For years, investors have been encouraged to think about the assets in their portfolios as nothing more than a series of raw numbers. Charts and graphs. Values with no connection to the real world around them.

Of course, that idea is simply not true. Most investments — stocks and bonds included — directly represent businesses, entities, and commodities in the real world. But in today’s investing environment, where securities get mashed together into massive, industry-spanning index funds or ETFs, it’s easy to lose track of how your portfolio is tied to everything around you. Much of the time, for many investors, that’s worked well enough.

But real estate is different. Real estate is an investment class where stories really matter — stories that are vivid, often visual, and concrete. These stories are easy to understand. Anyone can sense the power and presence of real estate, how it shapes the spaces around us: the implications of new construction, new buildings, new homes, new stores, new offices, new schools. The evolution of neighborhoods, cities, and more.

At Fundrise, it’s part of our mission to embed the importance of real estate directly into the experience of being a Fundrise investor. We give our users visibility into every property on our platform via periodic updates, to showcase how real estate is growing in very real-world terms.

Starting on our assets page, you can view the profile of any one of our properties and see all the ways that specific property has progressed since its initial acquisition. In this article, we present a quick breakdown of the key elements you should look for and understand anytime you browse one of these property profile pages, like this one, for example. Or this one. Or this one. Or, in fact, any of the 220+ active and 80+ completed properties currently on our website — they’re all available on our platform, all the time.

Project title, type, and city

At the very top of each property profile, you’ll find the name of the specific investment project, a brief description of the property’s type (e.g. “new apartment development” or “home construction”), and its geographical location.

Example screenshot from the asset page for Estraya at Falcon Pointe, available here.

For example, in the screenshot above you see Estraya at Falcon Pointe Apartments, a new apartment development in Pflugerville, TX.

Meanwhile, in the case of a for-sale home property — or any other property that doesn’t have a proper name — you’ll simply see a property description and location, such as “Single-family rental home — West End, Atlanta, GA.”

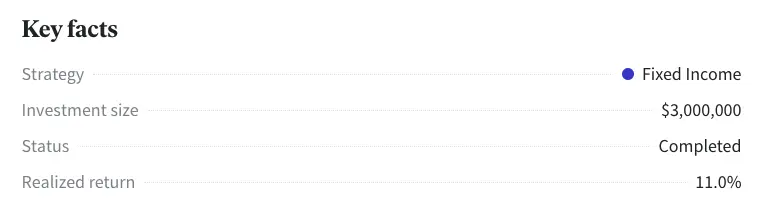

Photo and map

An image featuring a visual highlight of the property. These can range from beautiful, fully realized photographs in the cases of stabilized or complete properties, to architectural renderings in those cases where we’ve invested in a still-underway project involving ground-up construction. Each property’s alternate map view gives you an instant look at its location, with many offering views down to the property’s neighborhood and street. Note that in the case of single-family homes, we will withhold more granular location information for privacy reasons.

Example screenshot from the asset page for Estraya at Falcon Pointe, available here.

