While many people recognize that alternative assets have been a historically critical component of excellent portfolios, it’s not always obvious how they generates returns, or the shape those earnings take by the time they reach the hands of investors.

For many of the assets like those in Fundrise portfolios, returns typically manifest in two forms. On one hand, you have dividends — aka income or cash flow — which are payments investors receive on some sort of ongoing timeline (for Fundrise investors, we aim to distribute earned dividends on a quarterly basis).

On the other hand, even as dividends accrue, a sound investment can simultaneously drive returns through appreciation. In fact, in many cases appreciation represents a far more substantial portion of the investor’s return — albeit along a longer timeline.

In this article, we’ll help investors new to real estate investing establish a more thorough understanding of appreciation when it comes to this particular asset class, how Fundrise investments can support appreciation-based returns, and how our investors may realize those returns.

Defining Appreciation, both for Fundrise and beyond

In general, “appreciation” often refers to an increase in the value of a specific asset — a company in the case of venture capital, for example, or a property in the case of real estate. When you sell or liquidate your investment, any gain beyond your initial investment is considered a return driven by appreciation. Again, this is distinct from dividends, which generally consist of income or cash flow that an investment produces during the investment — think sources like rental payments from tenants — independent of an asset's actual value or how that value changes over time.

For example, with real estate, imagine you purchase a rental home: once you have tenants, you’d be in a position to collect money on a regular basis, in the form of rental income. But even as you’re pocketing that cash on a regular, usually predictable basis, the market value of the home or property itself could simultaneously increase, as, say, the neighborhood becomes more desirable, as surrounding blocks develop, as you perform value-add renovations, as inflation creeps up, or any number of attending factors that support the home’s underlying value.

However, for Fundrise investors, “appreciation” refers to any increase in the value of their shareholdings over time. It’s the amount that an investor’s account value increases, not including any principal added through subsequent investments, from sources like auto-invest or dividend reinvestment.

This distinction is important because Fundrise investor’s position is always in funds, which contain multiple assets, and never individual assets on their own.

In terms of Fundrise portfolios, when we speak about appreciation and how it may contribute to investors’ returns, we’re actually referring to increases in the value of any shares they hold in their account. These shares represent ownership of our funds, and those funds, in turn, hold a wide range of individual real estate assets, or in the case of the Fundrise Innovation Fund, venture capital assets, i.e., ownership of high-growth tech companies. As each asset’s value individually increases or decreases, it contributes to the potential appreciation of the fund in which it’s held. But because investors only purchase and sell Fundrise investments on the share level, that’s where they realize potential appreciation too.

To give an example, if you were to invest $5,000 in a Fundrise account, you would be acquiring $5,000 worth of shares in various diversified funds. A year passes. You might receive dividend distributions from those funds once per quarter. However, by the end of that year — even if you do not invest additional principal or reinvest your dividends — your account may be worth $5,500, purely thanks to growth in your shares’ value. Your share value likely increased as a result of individual assets growing in value within your owned funds. So, in this example, you’ve seen a 10% ($500) gain through appreciation — in addition to any dividends you received throughout the year. Keep in mind, though, that you won’t realize that return until you decide to liquidate your investment.

How do individual Fundrise assets support an investment’s appreciation?

Appreciation through equity

In order to understand how investors’ share values increase, we should look at how a fund’s value increases. And to see how a fund’s value increases, we should remember that every fund is made up of a collection of individual assets.

It’s worth pointing out that this kind of fund structure shouldn’t feel unfamiliar or alien: it’s how mutual funds work, and it’s how traditional private equity funds work. At Fundrise, we’ve taken that proven, powerful structure and applied it to alternatives, like private market real estate and venture capital, using our tech-driven platform to make it more affordable and accessible than ever before — and that is new.

Remember, for collective funds like these, overall growth depends on the strength of the individual assets it contains.

This example image for illustrative purposes only. Actual portfolios may differ.

The type of investment that most meaningfully supports overall fund appreciation is called an equity investment. An equity investment is one in which the investing fund actually owns an asset in full or in part. That means that as the asset value shifts, those increases or decreases are reflected in the value of the investor’s equity. And, of course, if that value ultimately goes up, investors enjoy returns in the form of appreciation when that equity stake is sold.

It’s worth noting again that an equity investment in an asset can simultaneously produce cash flow as it appreciates (or depreciates). For real estate, for example, this typically takes the form of rental income a property produces during the period the investor (or investment fund) holds an equity stake in that asset. Because the investor owns a piece of the asset, they’re entitled to a piece of that income too.

To support appreciation-based returns through equity investments, it’s the job of our in-house team to identify assets where we have strong reasons to believe that their values will grow over time, based on a multitude of data points that we analyze prior to acquisition. For instance, with real estate, we may look at factors like rent and sales comparisons, public infrastructure investments, recent and slated employer relocations/expansions, demographic shifts, etc. Notably, areas with strong growth potential in terms of appreciation typically also see rents rise over time as a result of the same forces, meaning strong appreciation tends to correspond with robust income generation, though this is not guaranteed. With venture capital, our focus on “high-growth tech companies” means that projecting equity growth and appreciation is central to our evaluation of a company’s potential, as we aim to evaluate which burgeoning businesses are most likely to become transformative leaders in their respective spaces, such as data infrastructure.

