Over the past three decades, we have witnessed six cycles of interest rate hikes, including the Federal Reserve’s most recent battle, beginning in 2022 and continuing through today, in a notable effort to combat inflation. This initiative has been regarded as one of their most aggressive undertakings in decades, with the federal funds rate being raised eleven times since March 2022. These rate hikes mark a significant turning point, indicating the conclusion of an era characterized by historically low interest rates. During this time, the Federal Reserve also implemented a restrictive monetary policy known as quantitative tightening by winding down their asset purchases.

Considering the substantial magnitude and swift implementation of the Federal Reserve’s rate hikes and restrictive monetary policy, it became evident that these policies had the potential to generate economic uncertainty, uncover vulnerabilities within the financial system, and considerably raise borrowing costs.

So, it was unsurprising that these abrupt changes materialized peoples' worst fears and triggered a wave of instability in public financial markets, causing widespread disruptions and a substantial decrease in essential liquidity. This trend was further accelerated in early March 2023 when multiple banks collapsed, sending shockwaves throughout the financial system and exacerbating the banking crisis, further draining liquidity from the public markets.

Consequently, institutional investors are now shifting their attention back to lower-risk assets that provide higher yields. The rise in interest rates has created a significant yield buffer in bonds, especially in the front end of the yield curve, offering insulation against potential shifts in economic trajectories. This renewed emphasis on income-generating investments is driven by their historical capacity to safeguard against market volatility and mitigate risk, particularly during a cycle of interest rate hikes.

