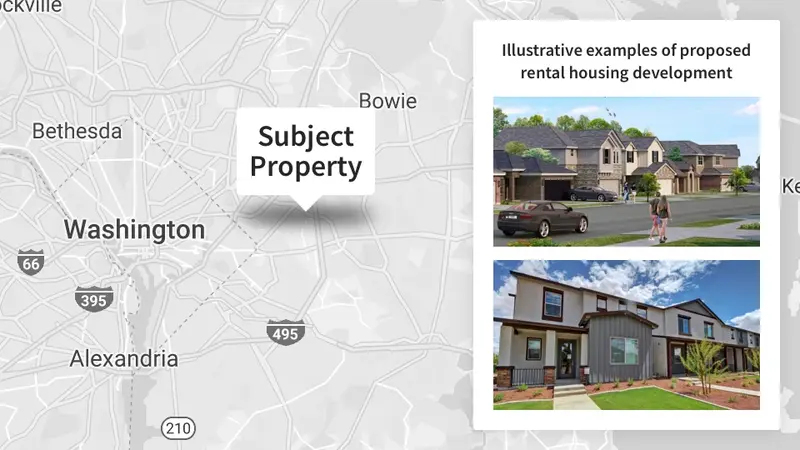

We’ve acquired a 22-acre property in Landover, Maryland for approximately $6.3 million, with plans to develop it into a rental housing community. The site is located about ten miles east of downtown DC near FedEx Field, Washington’s NFL stadium.

Reasonably-priced housing continues to be in short supply in major metro areas, and DC is no exception. At a strategic level, we continue to see opportunities to earn attractive risk-adjusted returns by investing in the creation of housing in these supply-constrained markets.

Business plan

At the time of our acquisition, the property was vacant with no existing structures in place since it was previously used as a parking lot. We aim to secure the necessary permits and entitlements to build 240 rental units on the site. We expect this process will take roughly two years to complete.

Upon securing the necessary entitlements and permits, we plan to engage a contractor and begin construction. Following the completion of construction and leasing up the homes, we plan to seek opportunities for an exit via sale or refinance.

Our goal is to earn regular rental income once the community is finished and leased up, and eventually to sell the finished product for more than we spent on the land acquisition and development.

Why we invested

- Excellent location: Located just ten miles east of downtown DC, the property is within close proximity of two metro stations and major highways, providing easy access to the city.

- Strong, stable local economy: With over 30% of residents employed by the government, the DC market and surrounding Maryland and Virginia suburbs are uniquely insulated from national economic downturns. In addition to federal workers, demand is driven by private-sector employees that support the government, such as consultants, lobbyists, and lawyers. For more information, please see our DC market analysis.

As always, please don’t hesitate to reach out to investments@fundrise.com with any questions or feedback.