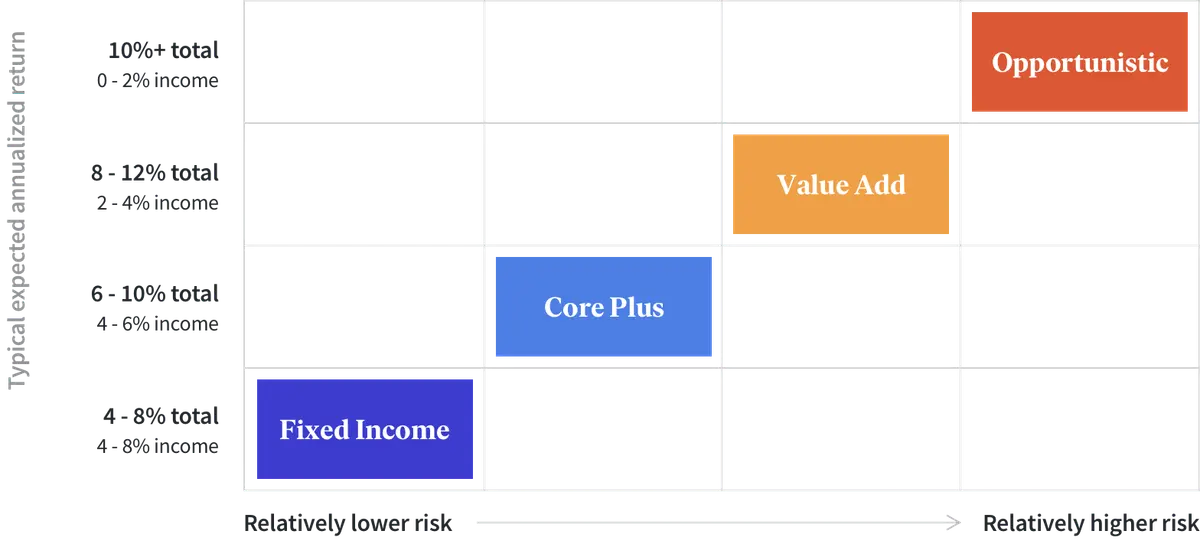

By employing a combination of strategies, we aim to build well-rounded, resilient portfolios targeted to deliver consistently strong results based on our clients’ goals and appetite for risk.

Fixed Income

Our Fixed Income strategy seeks to generate above-market yields by providing creative and comprehensive financing solutions underpinned by high-quality real estate. We seek to lend with a margin of safety to product types with high durability of demand (e.g., housing) and real constraints on new supply, thereby supporting property values.

Typical return profile*

- Cash flowing at acquisition

- Income: 6-8%

- Total return: 6-8%

*of a general private real estate investment of this type. There is no guarantee that the manager will achieve such results.

Some of our Fixed Income investments

New apartment development, Atlanta, GA

Finance the redevelopment of an underutilized site located in the heart of Atlanta’s growing West Midtown neighborhood.

$9.5 million invested

Station East

Finance a master-planned community in one of the fastest-growing parts of the Bay Area.

$28.0 million invested

Elysium 14

Finance the development of a premier mixed-use destination in the heart of Washington, DC’s booming 14th Street corridor.

$6.5 million invested

Core Plus

Our Core Plus strategy features stabilized real estate with a long investment horizon and moderate leverage, where we can unlock additional value through focused asset management. We aim to buy quality assets at an attractive basis in growing markets across residential and industrial asset classes.

Typical return profile*

- 6-12 months to first cash flow

- Income: 4-6%

- Total return: 8-10%

*of a general private real estate investment of this type. There is no guarantee that the manager will achieve such results.

Some of our Core Plus investments

Interwest EVO

376-unit luxury apartment community in fast-growing Las Vegas, which continues to absorb new residents from California

$43.3 million invested

Williamson at the Overlook

Brand new 330-unit apartment community outside Austin, TX.

$25.0 million invested

Amber Pines at Fosters Ridge

Acquisition of 120 unit single family rental community in suburban Houston, TX

$32.3 million invested

Value Add

Our Value-Add strategy focuses primarily on acquiring existing properties below replacement cost and investing capital to increase their competitiveness. We focus primarily on acquiring reasonably-priced residential communities in growing markets where affordable rental housing is scarce.

Typical return profile*

- 12-18 months to cash flow

- Income: 2-4%

- Total return: 10-12%

*of a general private real estate investment of this type. There is no guarantee that the manager will achieve such results.

South LA creative office

Acquisition of a commercial building with an in-place creative tenant in the booming West Jefferson area of South LA.

$3.5 million invested

Enclave Lake Ellenor

Renovation and expansion of suburban apartment community in Orlando, FL

$7.7 million invested

Carlyle Corner

Mixed-use development located in the main corridor for defense contractors, 10 minutes from the Pentagon

$35.9 million invested

Opportunistic

Our opportunistic strategy seeks to acquire underutilized, well-located properties in the most dynamic markets. With the combined expertise of our in-house development team and best-in-class partners, we reimagine these properties, often from the ground up. These business plans are the most complex and longest-dated that we execute, but carry the potential for the greatest reward.

Typical return profile*

- 2-3 years to first cash flow

- Income: 0-2%

- Total return: 12-15%

*of a general private real estate investment of this type. There is no guarantee that the manager will achieve such results.

West Jefferson

Creative office redevelopment

$3.6 million invested

Electronic Drive

Redevelopment of one-of-a-kind industrial site to a new Class A industrial terminal

$15.7 million invested

Hampton Station

Development of 150-unit residential community adjacent to walkable local retail destination

$2.2 million invested

Compare our strategies

This table is intended to aid in the general understanding of how real estate investing strategies relate to one another, and is not meant to be representative of any particular investment; all investments involve the risk of loss, and there can be no guarantee of returns.

| Fixed Income | Core Plus | Value Add | Opportunistic | |

|---|---|---|---|---|

| Overview of typical business plan | Provide real estate backed loans or similar structured financing | Acquire and operate stabilized, cash flowing real estate | Acquire real estate that needs improvements and / or lease-up | Acquire and (re)develop the real estate, often from the ground up |

| Timing of expected return | Typically begin earning interest immediately | Begin earning income shortly after acquisition | Several months to a year to begin seeing returns | Often two years or more to begin seeing returns |

| Primary expected source of returns | Interest income | Rental income with some growth | Growth with some rental income | Growth |

| Expected total annualized return1 | 4 - 8% | 6 - 10% | 8 - 12% | 10%+ |

| Expected annual income 1 | 4 - 8% | 4 - 6% | 2 - 4% | 0 - 2% |

| Expected variability of return | Low | Moderate | High | Very High |