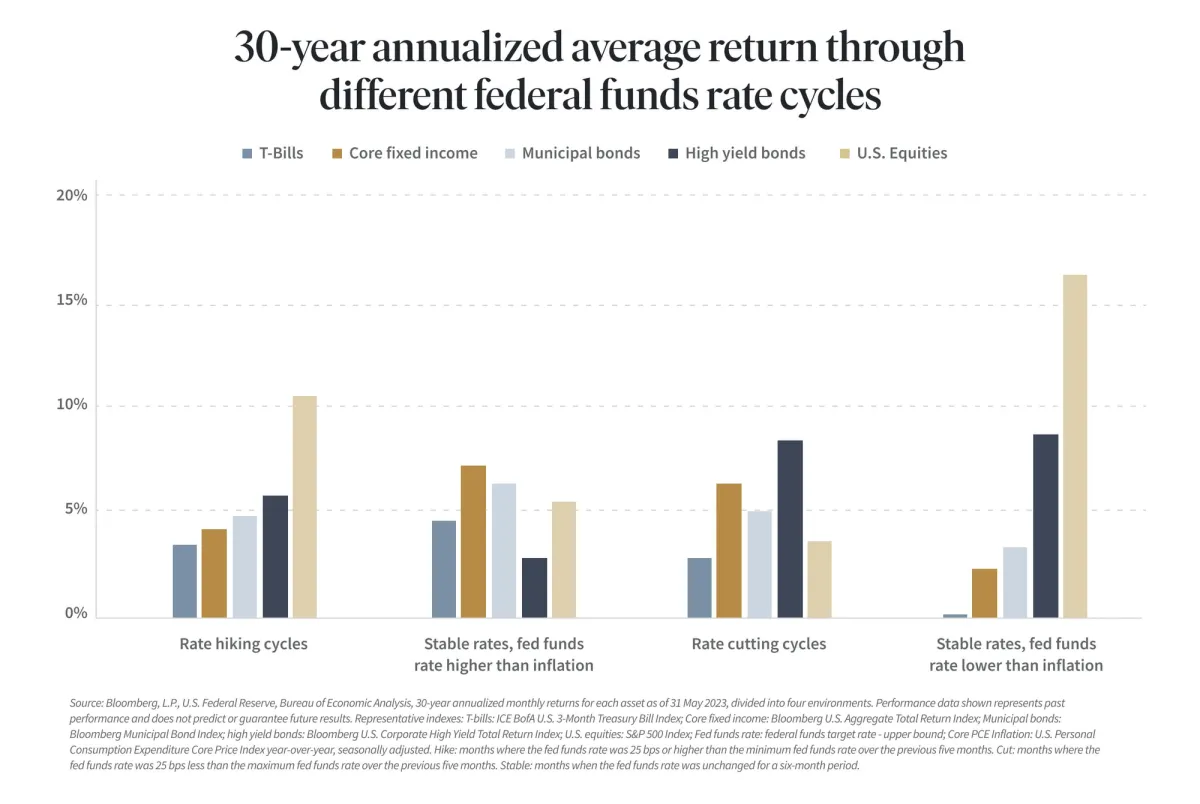

This article will explore what are likely to be the most popular income-generating investment options available in the private markets over the next several years. These opportunities are classified into four distinct rate cycles: rate hiking cycle, stable rate cycles where the federal funds rate exceeds inflation, rate cutting cycle, and stable rate cycles where the federal funds rate is lower than inflation.

Is the era of aggressive rate hikes coming to an end?

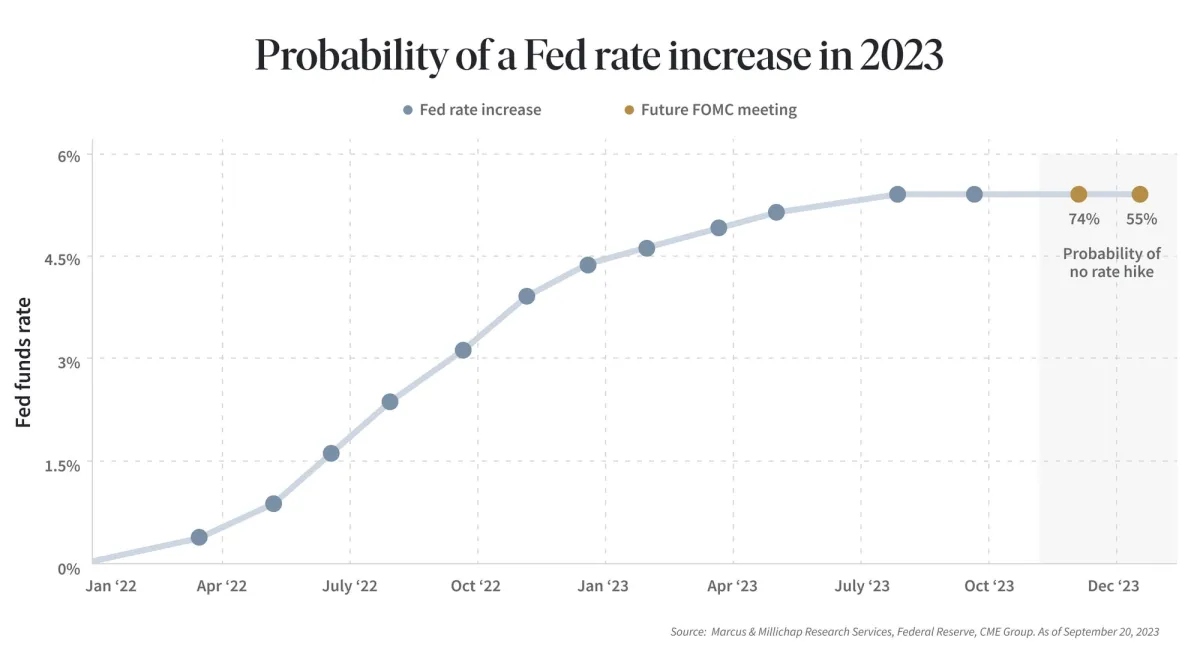

After reaching a peak of 9.1% in June 2022, inflation has significantly eased to 3.7% as of August 2023, largely thanks to the Fed’s most aggressive hiking campaign in decades. With inflation now at moderate levels, the key question is when and whether, over the upcoming three FOMC meetings, the Federal Reserve will increase the federal funds rate or shift its focus to transitioning into a stable rate cycle.

