Last July, we acquired a property in South Los Angeles as part of your Fundrise portfolio, with plans to redevelop it into an apartment building with ground-floor retail.

An opportunity to build higher density

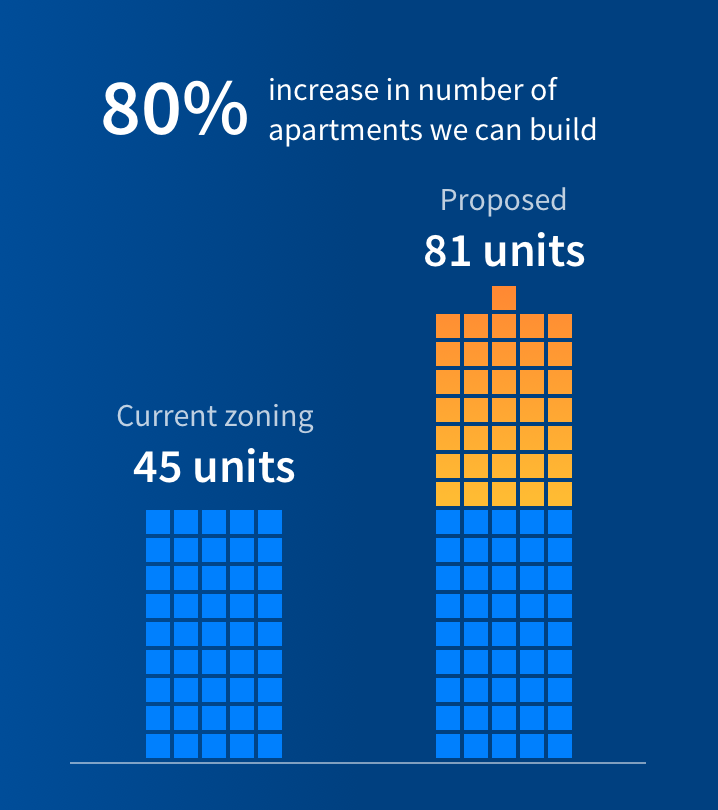

The current zoning allows for the “by-right” construction of up to 45 apartment units. However, due to its close proximity to the Expo/Crenshaw Metro Station, the property falls under the LA Transit Oriented Communities (TOC) program, which gives us the ability to entitle the land for greater density (i.e. obtain the right to build a larger building with more units). The LA TOC program was created to encourage more walkable development and help address the city’s shortage of reasonably-priced housing. Under the program, properties located within a certain distance of public transit are allowed to increase their overall development scope in exchange for providing additional affordable housing units.

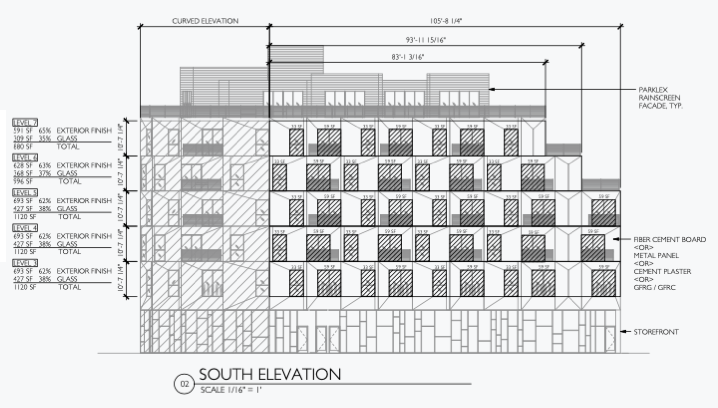

Over the past few months, we’ve engaged a team of experienced LA-based architects, engineers, and land use consultants to work with us in drafting plans for the new development, as well as preparing a robust community outreach effort. We’ve approached this work with an eye toward building a systematic program aimed at reducing costs and increasing our ability to scale this business plan across multiple similar investments in the future.

To that end, we’re pleased to report that we recently filed an application to entitle the property for a seven-story, 81-unit apartment building. This represents an 80% increase over the 45 units currently allowed.

By increasing the density of the development (in technical real estate terms, both the floor area ratio or FAR, as well as the total unit count), we expect to not only earn a more attractive return than if we only built the current allowable 45 units, but also provide much needed additional housing units to the area. The $4.2 million that we paid for the land represents a fixed cost, so the more apartments and retail space we can build, the more that fixed cost is spread out, thereby increasing the potential profitability of the investment. In addition, larger construction projects generally benefit from greater economies of scale which means lower relative cost to construct on a per-square-foot and per-unit basis.

We expect the approval process to take between six and nine months to complete. Upon receiving approval, we’ll use the final design to obtain building permits, with the goal of beginning construction early next year.

While the Transit Oriented Communities application represents a potentially longer timeline than we initially anticipated, we believe it’s well worth it to build a process aimed at securing additional density for this investment and others like it that we may make in the future. In the meantime, we should benefit from the strong growth occurring around the property, while continuing to collect rent from the existing tenant (an auto repair shop which is on a month-to-month lease).

How might the impact of COVID-19 affect this investment?

While many jurisdictions have kept their planning and permitting offices open, it is reasonable to assume that the standard approval process may move slower as a result of the broader shelter-in-place orders. Although we believe that the potential for a prolonged downturn would likely reduce demand for new apartments, we believe that construction prices for new developments may come down during such a period, and long-term demand is likely to rebound faster in supply-constrained urban markets such as Los Angeles.

Investor FAQ: How does this project impact your portfolio?

This investment is structured as equity, and, in this case, we are the sole owners. This means we have full claim to any rental income it may generate, as well as any future increases in the property’s value. As an investor, you can expect to see this impact your return in two ways: any rental income would contribute to quarterly dividends, while changes in the property value would be captured in adjustments to the Growth eREIT 2019’s net asset value (NAV) per share.

We look forward to providing you with further updates on this project. As always, if you have any questions or feedback, please visit our help center or reach out to us at investments@fundrise.com.

————

How we’re navigating the coronavirus (COVID-19) global outbreak

Though black swan events like the current coronavirus pandemic are impossible to predict, nearly every decade has experienced some form of significant economic disruption. Recognizing this, we’ve spent the last several years structuring our investments to withstand a sudden and prolonged period of distress. Given today’s extreme uncertainty, we have begun taking decisive action aimed at further fortifying your portfolio.

Broadly, we expect to pause most new acquisitions and anticipate holding more cash in reserve. We plan to focus on pushing our existing projects — like this one — forward, and in rare instances, look to deploy strategically into properties that we feel are particularly well suited to withstand near term stress or even benefit from the current disruption in the market. That said, given how quickly things are unfolding, we will continue to reevaluate the situation daily and keep you updated on your investments with us.