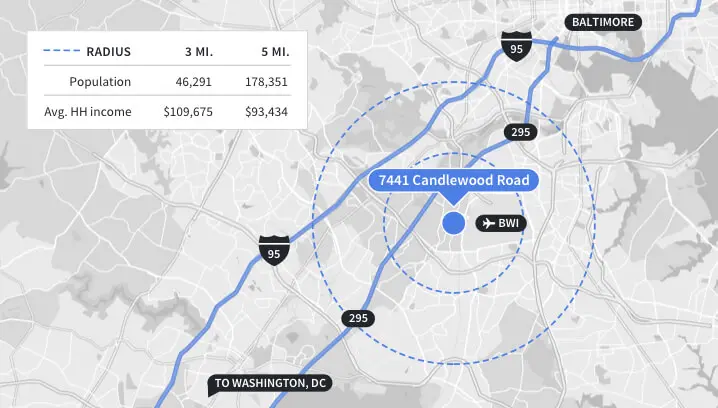

We’ve acquired a 253,330 square foot distribution center in Hanover, Maryland, for roughly $49.6 million (including anticipated costs). The property is located about 45 minutes from downtown Washington, DC, about 1.5 miles from the Baltimore-Washington Parkway — which offers access to a network of major roads in the national capital region — and less than ten minutes from BWI International Airport.

As demand for more and faster delivery continues to grow, we believe that “last-mile” distribution facilities located close to major population centers will become increasingly important for retailers.

This acquisition was made by a joint venture between two Fundrise sponsored funds, the Fundrise Flagship Fund, which invested roughly $21.7 million, and the East Coast eREIT, which invested roughly $2.4 million. A senior loan in the amount of $24 million was also provided. The investment amounts include a budget for financing and other soft costs, bringing our total projected commitment to approximately $49.6 million.

Strategy

Core Plus

Acquire and operate stabilized, cash flowing real estate

- Risk-return profile: Moderate

- Expected timing / delay of returns: Shortly after acquisition

- Expected source of returns: Income with some growth

Note that this section is intended to provide a general overview of the Core Plus strategy for educational purposes only, and is not meant to be representative of the specific details of any individual investment. All investments involve risk and there are no guarantees of any returns.

Business plan

Approximately 30 miles from Washington, DC, the property is well-suited to perform as a last-mile distribution facility, serving customers across the broader national capital region and its suburbs, some of the country’s fastest growing areas for years. With Northern Virginia continuing to attract high-value business — including footholds from major tech companies, such as Amazon’s new national headquarters — this section of the mid-Atlantic is expected to see continued development in the near future, both in terms of population growth and economic expansion. Alongside the growth in the area’s workforce, we expect demand for e-commerce infrastructure in the area to grow, giving well-located and accessible distribution centers like this one significant potential value.

A last-mile distribution center, also referred to as a terminal building or sorting center, acts as a handoff point to connect 18-wheeler trucks, which typically carry goods in bulk across longer distances, with the smaller vehicles that make the final leg of the journey to drop off packages at individual homes and businesses.

While it’s critical that these types of facilities are located close to major population centers and easily accessible to the major highways, the availability of industrial zoned land that meets this criteria (generally speaking) is in increasingly short supply, which we believe will help drive long-term value.

In addition, as more technology and information businesses have established themselves in the areas around Washington, the presence and demand for data centers — industrial properties housing commercial-scale databases, requiring vast amounts of space — has spiked. As a result, the value of traditional industrial properties has risen as well, as more warehouses have been outfitted to act as data center sites, becoming more scarce, or have the potential to serve that purpose in the future.

Our investment involved a leaseback to the seller, and, as such, 100% of the property’s space is currently leased, with three years left on the tenant’s term. Our goal is to operate the property for the existing tenants while earning regular rental income, re-lease the space as necessary as the current leases expire, and then eventually sell the property at a profit. Though the building was constructed in 1986, it’s in good operational condition, and our budget does not anticipate costs for renovations.

Why we invested

-

Prime location: The property is located roughly a mile and half from the Baltimore-Washington Parkway, with additional direct access to I-195, I-695, and I-95, all major highways in the area. From the site, delivery vehicles can reach downtown Washington, DC, in roughly 45 minutes and downtown Baltimore in roughly 25 minutes, allowing tenants to serve customers across the national capital region and benefitting from close proximity to the port of Baltimore.

-

Growing e-commerce demand: Same-day and short-term delivery is becoming not just essential, but the expected norm from customers. In order to fulfill increasing demand, companies ranging from online grocery delivery to e-commerce retailers need space in highly specific locations with access to regional transportation.

-

High-demand property type: Despite the continuing, fast growth of e-commerce delivery — a trend that was only accelerated by the COVID-19 pandemic — zoning restrictions have limited the amount of new supply of industrial, last-mile properties available. As the national capital region continues to expand, fewer industrial sites with prime locations and direct access to the area’s key highways remain available, increasing the potential value of properties like this one.

As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.

Additional Information: An investor in the Fundrise Real Estate Interval Fund (the “Flagship Fund”) should consider the investment objectives, risks, and charges and expenses of the Flagship Fund carefully before investing. The Flagship Fund’s prospectus contains this and other information about the Flagship Fund and may be obtained here. Investors should read the prospectus carefully before investing.