The Fundrise Innovation Fund has invested $2 million into Jetty, a leading financial services platform for the rental real estate industry. Our investment is part of a round that includes other strategic investors like Citi Impact Fund (lead), Paypal Ventures, and Experian Ventures, and represents the fund’s second investment within the real estate and property technology (proptech) sector that we identified as a focus when we launched the fund last year.

For the more than 120 million Americans (36% of households)¹ who rent their homes, housing typically represents their largest expense. Accordingly, rental housing represents roughly 12% of US GDP², making it the largest addressable market by several measures. While technology has made large strides over the last two decades making it easier and more cost-effective for individuals to manage many aspects of their personal finances (e.g. banking, borrowing, investing), the rental real estate market has historically been overlooked in spite of its size, with many practices changing little over the past century.

Jetty recognized this opportunity and built an integrated financial services ecosystem that makes renting more flexible and affordable for renters, while at the same time enabling property managers to lease up faster and reduce bad debt. With the launch of their first four products and adoption by many of the largest owners and managers in the country (including Fundrise), Jetty is the clear leader in the race to modernize the financial services aspect of rental real estate, and well on their way to becoming the overall category winner.

Why we invested

- Integrated approach: Jetty’s mission to offer a best-in-class solution to all financial services related to renting (security deposit, renter’s insurance, flexible rent payments, credit bureau reporting, and more to come) within a unified platform, represents a major customer experience improvement when compared with individual point solutions, and also creates the opportunity to easily expand revenue by cross-selling additional solutions in the future.

- Strong track record of adoption: Jetty has proved they have what it takes to win and retain the business of the nation’s largest owners and managers. As of this writing, they can count 6 out of the top 10 residential owners and all four of the largest property managers among their clients. This strong execution to date gives us confidence that they will be able to scale their business to become the dominant provider to the industry.

- Invest value-add beyond capital: As a current client of Jetty, we expect to be able to provide useful input on product strategy to their team, as well as making introductions and providing references to potential new customers across the industry.

Market opportunity

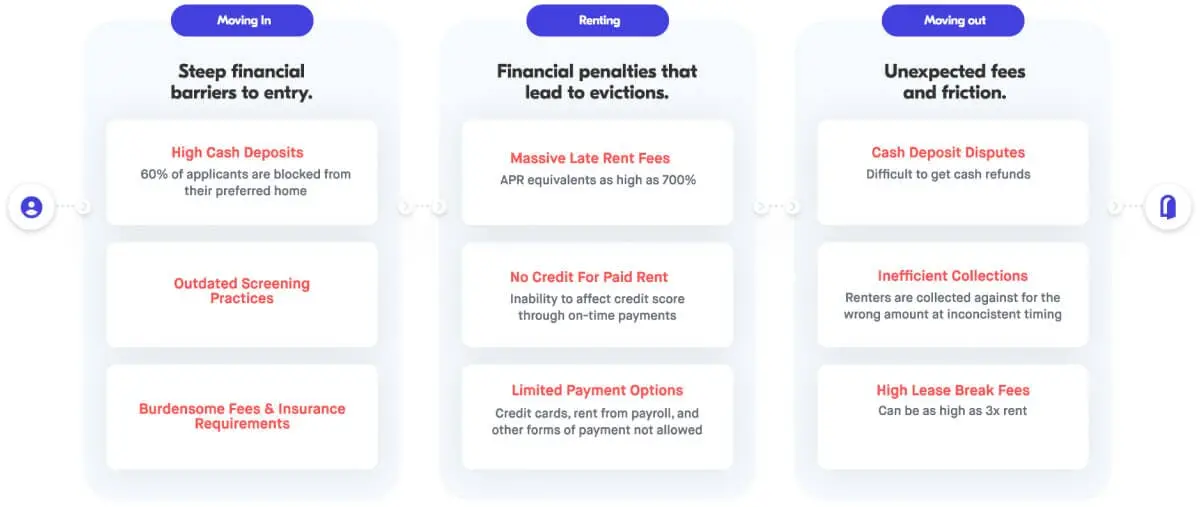

The tenant-facing financial services of rental real estate are largely still stuck in the last century. From requiring a full month’s rent as a security deposit, to inflexible rent payment terms with massive late fees, these outdated practices place increasing burden on tenants, in many cases without meaningfully improving outcomes for owners. Exacerbating this is the fact that rent growth has far outpaced wages, especially in high-growth, high-demand markets.

