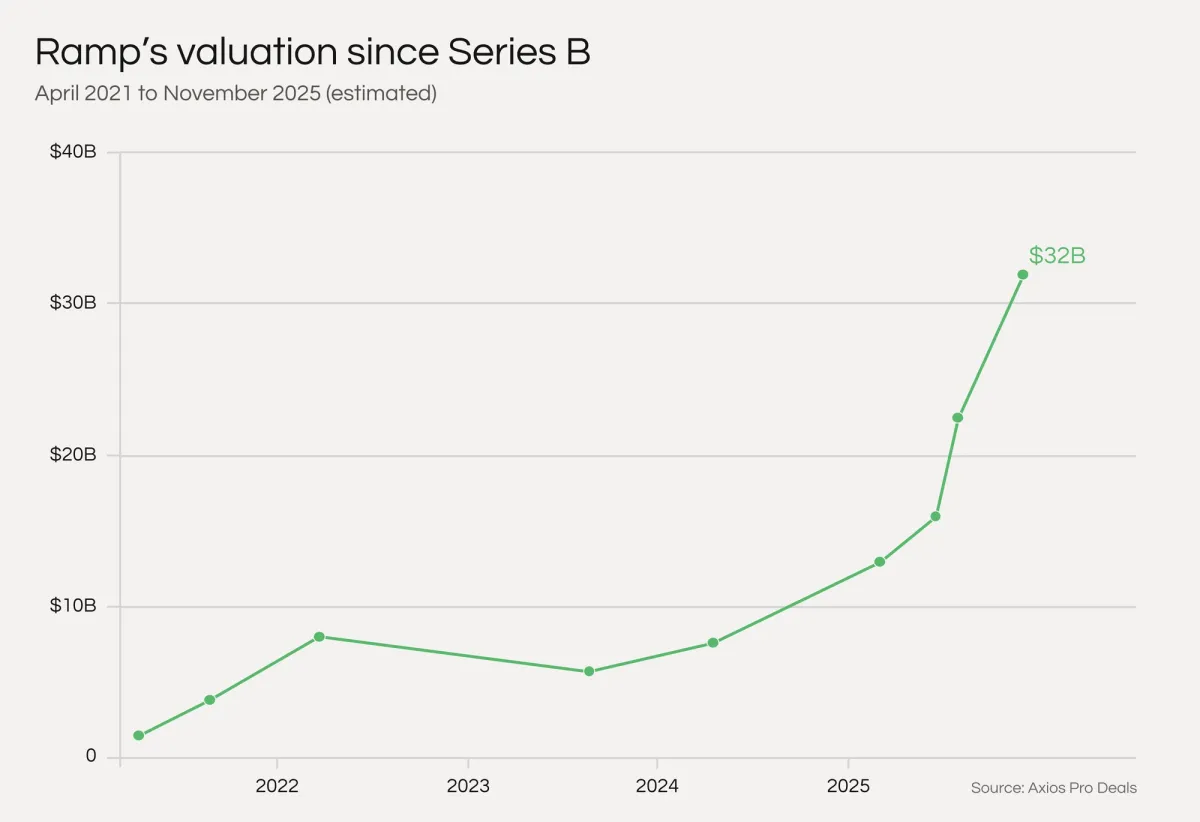

On November 17th, Ramp announced a $300 million primary financing round and employee tender offer at a $32 billion valuation, marking the company's third funding announcement in 2025. The round was led by Lightspeed Venture Partners, with participation from both existing and new investors including Founders Fund and Bessemer Venture Partners respectively.

This represents a significant and very impressive jump from the $22.5 billion valuation Ramp achieved in July, just 45 days after their $16 billion Series E in June. The company reports having surpassed $1 billion in annualized revenue this year, up from $500 million just 12 months ago, and now serves more than 50,000 customers.

