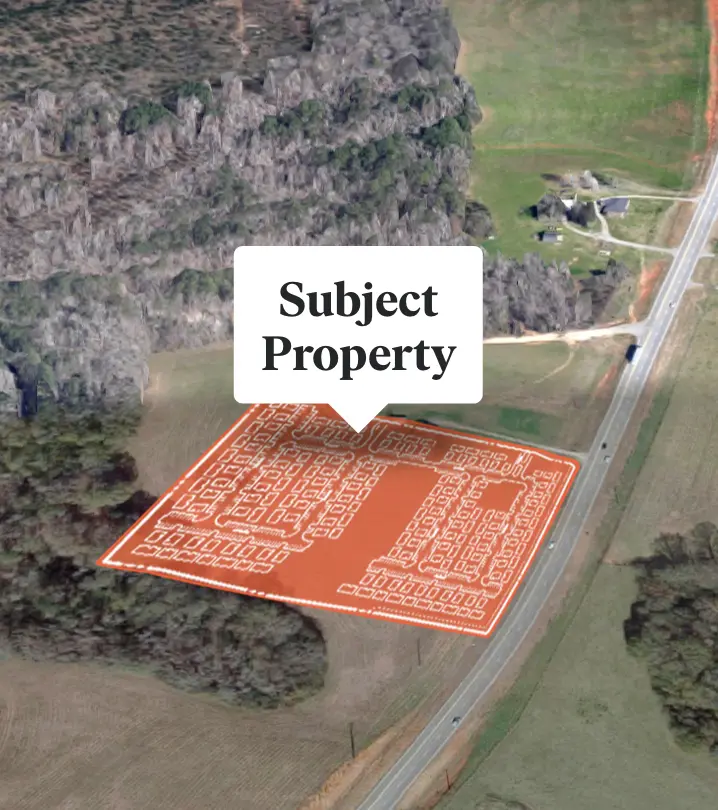

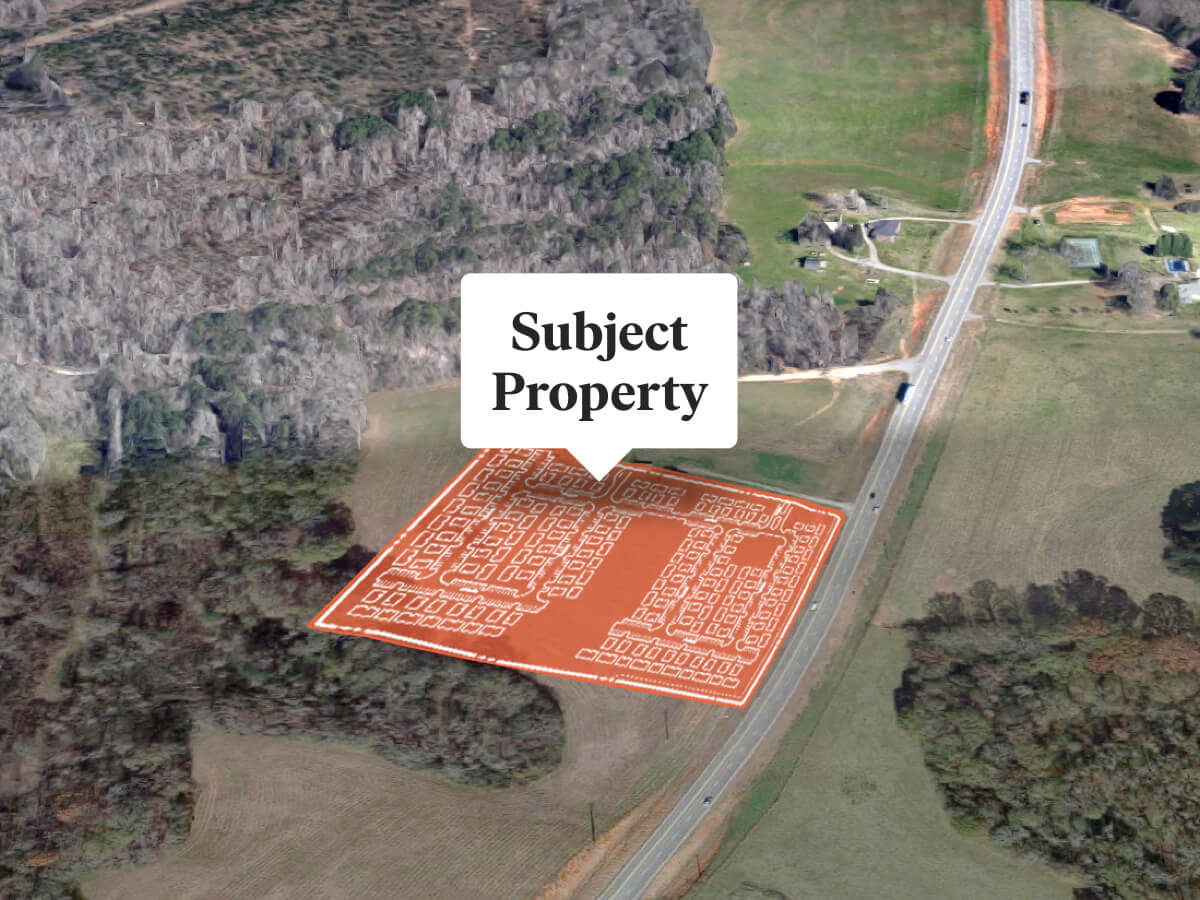

We’ve acquired approximately 26 acres of construction-ready land in Locust Grove, Georgia, for an initial purchase price of $6.4 million, with plans to build a 226-unit rental home community. The property is located just off of Highway GA-155, about an hour south of downtown Atlanta.

At a strategic level, this investment fits within our affordably-priced Sunbelt apartment / rental housing thesis. From millennials to retirees, a broad group of Americans has been taking part in a migration from northern to southern states over the past decade, driving continued demand for well-priced, well-located real estate, and supporting steady returns for disciplined investors. Learn more about the single-family rental asset class here.

As we reiterated in our third quarter performance update for investors, we believe that this long-term trend has only been further accelerated by the pandemic. In an economy where remote work is becoming the norm for more and more people, we expect that an increasing share of the population won’t need to live in expensive gateway cities and will instead seek out locations that offer lower living costs and more agreeable climates.

This acquisition was made by a joint venture between two Fundrise sponsored funds, the Fundrise Flagship Fund, which invested roughly $5,714,000 and the Balanced eREIT II, which invested $635,000.

Strategy

Opportunistic

Acquire and (re)develop the real estate, often from the ground up

- Risk-return profile: Very high

- Expected timing / delay of returns: Often two years or more

- Expected source of returns: Growth

Note that this section is intended to provide a general overview of the Opportunistic strategy for educational purposes only, and is not meant to be representative of the specific details of any individual investment. All investments involve risk and there are no guarantees of any returns.

Business plan

The property is already entitled for the construction of 226 cottage-like rental homes. We plan to work through design and permitting over the next several months, and construction will begin shortly after receiving full approvals from the city. We expect delivery of the first batch of homes in late 2023, with subsequent batches delivering on a monthly cadence thereafter. We’ve engaged a national general contractor to perform construction services on this project, whose track record consists of nearly 30 years of construction projects, including several other similar communities in the region.

