but also our internal operating platform, we expect that our technology first DNA will continue to allow us to remain a leader in the space.