This is a complex question and depends on various economic factors. While economists may disagree in their predictions on precise timing, there is a general consensus that the Federal Reserve will probably maintain the federal funds rate at its current level throughout the year. Subsequently, it is expected that we will reach the end of the rate hiking cycle in 2023, with the Fed aiming to keep interest rates unchanged for an extended period.

What does that mean for investment asset outlooks? In short, the current situation incentivizes investors seeking higher yields to turn their attention to the bond market. Within the bond market, investors have the chance to explore various investment options that have the potential to generate returns ranging from mid-single digits to mid-double digits. Looking at historical trends, in past rate hike cycles, income-generating investments such as corporate bonds, municipal bonds, private credit, and Treasury securities have performed well in the period following rate hikes. This is because the effects of the rate hikes gradually make their way through the economy. Furthermore, some of these investments have displayed resilience even during rate cuts that occur during times of economic weakness.

Taking into account these factors, investors could find it beneficial to allocate a portion of their portfolios to income-generating assets within the bond market. By doing so, they can capitalize on the potential for higher returns, even amid ongoing rate hikes and periods of heightened volatility, since returns are generated by income instead of relying on price appreciation.

Exploring income-generating investments: a breakdown by cycle

Rate hiking cycle

During a rate hiking cycle, investors may find short-term bonds with maturities of three years or less to be a favorable option as they tend to carry lower risk compared to long-term bonds. Short-term bonds are less susceptible to interest rate fluctuations, which makes them a more stable investment choice. Conversely, long-term bonds with maturities of ten years or more are more sensitive to fluctuations in interest rates and may experience a decline in price due to higher inflation.

This scenario occurred in 2022 when the U.S. grappled with mounting concerns of runaway inflation. In response, the Federal Reserve embarked on its most aggressive rate hiking cycle in 40 years. This move was aimed at curbing inflationary pressures. Consequently, the yield curve inverted, causing short-term bonds to offer higher returns compared to their long-term counterparts.

Furthermore, loans with floating rates pegged to the secured overnight financing rate (SOFR) have generated some of the highest average returns during rate hiking cycles. This is because SOFR closely tracks rising interest rates and ensures that the returns on these loans keep pace with the changes in interest rates.

Bottomline: During a rate hiking cycle, short-term bonds with maturities of three years or less provide lower risk, while loans with floating rates tied to SOFR offer attractive returns due to their ability to adjust to the changing interest rate environment.

Stable rate cycles where the federal funds rate exceeds inflation

Historically, fixed-income securities have demonstrated favorable performance following the conclusion of an interest rate hike cycle by providing reliable returns. During stable rate cycles, investors may find bonds with longer maturity and higher coupon rates to be particularly attractive returns as they have the potential to offer higher returns. Additionally, floating-rate loans, commonly utilized in private credit investments and other corporate bonds, can be advantageous due to their lower interest rate risk compared to fixed-rate securities. Loans with floating rates have the ability to adjust to short-term changes in interest rates, making them potentially more lucrative.

Bottomline: During stable rate cycles where the federal funds rate exceeds inflation, fixed-income securities with longer maturity and higher coupon rates, especially loans with floating rates such as private credit investments, can offer the best opportunities for consistent returns.

Rate cutting cycle

The purpose of rate cuts by the Federal Reserve is to stimulate economic growth during a downturn. Historical data reveals that fixed-income securities, such as investment-grade corporate bonds, municipal bonds, and U.S. Treasury bonds, have consistently outperformed stocks and cash during a rate-cutting cycle. This is primarily because long-term bonds tend to benefit significantly from decreases in interest rates. As interest rates decrease, the prices of long-term bonds generally tend to increase.

Bottomline: Long-term bonds may experience price appreciation during a rate-cutting cycle due to falling interest rates, presenting potential capital gains opportunities for investors.

