The year in review: Looking back

As has seemingly become something of a pattern in recent years, 2025 brought with it yet another series of “firsts”. And while the Fundrise platform once again delivered solid positive performance for the vast majority of investors—albeit with some asset classes performing stronger than others—it is difficult not to look back on the year as a tale of two divergent themes.

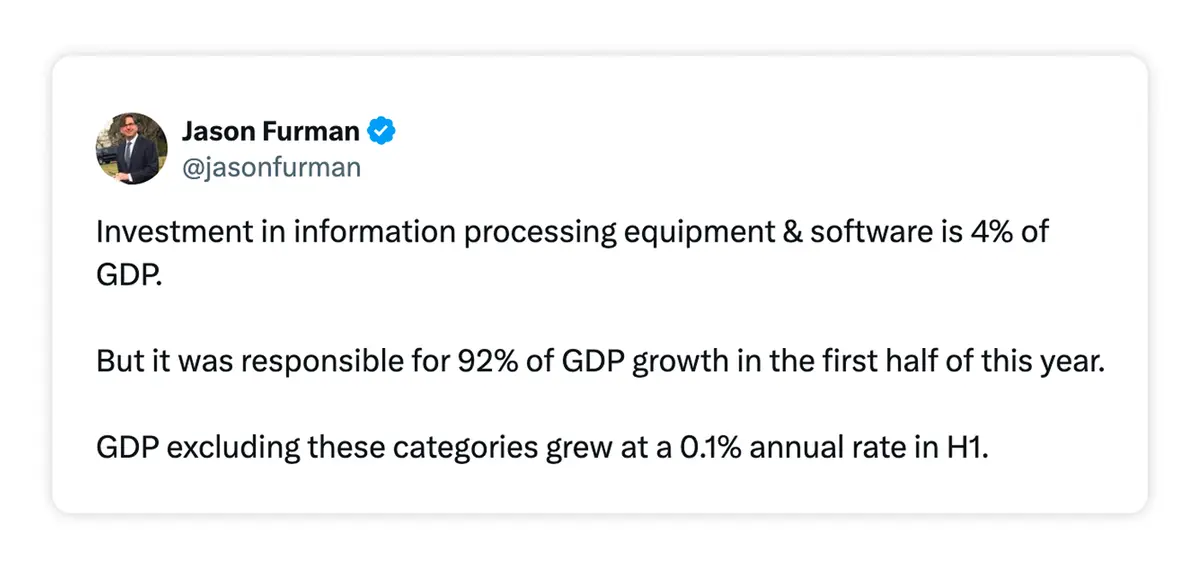

On the one hand, we saw the explosion of AI and all things AI related, moving the conversation from being one about the hypothetical potential of an innovative, yet unproven technology, to being focused on its emergence as the central driver of not only the US but world economy. Whether it was cutting-edge product releases from frontier research labs, new all-time highs for big tech stocks, or unprecedented infrastructure investments in data center development, 2025 was the year of AI.

Three years ago when we decided to expand the platform to offer venture capital as an asset class (despite some not-so-subtle skepticism on Reddit), we felt it was not only a logical and important step in unlocking access to an even more exclusive world, but it was also creating an opportunity for Fundrise investors to get direct exposure to what we believed would be one of the defining secular trends of the decade.

Yet even those ambitious objectives feel somewhat underwhelming in hindsight. Today, tens of thousands of Fundrise investors have been able to get in on the ground floor of what may turn out to be the single largest technology breakthrough and wealth generator since the Industrial Revolution, with investors in our venture plan earning an average net return of 21.2% in 2025.

Ensuring that all investors have the opportunity to take part in this societal shift could not be more fundamental to why we created Fundrise in the first place. (A mission we intend to take even bigger strides towards over the next year.)

Of course, on the other hand, the rest of the economy remained largely bogged down in the perpetual quandary of persistent macroeconomic uncertainty, driven most notably by the introduction of the largest tariff regime in roughly 100 years.

