As part of our broader strategy of investing in emerging urban areas, we’ve acquired a roughly 6,000 square foot commercial building in the West Jefferson area of South LA for approximately $3.8 million. Located just outside Culver City, we believe this area will benefit from its increasing attractiveness to businesses looking for a combination of unique affordable space and an excellent central location.

Business plan

Originally built in 1956, the property is currently occupied by a tenant whose lease expires in April, with an option for a six month extension. Once their lease ends, we plan to redevelop the property for creative office use. The property has seven parking spots on-site — a relatively rare and valuable resource in this part of LA, further increasing its potential to function as a “private campus” office in the future.

We anticipate spending an additional approximately $1.3 million on redevelopment, bringing our total investment to about $5.1 million.

Leveraging Opportunity Zone benefits

Because the property is located within a Qualified Opportunity Zone, as established in 2017’s Tax Cuts and Jobs Act, we’ve successfully categorized this investment under the rules for Qualified Opportunity Funds. As a result, a portion of our investment may qualify for gain deferral and basis step up, effectively providing tax relief for eventual capital gains. Beyond that, if we hold the investment for at least 10 years — as we plan to do — we qualify for a permanent exclusion from taxable income income of capital gains from the sale of our investment. Based on our business plan and expected holding period for the property, we expect these potential tax benefits to ultimately have a positive effect on long-term returns.

How might the impacts of COVID-19 affect this investment?

While the extent of the negative impacts of the pandemic on the broader economy remains uncertain, we believe this investment is well-positioned not only to withstand a prolonged economic downturn, but to potentially benefit from more permanent shifts in behavior that may result.

In the short term, the in-place lease should provide additional income to cover our holding costs, allowing us to be well positioned to execute a growth-oriented business plan as the economy continues to recover.

Over the longer term, we believe that owning lower-cost, flexible office / industrial space in South LA carries the potential for strong returns. This is due to two main factors:

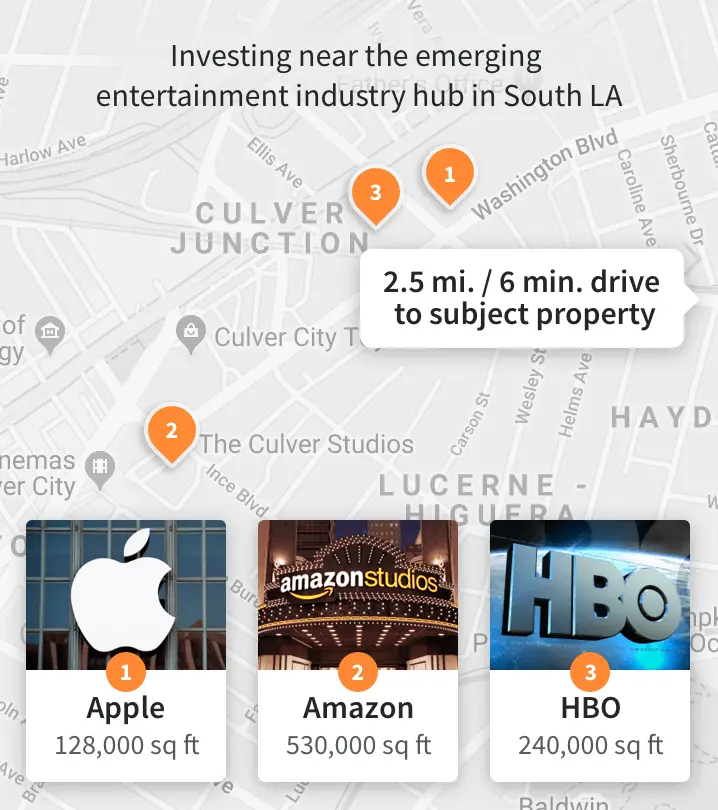

1. In-home entertainment industry booming in Culver City

The Culver City area is home to Amazon, Apple, Netflix, and HBO's digital content production arms, groups that we expect to continue to grow as demand for streaming video and similar in-home entertainment, is only accelerated by social distancing. It’s reasonable to suspect that Culver City and the surrounding neighborhoods could become the national hub of streaming digital entertainment over the next several years. This should bode well for creative office, housing, and retail property demand.

2. Well-suited for conversion to a “new normal” workspace

This property (typical of the other mid-century warehouses we own in the area) is ideally suited for conversion into a lower density private office, built out to suit the needs of a single tenant. In the world of COVID-19, the health / safety benefits of this product include private outdoor space, no shared elevators, corridors, or parking areas, and easy implementation of touchless access. High ceilings and ample square footage enable a business to have their office and industrial space under a single roof. All of this affords companies a level of privacy, flexibility, and control that would be difficult to match in a traditional downtown office tower, not to mention likely at a lower price.

Finally, like most of our equity investments in development, we own this property outright with no debt, so the risk of loss due to foreclosure (one of the primary ways that real estate investors risk losing principal during a financial crisis) is essentially non-existent.

As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.