Stable rate cycles where the federal funds rate is lower than inflation:

Stable rate cycles where the federal funds rate is lower than inflation represent a key objective of the Federal Reserve. By reducing interest rates, borrowing costs are effectively lowered, incentivizing businesses and individuals to embrace investment opportunities, expand their operations, and increase their expenditures. As a result, economic growth is sparked, leading to a higher level of overall economic activity. Lower borrowing costs also make capital expenditures more attractive, prompting businesses to embark on new projects, invest in research and development, and expand their operations. This surge in investment has a positive impact on productivity, innovation, and competitiveness, ultimately benefiting the economy as a whole.

The period following the Great Recession of 2008, when the Federal Reserve deliberately maintained historically low interest rates, we experienced the longest bull market for stocks in the nation's history. Spanning over a decade, this remarkable market surge can predominantly be attributed to this unprecedented and extraordinarily prolonged phase of stable rates.

Bottomline: The impact of low-interest rates is multi-faceted and instrumental in driving economic growth and stability. Through a reduction in borrowing costs, low-interest rates encourage businesses and individuals to seize investment opportunities, expand their operations, and amplify their spending. This heightened economic activity not only stimulates job creation and elevates consumer spending but also fuels growth in business revenues. By working together, these factors contribute to sustained long-term economic expansion and cultivate a stable economic environment that fosters the prosperity of businesses, individuals, and the overall economy in a comprehensive and holistic manner.

Exploring the depths: a comprehensive look into the world of popular bond market securities

Treasury Securities

The significance of U.S. government debt, including Treasury bonds, bills, and notes, cannot be exaggerated. Not only is the U.S. Treasury market the largest bond market globally, with a staggering size of approximately $24.9 trillion Treasury securities outstanding. However, its significance extends beyond its size, the U.S.’s reputation for consistently fulfilling its debt obligations established Treasury securities as an essential asset in global financial markets. These securities are regarded as safe-haven securities, providing investors with nearly risk-free returns. The significance of Treasury securities goes beyond their own financial merits. They also serve as a crucial benchmark against which returns on stocks and other bonds are measured. This is due to the fact that investors typically require higher yields on alternative securities to compensate for the perceived additional risk.

In early August, the Fitch Ratings agency, one of the three biggest rating agencies in the U.S., downgraded the U.S. top-notch credit rating to AA+. This event draws parallels to a similar incident in 2011 when Standard and Poor's downgraded the U.S. credit rating for the first time in history. The 2011 downgrade triggered a widespread selloff in equities, but coincidentally, it also boosted yields on Treasuries as investors continued seeking out safe-haven assets. This time is no different as investors again turn to Treasuries, reinforcing their reputation for stability and reliable returns.

Consequently, the safety and dependability of Treasury securities make them an attractive investment option for risk-averse investors seeking a secure asset. At the same time, they also play a pivotal role in shaping the pricing and attractiveness of other financial instruments in the financial markets.

Municipal Bonds

The U.S. municipal bond market, with a total outstanding bond issuance of approximately $4 trillion, is substantial but still represents only a fraction of its counterparts. Municipal bonds are financial instruments issued by state and local governments to fund initiatives such as public services and infrastructure improvements. One significant advantage of investing in municipal bonds is that they offer tax-exempt income, generally avoiding federal taxes and sometimes state and local taxes. This characteristic makes municipal bonds a highly sought-after investment option since it enables investors to earn interest, preserve their capital, and reduce their income tax obligations simultaneously.

Paradoxically, municipalities’ lower fiscal agility and inability to cut spending (due to contractual obligations to maintain mandated expenses, for instance) can give their bonds a real edge over corporations. During economic downturns, municipalities can rely on essential services like water, electricity, and gas for revenue collection, which historically have maintained robust collection rates. As a result, municipalities are better positioned to withstand market turbulence stemming from higher interest rates. This favorable scenario makes municipal bonds a more secure investment option, as investors perceive them as safer than corporate bonds.