In effect, the absence of a more modern, tenant-friendly, and flexible alternative to these rigid practices has shrunk the pool of qualified tenants for any given property, and is at least partially to blame for high eviction rates (which, while being far more damaging to the renter, are also a costly, time-consuming headache for owners and should be avoided if at all possible).

A single technology platform to serve the industry’s most pressing needs

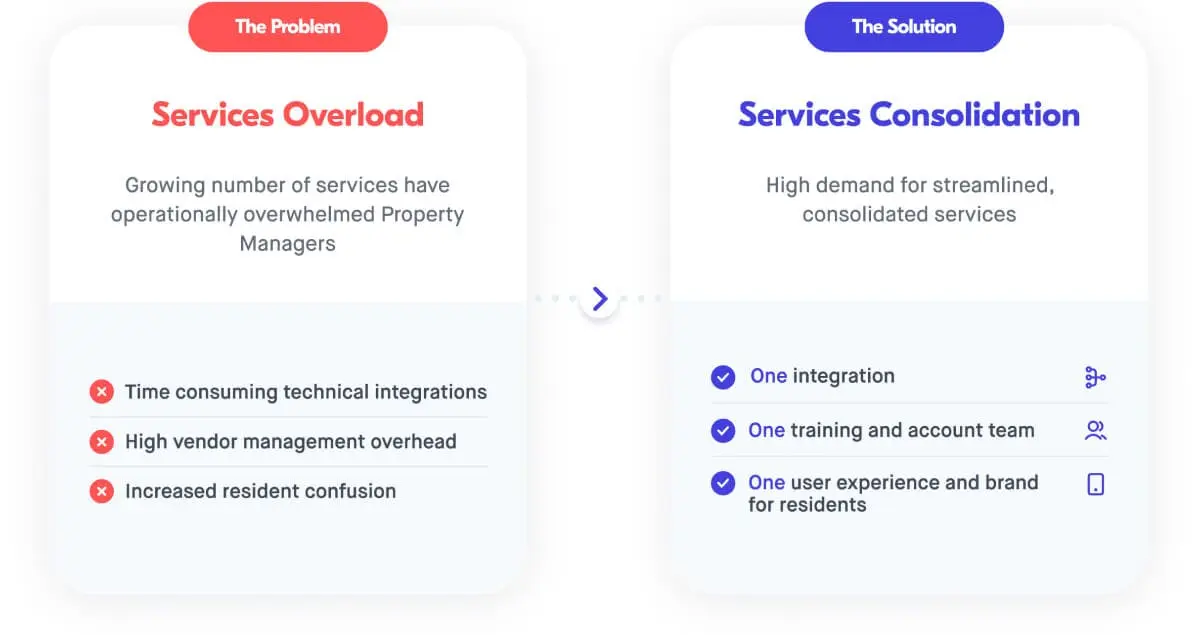

As has happened in many other industries which are early on in terms of being transformed by technology, the real estate world has seen a proliferation of “point solutions” — software products which only do one thing. While innovation in the space is welcomed and exciting, the downside of so many point solutions is services overload, the burden imposed on a business by having to make a purchase decision, negotiate a contract, set up and maintain integrations, and train team members on a different software system for each function in their business.

We see this firsthand at Fundrise, where we and our management partners currently use 28 — yes, you read that correctly — different software systems to handle the on-the-ground operations of our real estate business, which do everything from collecting applications and executing lease documents, to coordinating virtual tours, to tracking repair expenses.

The solutions fatigue is real, and operators are actively looking to consolidate their tech stacks to fewer partners that can each do several things well. Jetty recognized this problem from the beginning and has opted to build a single unified platform that can power all of the financial solutions that the industry needs.

Not only does this make for a more compelling product for both the renter and the owner who can get more things from one place, it has also created a tremendous competitive advantage for Jetty in terms of their technology leverage. This stems from the fact that all proptech software which serves the rental real estate industry must integrate on the back end with the property management and accounting system (usually Yardi or RealPage), for example to automatically post charges and payments to the accounting ledger, read or write unit and tenant information, and so on.

