We’ve acquired approximately five acres of construction-ready land in Houston, Texas for an initial purchase price of $16.2 million, with plans to develop it into a 78-unit rental townhome community. The site is located just five miles north of downtown in the Houston Heights neighborhood.

At a strategic level, this investment fits within our affordably-priced Sunbelt apartment / rental housing thesis. From millennials to retirees, a broad group of Americans has been taking part in a migration from northern to southern states over the past decade, driving continued demand for well-priced, well-located real estate, and supporting steady returns for disciplined investors.

As we stated in our mid-year and year-end letters to investors, we believe that this long-term trend has only been further accelerated by the pandemic. In an economy where remote work is becoming the norm for more and more people, we expect that an increasing share of the population won’t need to live in expensive gateway cities and will instead seek out locations that offer lower living costs and more agreeable climates.

This acquisition was made by a joint venture between two Fundrise sponsored funds, the Fundrise Interval Fund, which invested roughly $14.5 million, and the Growth eREIT VII, which invested roughly $1.6 million.

Strategy

Value Add

Acquire real estate that needs improvements and / or lease-up

- Risk-return profile: Moderate to high

- Expected timing / delay of returns: Several months to a year

- Expected source of returns: Growth with some income

Note that this section is intended to provide a general overview of the Value Add strategy for educational purposes only, and is not meant to be representative of the specific details of any individual investment. All investments involve risk and there are no guarantees of any returns.

Business plan

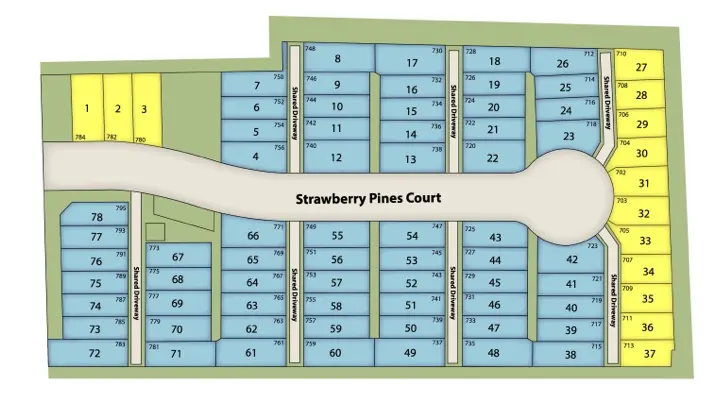

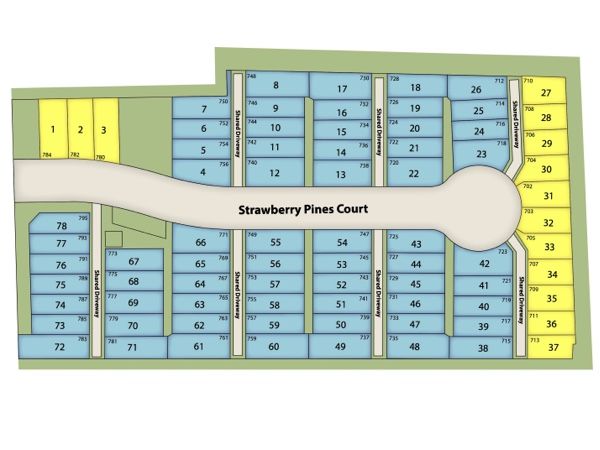

We acquired the property from a national homebuilder, who has already secured the permits and entitlements necessary to build 78 townhomes on the site, and completed the initial phase of land development, including paving the roads, setting utilities, and laying foundations. We have engaged the same builder to complete construction on the homes, which they have agreed to deliver at a fixed price (i.e. they are responsible for cost overruns). They expect to deliver the homes in batches of roughly eight homes per month, starting with the first batch later this summer.

Similar to our other single-family rental home communities, our intent is to lease up each batch of homes as they deliver, while construction on the overall community continues. In addition to the homes, the finished community will include key common amenities, such as a clubhouse and pool. When construction is complete, we will be the sole owners of an entire rental townhome community, situated in a desirable location in northern Houston, putting us in an excellent position for both ongoing rental income generation and long-term appreciation.

We expect the project’s total cost to be roughly $28.6 million, with $25.74 million (90%) contributed by the Interval Fund, and the remaining $2.86 million (10%) contributed by the Growth eREIT VII. We have agreed to fund the construction costs to the builder in installments, following the completion of determined development milestones of each batch of homes, such as finishing framing or drywall installation.

Our intent with this and other similar investments — including both single-family rental home communities and some apartment communities — is to be a long-term investor, building a scaled portfolio that generates consistent rental income, while at the same time positioning ourselves to capture what we believe will be outsized price appreciation thanks to a confluence of demographic factors driving demand across the Sunbelt.

While we’ve acquired the land in an all-cash transaction, we intend to obtain portfolio-level financing when the homes deliver, with the aim of increasing expected returns and freeing up cash to deploy elsewhere.

Why we invested

While the extent of the negative impacts of the COVID-19 pandemic on the broader economy remains uncertain, we believe this investment is well-positioned not only to withstand a prolonged economic downturn, but to potentially benefit from more permanent shifts in behavior that may result.

- Construction-ready site: Prior to our investment, all of the processes necessary in order for us to build homes at the property had already been completed, including permitting, design, entitlements, and even initial land development. Because the property is already fully prepped for construction, we’re able to begin development immediately, which reduces our overall risk in the investment.

- Great location: The Houston Heights neighborhood — northwest of downtown Houston — has become a desirable suburb in the growing Houston MSA. As of March 2021, property values have risen rapidly to an average of $570,000, with median household incomes of $115,000. The neighborhood further benefits from accessibility to key interstates, providing quick access into and out of central Houston and other sections of the Houston MSA.

As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.