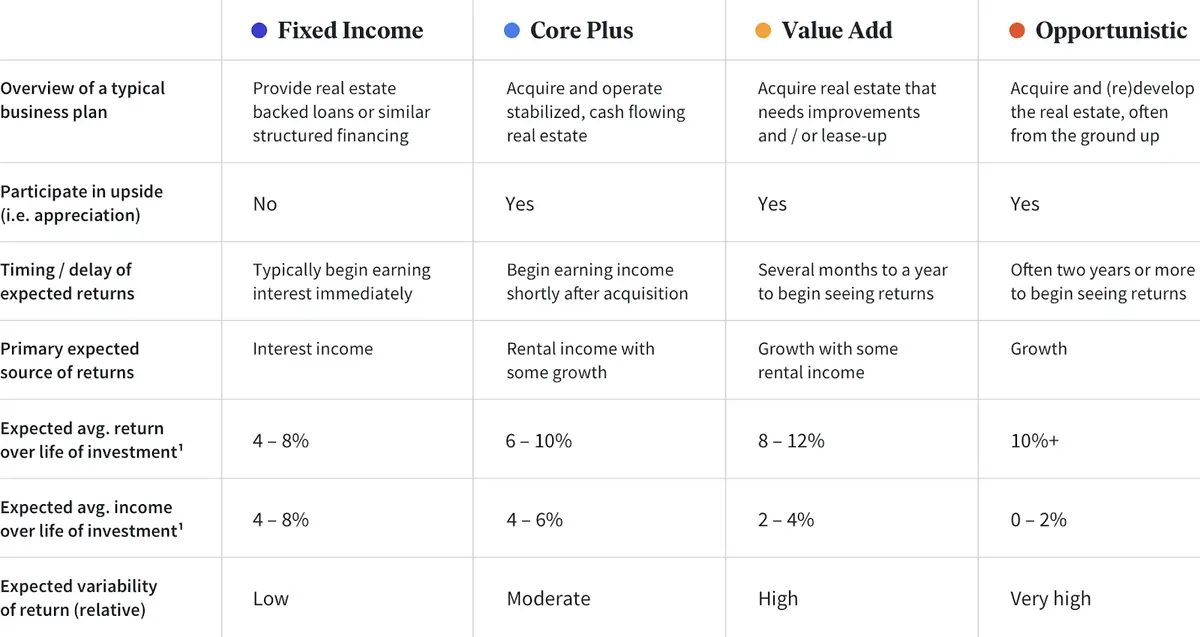

Key facts

While a property’s basic type and geographical position can communicate several crucial elements of an investment, each property’s page also includes a section that delves deeper, outlining more nuanced details about the property.

Example screenshot from the asset page for Etraya at Falcon Pointe, available here.

This deeper information includes the following:

- Strategy: All of the investments that make up the Fundrise platform portfolio fall into one of four possible investment strategies: Fixed Income, Core Plus, Value Add, or Opportunistic. Each of these strategies represents a fundamentally different kind of investment and business plan — think a construction loan (Fixed Income) versus developing an apartment community from the ground up (Opportunistic) — along with a varying balance of risk against return, advancing from lowest variability of return and lowest expected average of return, to the highest. When you view a property profile in your Fundrise dashboard, you can refer to its strategy type to immediately understand a few crucial details about our plans for the property and how you can expect the investment to proceed, along the lines that you see here:

- Investment Size: The total amount of money Fundrise has committed to invest in the property.

- Status: “Active” or “Completed,” indicating whether the investment is still ongoing or has completed and paid off.

- Realized Return: For completed investments, current Fundrise investors can view the asset in their portfolio and see the final return the asset achieved for its fund. In the case of Fixed Income investments that are still active, investors can instead see the Interest Rate in this section, representing the return that we are entitled to as part of the structure of our investment.

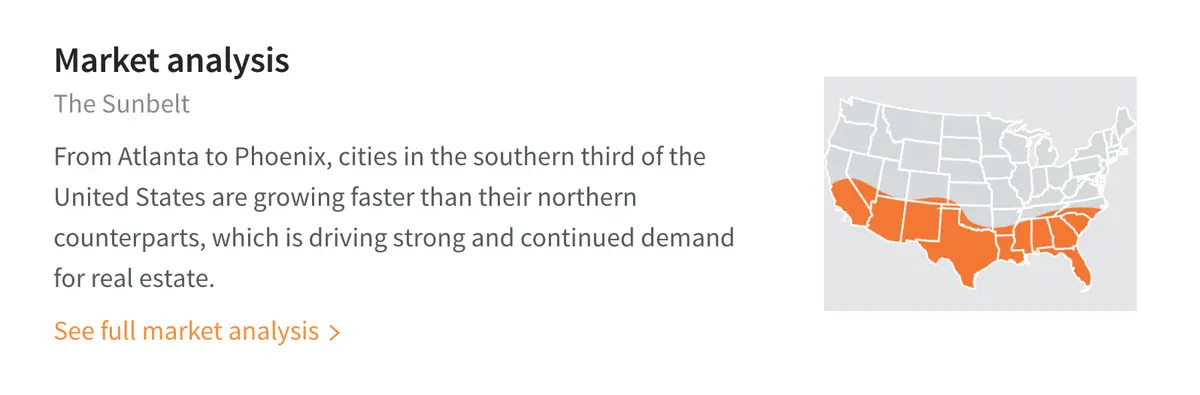

Market Analysis

For many of our properties, in this section we include an analysis assessing the broader market in which the properties are located, to help readers understand our team’s overall strategy for pursuing investments in that part of that country.

These cities and regions include Los Angeles; Seattle; Denver; the National Capital Region, which contains Washington, D.C. and its suburbs; and The Sunbelt, a band across the Southern expanse of the United States, containing cities such as Atlanta, Phoenix, Dallas, and Houston. Each market analysis has sections covering “Why we invest here,” “Investment strategies,” and the option to view all Fundrise projects that fall within that market’s borders.