Appreciation through debt, too

The counterpart to an equity investment is a debt investment, or a loan that an investor (or fund) makes to the equity owner of an asset, such as the developer of a real estate project.

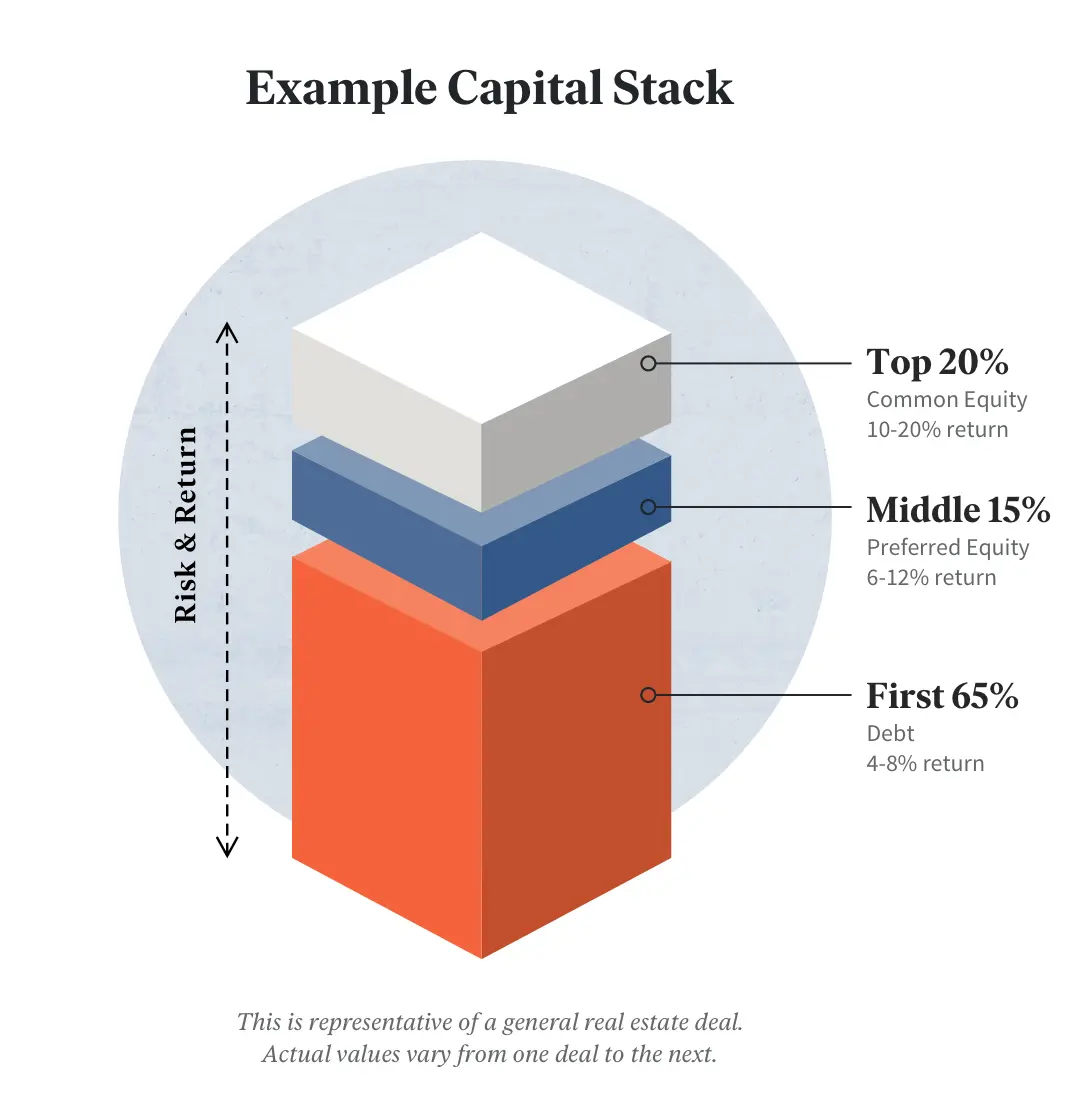

Debt investments usually produce their returns through interest payments, which are detailed in the terms of a deal before the investment is committed. These investments tend to follow predictable timelines as a matter of course, and because of the way that the capital stack is structured, debt payments are relatively safe, because debt investors have the highest priority in receiving payments.

In a real estate deal, an investor’s position in the capital stack determines their priority in getting paid as the deal matures. In this image, debt is senior to preferred equity and common equity, and preferred equity is senior to common. The higher the seniority, the lower the risk — but, as you can see, with higher risk, the higher the projected return.