Similar to other fixed-income securities, the prices of municipal bonds are impacted by changes in interest rates. When interest rates decrease, bond prices generally increase, which creates a positive environment for municipal bonds, especially during a rate-cutting cycle. This favorable environment provides investors with stability and a dependable source of income that helps mitigate price volatility. Additionally, historical data highlights the resilience of municipal credit across various economic cycles, regardless of the factors driving those cycles. Consequently, investing in municipal bonds is a wise decision for individuals who want a tax-efficient strategy for generating income while preserving their capital.

Corporate Bonds (non-investment grade and investment grade bonds)

The U.S. corporate bond market boasts a significant outstanding bond issuance totaling approximately $10.4 trillion. It’s divided into two primary grading categories: investment grade, which includes bonds rated Baa3/BBB- or higher, and non-investment grade, also referenced as high yield or junk bonds, with ratings of Ba1/BB+ and lower. These bonds can offer yields of approximately 5% to 8%, depending on their grade, which is well above the ten-year average. While the impressive valuation of the U.S. corporate bond market is undeniable, navigating this investment landscape can be complex, especially during an economic slowdown. Corporate bonds can become vulnerable during these periods, as investors may not receive adequate compensation. This can lead to narrower credit spreads that fail to compensate for slower growth and tighter credit conditions adequately.

Therefore, it is vital to comprehend the challenges associated with the U.S. corporate bond market, particularly in terms of risks and the potential scarcity of appealing investment opportunities as we approach a rate-cutting cycle.

At Fundrise, our Innovation Fund has been strategically focused on investing in debt instruments while biding time waiting for a full market reset. By capitalizing on attractive credit market conditions, we have seized the opportunity to acquire corporate bonds of public technology companies. This approach has not only allowed us to navigate the prevailing market conditions but has also enabled us to take full advantage of the current market landscape. As a result, we have successfully built a bond portfolio that, as of mid-June 2023, was boasting an approximate net yield of 10.5%.1

Private Credit

Prior to the Great Recession, public debt markets and banks played a crucial role as the primary sources of financing. However, regulatory changes such as the Dodd-Frank Act implemented after the Great Recession, aimed at strengthening the financial system, have significantly increased the minimum size of public debt issuances. This has posed a major challenge for companies, especially small to mid-sized ones, to access the public debt market. Additionally, regulations have curtailed the lending capacity of banks, resulting in further restricting the amounts they can lend.