Similar to our other single-family rental home communities, our intent is to lease up each batch of homes as they deliver, while construction on the overall community continues. When construction is complete, we will be the sole owner of an entire rental townhome community, situated in a desirable location just south of Atlanta, putting us in an excellent position for both ongoing rental income generation and long-term appreciation.

We expect the total budget to be approximately $54.2 million.

Our intent with this and other similar investments — including both single-family rental home communities and some apartment communities — is to be a long-term investor, building a scaled portfolio that generates consistent rental income, while at the same time positioning ourselves to capture what we believe will be outsized price appreciation thanks to a confluence of demographic factors driving demand across the Sunbelt.

While we’ve acquired the land in an all-cash transaction, we intend to obtain portfolio-level financing when the homes deliver, with the aim of increasing expected returns and freeing up cash to deploy elsewhere.

Why we invested

-

Already entitled site: Prior to our investment, the property had secured the entitlements necessary for the development of 226 units. Because the property has already taken those important steps toward construction, we’re able to begin development significantly sooner than if we needed to entitle the project ourselves, which reduces our overall timeline and uncertainty in the investment.

-

Fast-growing area: Between 2010 and 2019, the Atlanta area’s population grew at nearly triple the rate of the national average, according to the U.S. Census. As the area continues to grow, affordability is becoming a top concern, making neighboring areas like Locust Grove attractive to both renters and homebuyers.

-

Social distancing-friendly: We believe the privacy provided by the community’s spacious homes will be particularly attractive to renters seeking an additional level of social distancing, or who simply need more living space as norms around work and school shift.

As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.

Additional Information: An investor in the Fundrise Real Estate Interval Fund (the “Flagship Fund”) should consider the investment objectives, risks, and charges and expenses of the Flagship Fund carefully before investing. The Flagship Fund’s prospectus contains this and other information about the Flagship Fund and may be obtained here. Investors should read the prospectus carefully before investing.