For Fundrise investors, debt investments typically generate returns by supporting potential dividends: interest payments on loans come back to the fund on regular, set schedules, and are then distributed to investors, typically once per quarter.

However, some portion of this cashflow can stay in the fund too (our REITs specifically always distribute at least 90% of earned taxable income as dividends annually), ultimately contributing to the fund’s overall value. This, in turn, could generate an increase in the value of an investor’s shares — i.e. appreciation-based returns.

In summary, Fundrise investments may support appreciation-based returns in two ways. If a fund owns equity investments in assets that collectively grow in value over time, that equity stake should also grow in value, as should the value of the fund itself. As the value of a fund increases, shares in that fund should increase in value too.

For debt investments, the generation of appreciation-based returns is generally expected to be minimal, but may result from a fund issuing senior debt loans and opting to retain a portion of interest payments within the fund, rather than distributing them.

(Also note that we classify Preferred Equity investments — despite their name — as debt, due to the similarity in how they’re structured, in how they typically generate predictable returns along a predictable timeline, and in how those returns are categorized as they reach investors: as income.)

It’s always possible to view individual Fundrise real estate assets in our funds here, where you can see key details relating to that asset, such as the asset’s categorization as either an equity or debt investment, the structure of the capital stack for that deal, and any projected or realized return associated with that deal.

NAV: How much a fund is worth and its impact on measuring appreciation

Now that you understand what apprecation is on the fund-level, how do you measure that kind of appreciation?

First, in order to determine how much appreciation your investment in a fund has earned, you need to know the current, overall value of the fund and, subsequently, the value of your individual shareholdings. We refer to the total value of a fund (minus its liabilities) as Net Asset Value (NAV).

For many asset types — especially those traded on the public market — assessing a fund’s NAV is fairly straightforward. For those public investments, holdings are bought and sold at such frequency — potentially millions of times per day! — that they’re believed to be efficient and have perfect pricing, making NAV calculations relatively simple: you just need to look at the public market’s current listing price for that investment. In other words — the market sets the price.

For a private market asset, however, the market value of a property is not available on such a high-frequency basis since elements like buildings and land lots typically only sell once every few years, rather than on a continuous basis. Similarly in the case of venture capital, the tech companies of concern are generally private, meaning their shares are not yet valued and traded in a public space.

Instead of relying on high-volume trading to reveal the value of an investment asset, a private market asset’s value must be determined according to a number of different factors, which our in-house team works hard to assess. This can be a complex analysis, especially if an asset is still in the process of executing its business plan. For real estate, that might mean being in the middle of construction, undergoing renovation, or is being leased up. To calculate an individual property’s value, we generally gather data on an asset's operations and performance; assess macro-economic and submarket conditions; consider any future equity contributions or distributions; and then apply most applicable valuation methods.

As you can imagine, the NAV of a fund holding many private assets is dependent on determining the value of each individual one held within the fund. Many private equity firms do not update their funds’ NAVs for extended periods, due to the inherent difficulty of assessing those values. However, at Fundrise we calculate NAV changes with more relative frequency — even if the fund doesn’t intend to sell those properties for weeks, months, or years.

At Fundrise, we make NAV adjustments for all of our funds on a regular basis, so our investors can see a steady evaluation of their account’s growth. We’ve designed our investor dashboard to display investor earnings with real-time performance reporting, which makes it simple to understand a Fundrise account’s ongoing growth.

These figures are displayed both on the individual fund level and the overall account level.

That means every investor has a window directly into the makeup and progress of their account’s growth, where they can see how much their account has earned as a result of appreciation, per the latest NAV adjustments. Despite the inherent challenges associated with reporting interim performance on long-term, illiquid investments, we’ve committed ourselves to developing a framework that aims to provide investors with the fullest possible estimate of how their portfolio is doing along the way.

We are (to our knowledge) the first to provide this level of software-driven, real-time reporting for private equity alternative investments. It is very important to note, however, that like any appreciation-based returns, these figures are necessarily projections and prone to fluctuation until an investor locks in their final appreciation-based return by liquidating their investment through selling their shares.

We also work hard to provide redemption plans that allow investors to request to redeem their shares before the expected 5+ year timeframe, albeit with a redemption penalty for some of our funds if redemption occurs earlier than 5 years. Please also note that while under normal market conditions we seek to provide our investors with liquidity through the redemption plan, during a financial crisis investors should expect us to pause the redemption plans for some of our funds long enough to allow enough time for whatever events may unfold. You can learn more about how Fundrise may act in a financial crisis here.

Important: In order to protect the entire Fundrise investor community, some of the Fundrise-sponsored funds may suspend redemptions during periods of extreme economic uncertainty.

Adding Fundrise appreciation to your investment strategies

Now that you have a better understanding of appreciation and how it fits into the return profile of a Fundrise portfolio, you’re better prepared to understand and evaluate which Fundrise investment option is best for you.

If you ever have any additional questions about appreciation, though, feel free to reach out to our team at investments@fundrise.com.