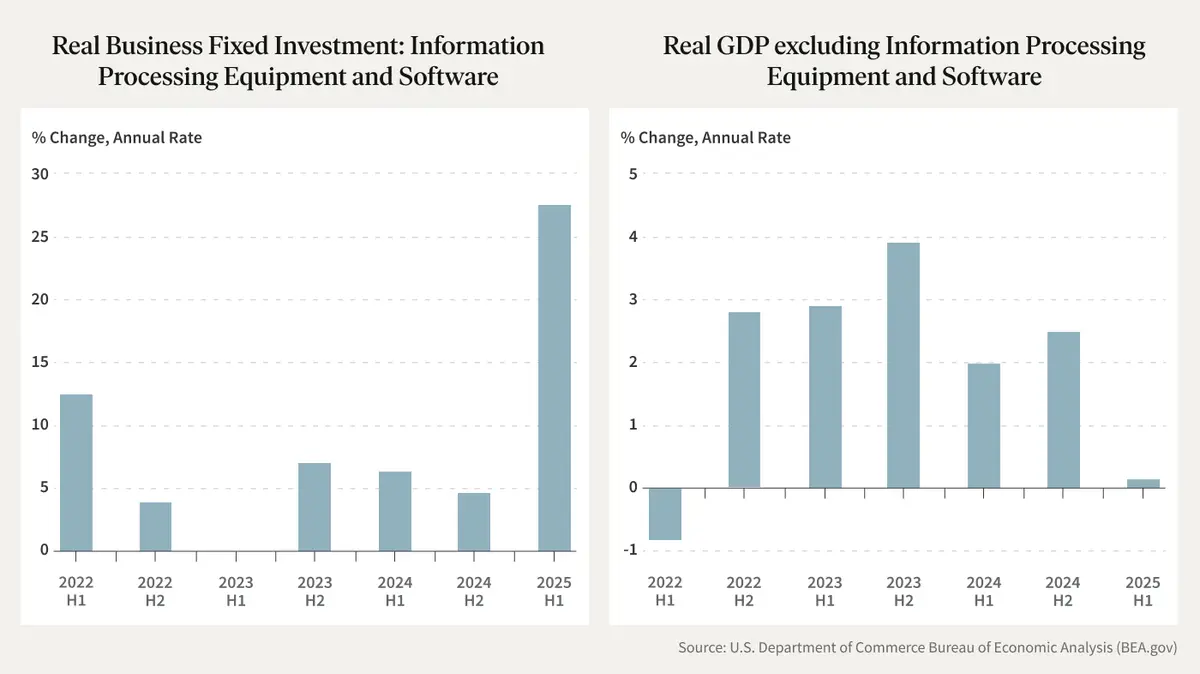

And while we began the year cautiously optimistic that cooling inflation and a modestly slowing economy would bring with it lower rates and eventually higher values for real estate, we instead ended the first quarter forced to face the reality of “liberation day” and the start of what would end up being the second major theme to dominate headlines.

