Editor's Note: an earlier version of this update reported the expected annual return of the portfolio as 11%. We have adjusted this to 10.6% to more accurately reflect the expected return on the entire portfolio of 11 assets, including the portion of our investment which we expect to be used for renovation costs.

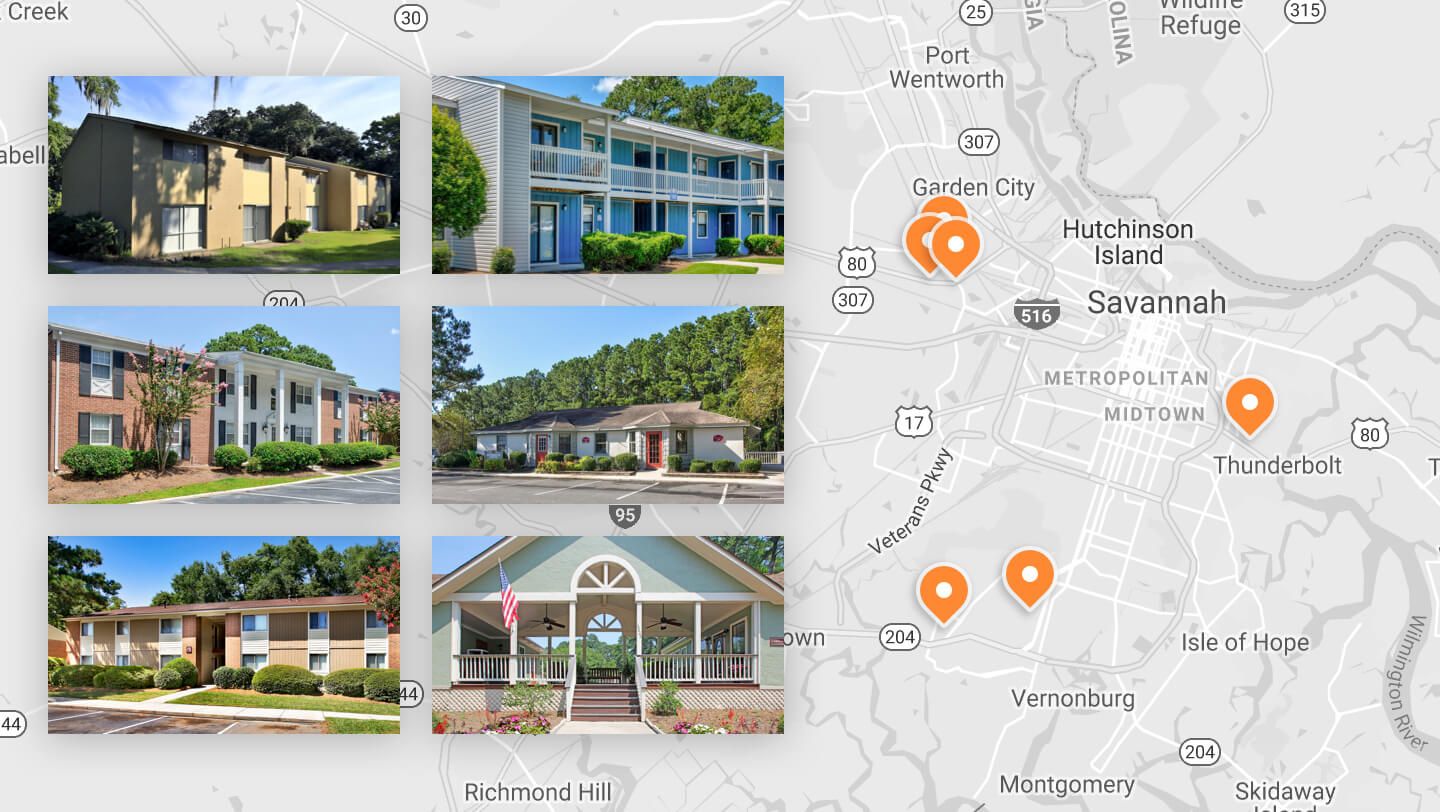

We’ve invested roughly $10 million in the acquisition and renovation of six apartment communities located in or near Savannah, Georgia. Like many other areas in the Sunbelt, the Savannah metro area has grown by more than double the national average since 2010.

At a strategic level, we continue to see opportunities to earn attractive risk-adjusted returns — in this case, roughly 10.6% annually — by identifying older, affordably-priced apartments in growing areas, and renovating them to increase rental income and property values.

Business plan

Each of the properties is a garden-style apartment community, with occupancy ranging from 92 – 97% at the time of our acquisition. While structurally sound, they could benefit greatly from aesthetic improvements to make them more competitive.

The project’s sponsor, Carter Multifamily, plans to upgrade each community’s common amenities and renovate all 808 apartments as they turn over. We expect the improvements to drive an increase in rental income, and consequently, the overall value of the properties.

Following the completion of renovations, the sponsor plans to actively manage the property for roughly five years before seeking exit opportunities via sale or refinance. During the term of the investment, we are entitled to our share of the monthly cash flow. Upon exit, we are entitled to receive a return equivalent to 10.6% annually (including the cash flow we received in the interim) before the sponsor can earn a return for themselves.

Why we invested

-

Experienced sponsor: Carter Multifamily is a Florida-based real estate investment firm that specializes in renovating apartment communities across Alabama, Florida, Georgia, Louisiana, and North Carolina. Their current portfolio is valued in excess of $100 million.

-

Paid first upon exit: Upon sale or refinance, we are entitled to receive a return equivalent to 10.6% annually (including the cash flow we received in the interim) before the sponsor can earn a return for themselves.

Details about each project

| Investment | No. of units | Occupancy | |

|---|---|---|---|

| Alhambra | $2,798,979 | 150 | 94.0% |

| Azure Cove | $2,582,281 | 144 | 97.2% |

| Carriage House | $2,530,312 | 144 | 94.4% |

| Kessler Point | $2,170,967 | 120 | 92.5% |

| Ridgewood | $2,461,942 | 144 | 95.1% |

| The Arbors | $2,245,456 | 108 | 95.3% |

We look forward to sharing progress on the renovations as these apartments are given a fresh new look. As always, please don’t hesitate to reach out to investments@fundrise.com with any questions or feedback.