In his announcement, CEO Eric Glyman introduced what he calls "the age of thinking money," describing how AI has fundamentally transformed corporate finance. In October alone, Ramp's AI made over 26 million decisions across more than $10 billion in customer spend, preventing 511,157 out-of-policy transactions and moving $5.5 million from idle cash to higher-yield investments.

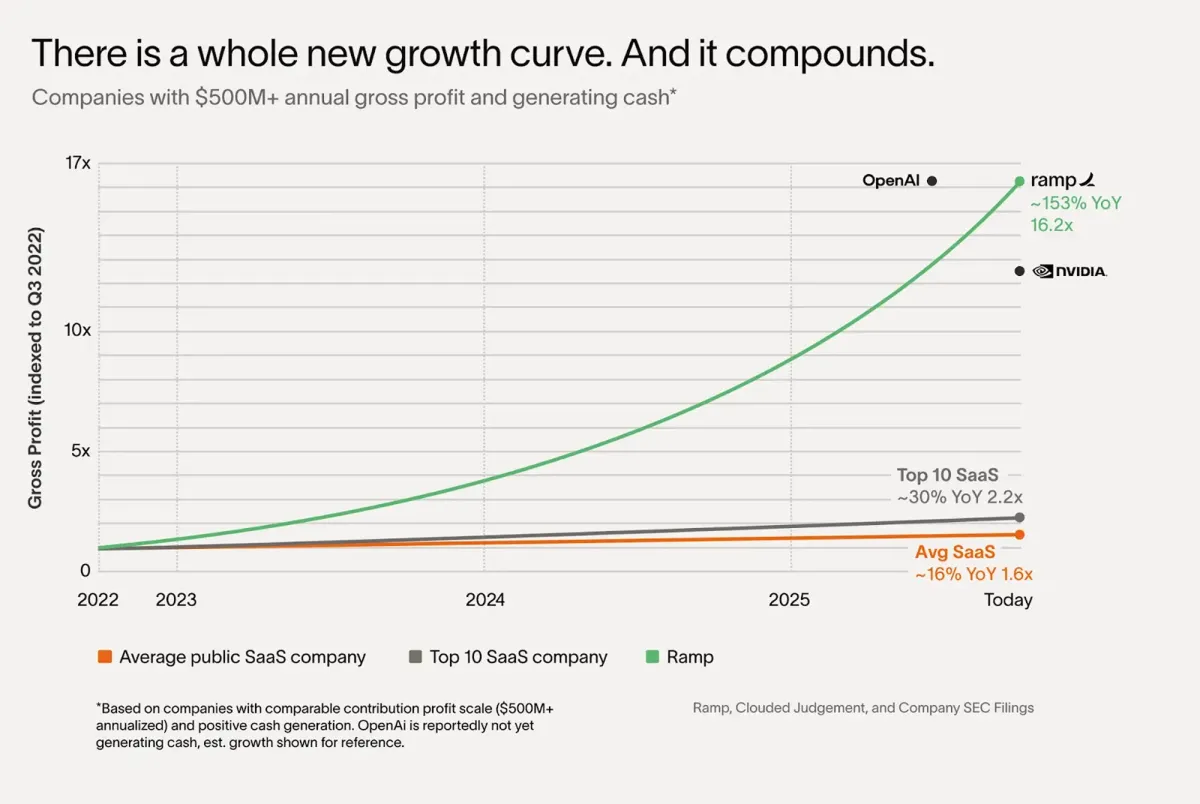

According to Glyman, Ramp's underlying profitability is growing 153% year-over-year—10x faster than the median publicly traded SaaS company. The median Ramp customer now saves 5% on expenses while growing revenue 12% year-over-year.

Read CEO Eric Glyman's full announcement on how AI is reshaping corporate financial operations.

For Fundrise investors interested in experiencing Ramp's platform firsthand, we've partnered with them to offer a unique opportunity. Visit ramp.com/partners/fundrise. 1

*For the fund's full portfolio holdings, click here.