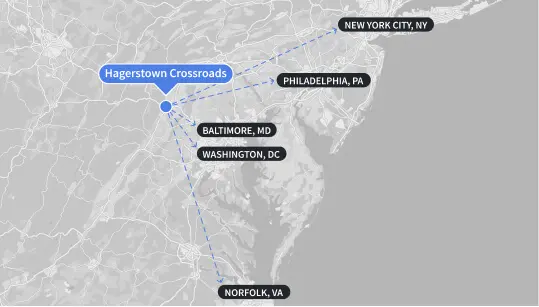

We’ve acquired an approximately 826,000 square foot distribution facility in Hagerstown, Maryland, for a purchase price of roughly $104.9 million. The property is uniquely located to the northwest of Washington, DC, and Baltimore, at the intersection of major highways I-81 and I-70. This strategic location puts the property within about 4.5 hours of many of the East Coast’s major cities, including New York, Philadelphia, DC, and Baltimore, allowing tenants to serve a significant portion of the nation’s population overnight.

As demand for more and faster delivery continues to grow, we believe that distribution facilities located in strategic relation to major population centers will become increasingly important for retailers.

This acquisition was made by the East Coast eREIT, which invested roughly $53.3 million. We also financed the investment with a senior loan of roughly $56.5 million. Including our budget for other soft costs and fees, the total projected cost comes to roughly $109.8 million. In addition, approximately 60% of the East Coast eREIT’s investment was funded in a 1031 Exchange — a sophisticated method for reinvesting capital gains for advantageous tax treatment — with the proceeds from the fund’s previous investment in the Enclave at Lake Ellenor.

Strategy

Value Add

Acquire real estate that needs improvements and / or lease-up

- Risk-return profile: Moderate to high

- Expected timing / delay of returns: Several months to a year

- Expected source of returns: Growth with some income

Note that this section is intended to provide a general overview of the Value Add strategy for educational purposes only, and is not meant to be representative of the specific details of any individual investment. All investments involve risk and there are no guarantees of any returns.

Business plan

Completed in 2022, the building is well-suited and ideally located for a variety of industrial applications, including as a logistical juncture for e-commerce operations aiming to reach cities ranging from New York all the way down to Norfolk, Virginia, overnight.

This property is well situated to serve as a “bulk distribution facility,” where items are stored in bulk before typically being distributed to “last-mile” facilities. In turn, a last-mile facility (also referred to as a terminal building or sorting center), acts as a handoff point to connect 18-wheeler trucks, which typically carry goods in bulk across longer distances, with the smaller vehicles that make the final leg of the journey to drop off packages at individual homes and businesses.

At the time of acquisition, the property was vacant. We expect to hire professional leasing brokers to secure tenants for the space, and we project that it will achieve significant occupancy and cash flow in the coming months.

We then plan to hire professional property managers and hold the property over the long term, re-leasing the space as necessary, with the goal of earning regular rental income and then eventually selling the property at a profit.

Why we invested

-

Prime location: The property is positioned within ninety minutes of DC and Baltimore, three hours of Philadelphia, and 4.5 hours of New York, New Jersey, and Norfolk, meaning that overnight trucks can reach each of these critical cities and ports reliably, letting the property potentially serve a critical role as a bulk distribution facility, a valuable component of the e-commerce delivery infrastructure.

-

High-demand property type: In order to efficiently distribute goods across major metropolitan areas, companies ranging from online grocery delivery to e-commerce retailers need space in highly specific locations with access to regional transportation.

-

Sophisticated investment structure: By redeploying the proceeds from a prior investment in a 1031 Exchange, this investment allows the East Coast eREIT to claim valuable tax treatment and capture considerable savings for the fund.

As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.