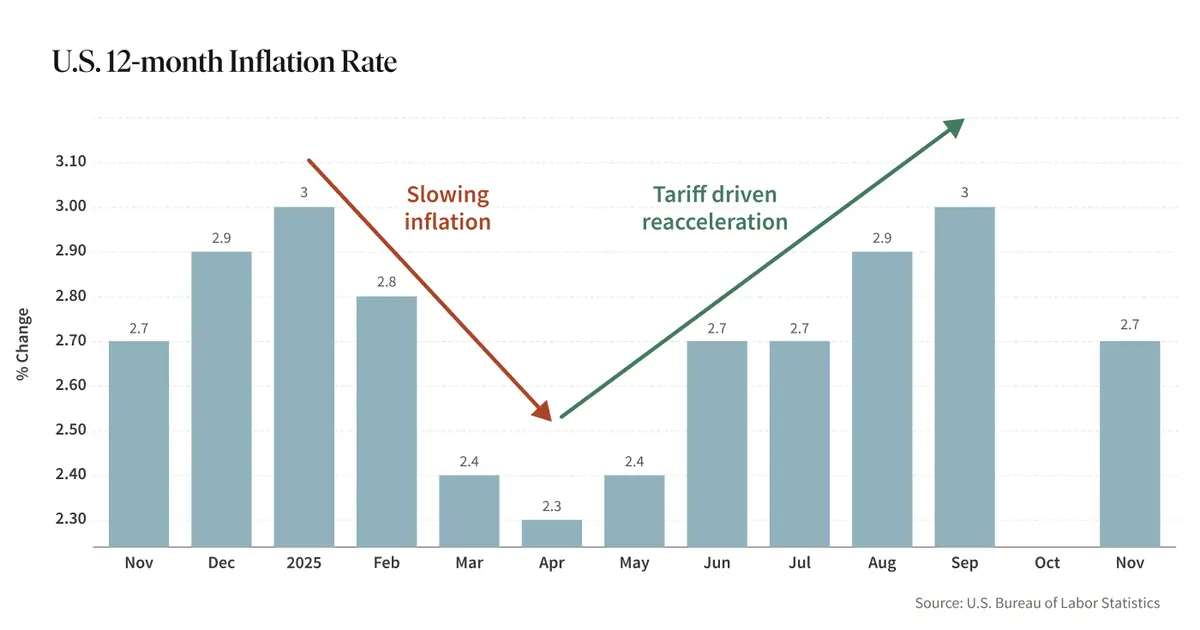

Although both the constitutionality and near term impacts of the new administration’s tariff policies remain hotly debated, what is hard to argue is that the uncertainty around the future and volatility in the economic reporting data resulted in both the private sector and the Fed moving to a “wait and see” approach, with many corporations pulling back dramatically on any large, long-term decisions (minus those related to AI capex) while the Fed decided to pause its rate cutting cycle for the better part of the year.

For real estate investors, this translated into a year of consolidation rather than revaluation or recovery with property prices, along with those of most private assets, moving largely sideways. This stagnation was driven less so because fundamentals deteriorated (although the lagging absorption of new construction supply did cause rents growth to slow in many markets) and instead because financing conditions and overall capital markets remained highly restrictive, with very little activity on either the buy or sell side occurring as most well capitalized owners opted to continue to ride out the “higher for longer” storm.

Of course, the other bright spot that came out of this dynamic was the continued attractiveness of the fixed income and private credit business. Fewer financing options and more restrictive capital markets meant that once again, investors in the Income Fund were benefitted by a particularly attractive risk/reward setup with the Fund delivering a 8.0% total annual return with 7.6% paid out in distributions1. While an increasing number of new competitors have attempted to enter the preferred equity lending market, Fundrise’s now decade plus track record of being one of the most appealing capital partners to top quality builders and developers, meant that we were able to grow total origination volume in a year where twice as many groups were bidding on the same deals.

What 2026 may hold: Looking ahead

As eventful as the last year has been, we see 2026 setting up in a similar way, with perhaps the main difference being the potential for even larger variances in outcomes on either end of the extremes.

First, AI is bigger, better, and everywhere all at once. Despite what felt like numerous incredible leaps forward at nose-bleed-like speeds, we believe that both the growth rates and impacts of AI in all its forms only continues to pick up momentum over the near term.

It’s difficult to capture in writing just how monumental the impacts of this may be for nearly all things and arguably the topic deserves its own, much more in depth multi-part piece (which we are working through currently), but just to name a few examples: it potentially changes fundamentally overall US growth rates and the make-up of the US labor force, which in turn has huge implications for not only investment-related questions such as how people will use real estate and stock market valuations but also broader societal impacts and the types of existential questions that arose from US workers moving from farm to factory, and factory to office in the centuries before.

In short, we believe if you aren’t seriously thinking about how AI is impacting your business and personal life you are likely to get caught flat-footed…and if you aren't invested in literally owning the future of AI then you risk being meaningfully less well off.