Example screenshot from the asset page for Estraya at Falcon Pointe, available here.

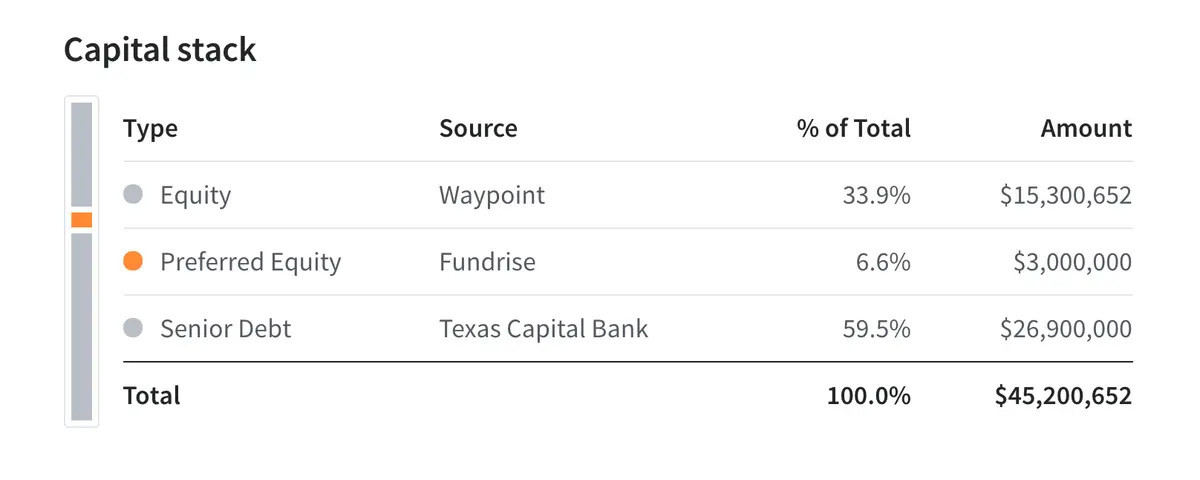

Capital Stack

The capital stack represents all types and sources of capital invested in the given real estate asset, and it illustrates the relationship between each category, including the hierarchical relationship between the equity and the debt. The lower on the stack, the lower the risk to that capital invested, and vice versa. Generally, lower risk translates to a lower return. As you move up the stack, the risk and potential returns increase accordingly. This relationship can also be described as seniority. Learn more here.

As part of every property’s profile on our platform, we provide an overview of that deal’s capital stack, with details on Fundrise’s position in relation to other capital sources, the amount each source has invested, and the % of the total deal that that amount represents.

Example screenshot from the asset page for Estraya at Falcon Pointe, available here.

Project timeline

The project timeline is a unique element of our property profiles, representing one of the most powerful ways we provide transparency into our investment strategies and our properties’ progress. The project timelines for our properties are where you can find chronologically organized asset updates — detailed articles with illustrative imagery — describing the projects’ ongoing development and key milestones.

Let’s look at two examples from the timeline of a property that has fully completed its investment term on our platform: this 31-unit apartment development in Koreatown, Los Angeles. This project’s first update, from June 2018, showcases our reasoning and analysis that drove our original acquisition of the property. Acquisition updates are a great place to read about the strategic thinking employed by Fundrise’s team of real estate experts as we assess each project’s quality and vet its potential. Also, in the case of completed projects like this one — which successfully paid back in about a year — you can often read an exit update, a short recap of how the investment proceeded and ultimately realized its return (9% in this case).

Thanks to these project timelines and the asset updates they contain, Fundrise investors are able to follow along with the acquisition, development, and eventual completion of the individual real estate assets that together power their overall portfolios.

Example screenshot from the asset page for Estraya at Falcon Pointe, available here.

A deeper view into your portfolio

One of the ways that Fundrise has transformed real estate investing has been through our tireless work to provide deep transparency into every project in our investors’ portfolios. Where traditional real estate funds bundle up their properties into opaque funds — making it difficult, if not impossible, for investors to follow the factors that contribute to their investment’s bottom line — we believe in giving our investors deep insights into every property powering their portfolios. Using detailed visuals, information about location, timeline-based updates, and more, we’re dedicated to building the best real estate investment platform possible. Investors with active portfolios can expect for these updates to be delivered to them directly in their investor dashboards, shared via email or notifications directly on their phone, for users of our app.

Not yet a Fundrise investor? If you’re interested in opening your own account filled with properties supported with detailed updates like these, you can get started here.