Building and maintaining this integration is a major, capital-intensive investment which can be as complex from an engineering standpoint as the actual features of the application itself. By offering multiple products and services through a single platform, Jetty has gotten much better returns on the time and money they put into their back-end integration than a point solution that only offers a security deposit alternative or on-time rent reporting.

Best-in-class product suite

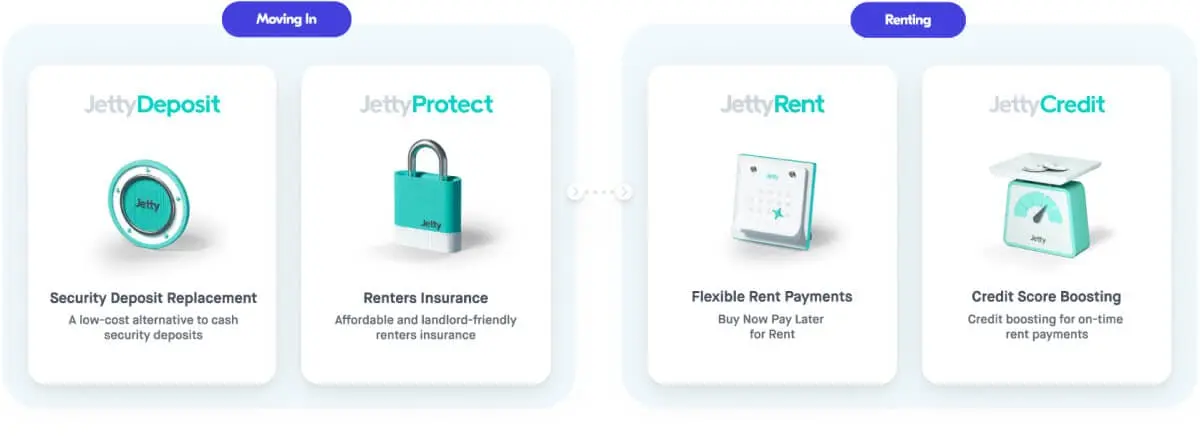

Jetty currently offers four products through their platform which solve the industry’s most pressing needs, with plans to add even more in the future, potentially consuming the entire resident life cycle from application to move-out.

Security deposit replacement

In place of the traditional one month’s rent cash security deposit, Jetty offers a security deposit replacement, which consists of a small monthly payment that is added onto the rent charge each month.

- Renters: Dramatically reduces the cash outlay at move-in.

- Owners: Makes the property more affordable without reducing rental rates, resulting in increased leasing conversion. Also offers coverage in excess of what one month’s rent would cover, reducing losses caused by damages.

Renter's insurance

Rather than introducing another party that both the renter and the owner need to interact with, Jetty brings affordable renter’s insurance onto their platform.

- Renters: Less hassle than dealing with a separate insurance agency (pay their insurance along with their monthly rent and utilities).

- Owners: Can ensure that all tenants have coverage without doing any additional work.

Flexible rent payments

Applying the “buy now pay later” concept to rent, Jetty will advance rent to the property owner on the 1st of the month and offer flexible repayment terms to the renter, which is all managed without the need for active involvement by the property owner/manager.

- Renters: Avoid costly late fees and damage to credit score if they fall behind on their rent.

- Owners: Get paid even if a tenant falls behind for a brief period. Reduces need to file evictions since tenants can catch up on their own timeline.

Rent reporting

Through a partnership with Fannie Mae, Jetty automates reporting rent payments to all three major credit bureaus on a monthly basis.

- Renters: Get credit for something they are doing already.

- Owners: Incentivizes on-time payments.

Looking ahead

With one in three Americans renting their homes, a number that is expected to grow in the coming years, modernizing the rental real estate market with technology is a generational opportunity. As the technology in the space matures, we expect the real estate world to follow the established pattern of point solutions going by the wayside in favor of consolidated platforms that bundle several related services. As users of their products across several parts of our own portfolio, we can see firsthand that Jetty is the clear leader in bringing best-in-class financial services to renters, and we’re excited to support the next phase of their growth.

Onward,

The Fundrise Team