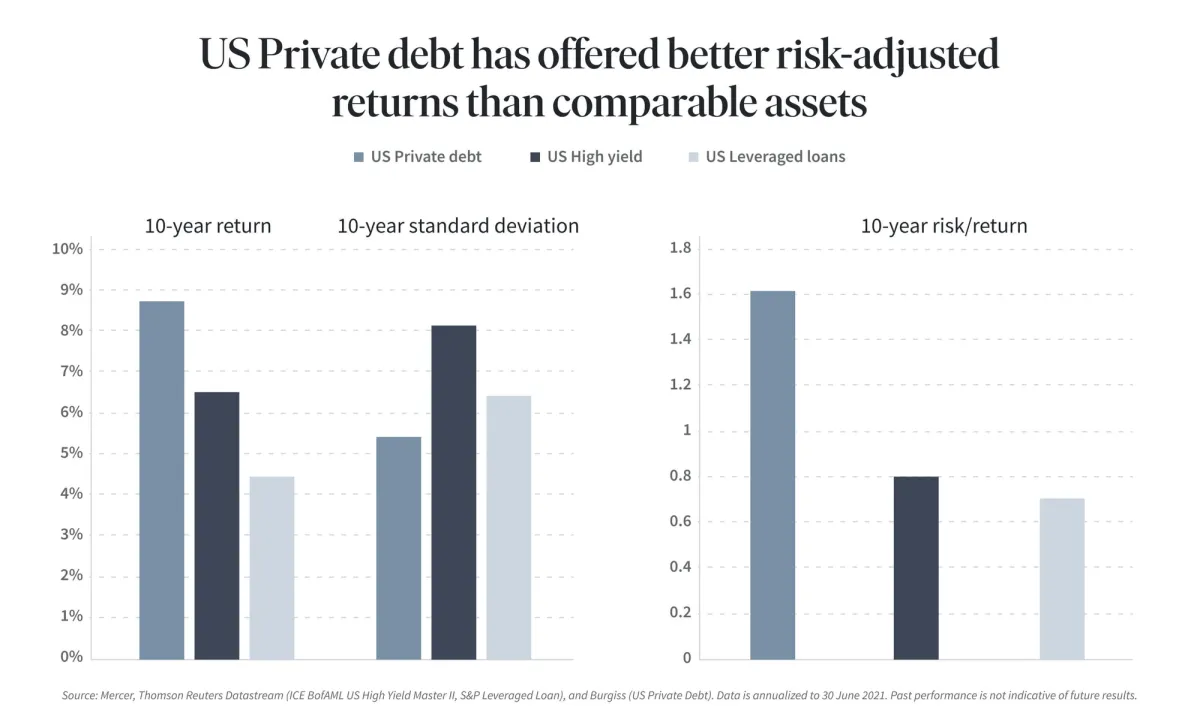

The changing landscape created an opportunity for private credit to emerge as a viable alternative, filling the lending gap left by traditional sources of financing. Since then, the private credit market has experienced consistent growth, driven by investors’ growing pursuit of attractive returns and borrowers’ increasing preference for swift execution. This momentum has allowed the private credit market to expand to approximately $1.3 trillion in outstanding securities today. Moreover, this upward trajectory is forecasted to continue, as Preqin projects that private credit to reach a substantial $2.2 trillion by 2027. Highlighting the remarkable expansion of opportunities within the private credit sector and underscore its growing significance in the global financial landscape.

In the current economic landscape, where the federal funds rate stands at 525 basis points, and Fed Chair Jerome Powell not ruling out the possibility of another rate increase during the July press conference, it is crucial for investors to proactively safeguard their investments against potential future hikes.

In this context, private credit investments are well-positioned to be highly attractive to investors seeking to capitalize on the Federal Reserve’s current monetary tightening cycle. This is because rising interest rates can yield favorable returns for private credit investors in contrast to bonds, which typically feature fixed interest rates. Most private credit loans are structured with floating interest rates that move in tandem with the rate hikes. This dynamic provides investors with consistent yields.

While historical data on private credit is somewhat limited, given that it only started to gain significant momentum around 2010, it is evident that the inclusion of floating rates offers a valuable layer of protection and enhances the value of investments within an environment characterized by high or rising interest rates. Thus, private credit investments are an attractive option for investors looking to maximize their returns in the current interest rate landscape.

At Fundrise, our private credit investment strategy is designed to bridge the funding gap for real estate owners facing liquidity challenges exacerbated by the rapid rise in interest rates throughout 2022 and 2023. These borrowers are often in the midst of implementing a business plan to enhance the value of their real estate assets, such as new construction, renovations, or lease-ups, and require additional time to reach stabilization. Our approach allows us to invest with a healthy margin of safety, focusing on high-quality real estate assets and creditworthy borrowers. As a result, we have successfully built a private credit portfolio that generates returns ranging between 13.5% to 15%.2

Considerations for today’s market environment in a nutshell

As recession fears for 2023 continue to diminish, investors remain steadfast in their search for higher yields, particularly in a sustained period of higher for longer interest rates. These higher yields not only provide a potential safeguard against market volatility but also present enticing opportunities for investors seeking capital appreciation and a reliable income stream. Among the various income-generating options available, private credit shines as a standout performer, offering impressive returns in the mid-double digits. This makes private credit an extremely attractive choice for investors seeking superior returns in the current economic landscape.

Furthermore, looking at historical trends in the bond market, positive performance has often followed the conclusion of interest rate hikes by the Federal Reserve. This further enhances the potential stability and growth prospects for income-generating investments. Nevertheless, it is crucial for investors to evaluate the risks associated with income-generating investments to make informed investment decisions and maximize long-term returns.