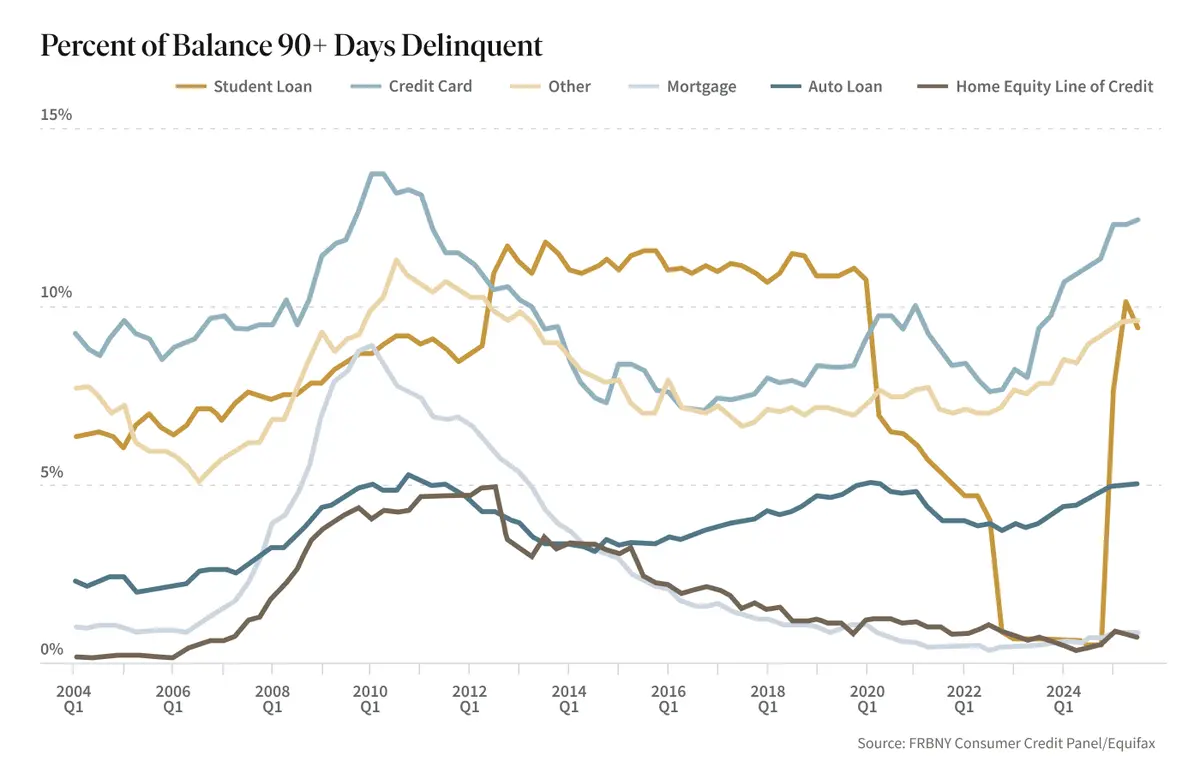

Second, interest rates will (yes, still) continue to come down. Though we were thrown off by roughly twelve months due to the surprise introduction of tariffs, ultimately, nearly every economic indicator that one can reference points to the same consistent conclusion…the economy is slowing, the US consumer (especially the middle class) is getting increasingly stretched thin and inflation (but for the short term impact of tariff-related pricing changes) should and would be continuing to slow. The net-net of all of this continues to point to lower overall rates and a more normalized long-term risk-free rate of return, which over time will manifest in higher asset values.

Third, prices for most real estate remain relatively low, while the stock market prices remain relatively high. We noted last year that prices for the stock market were, by most all standard measures, not just relatively high but also at levels that typically had preceded significant downturns. On the other hand, prices for real estate were not just relatively low, but at levels that were consistent with the 2008 Great Financial Collapse (after which real estate saw a nearly decade-long positive run).

The conclusion? Buy low and sell high—or in other words, it might be a good time to start reallocating some amount out of stocks and into more depressed assets such as real estate.

What has changed over the past twelve months? Little, except that both may be more true today than when we said it last year.

Of course, there is a balancing act when taking into consideration the first point that AI ultimately will be such a large driver of economic growth that it may very likely overshadow other more traditional factors (even normal business cycles). However, all that said, we as long-term disciples in ways of value investing, continue to believe that those who are diversified into alternative asset classes such as real estate are likely to be better protected against the more extreme black swan type downsides.

Stepping into 2026, we believe we are investing through a genuinely unique inflection point—one where secular technological acceleration is colliding with a more traditional late-cycle macroeconomic environment and even more unpredictable than normal public policy.

In such an environment, we see even less advantage than usual in trying to predict headlines over the next several quarters; instead we feel strongly that success for investors will come from the somewhat juxtaposed combination of staying disciplined while maintaining flexibility, owning durable assets at sensible prices while also being positioned to aggressively go on the offensive when either capital loosens and confidence returns, or unexpected breakthroughs create temporary pockets of extreme growth.

And that’s how we’re approaching the year across the entirety of the platform: continuing to build long-term exposure to the compounding upside of AI, while steadily deploying into income and real estate opportunities where valuations remain depressed and underwriting remains conservative. While it may mean certain funds lag the broader stock market for periods of time, we believe firmly that it positions investors against larger downside risk over the longer term.

As always, we want to thank you for your continued trust in Fundrise. We will, as before, remain committed to our investor-first principles, including transparently sharing our thinking (even when it may be contrarian or not actively in our own self interests), and most importantly, to our longer-term mission of building a platform that empowers individuals.

We look forward to navigating the uncharted territory that is 2026 together.

Onward,

Ben and the entire Fundrise team