We’re excited to announce that the Innovation Fund has led a strategic fundraising round into Inspectify, a vertically-integrated property inspection software platform and leading solution provider for inspection services in the United States and Canada. Our $4 million investment is joined by follow-on investments from existing investors Nine Four Ventures, Munich Re Ventures, Foundation Capital, and DivcoWest Ventures to bring the total size of the round to $5.76 million.

Inspectify represents our first investment within the real estate and property technology (proptech) sector that we identified as a focus when we launched the fund last year, and our earliest-stage investment to date. Having spent the last decade building our own technology company that touches nearly every part of the real estate value chain, we have a deep understanding of the problems and opportunities in the space that comes from a combination of building and buying (being an enterprise user of products that integrate with Fundrise’s proprietary tech stack).

In fact, we are one of Inspectify’s larger customers, having run nearly 5,000 property inspections through their platform over the past two years, and we consider their product essential to the superior operation of a real estate investment business.

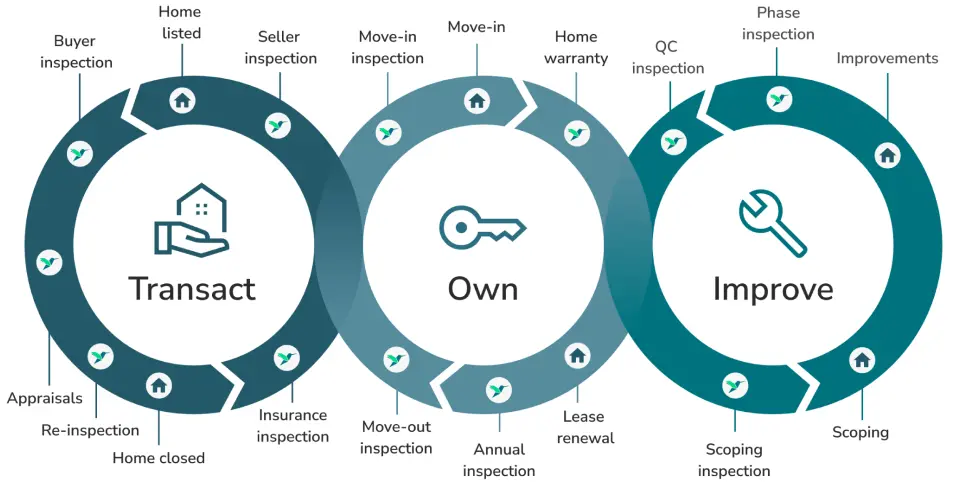

As anyone who works in the industry knows, inspections are a key data source that informs nearly every major decision in the real estate investment life cycle, including buying, financing, renovations, and ongoing repairs and maintenance, because inspections serve as the source of truth for the condition of the physical asset itself.

By leveraging technology to completely disrupt the status quo manual inspection industry, which is frictional to work with while at the same time falling short on providing actionable data for the party who wants to understand the property, we believe Inspectify has built the future of physical property diligence.

Like many other manual processes managed via spreadsheets and email, the opportunity for software is both obvious and subtle. Clearly, automation drives increased efficiency at a lower cost. However, less evident are the layers of data and applications that improve the quality of outcomes for the entire real estate value chain, from acquisitions to renovations, that cascade out from a simple inspection.

Imagine if everyone in the real estate industry had the accrued knowledge base of the entire inspection and repair industry since the beginning of time...

Why we invested

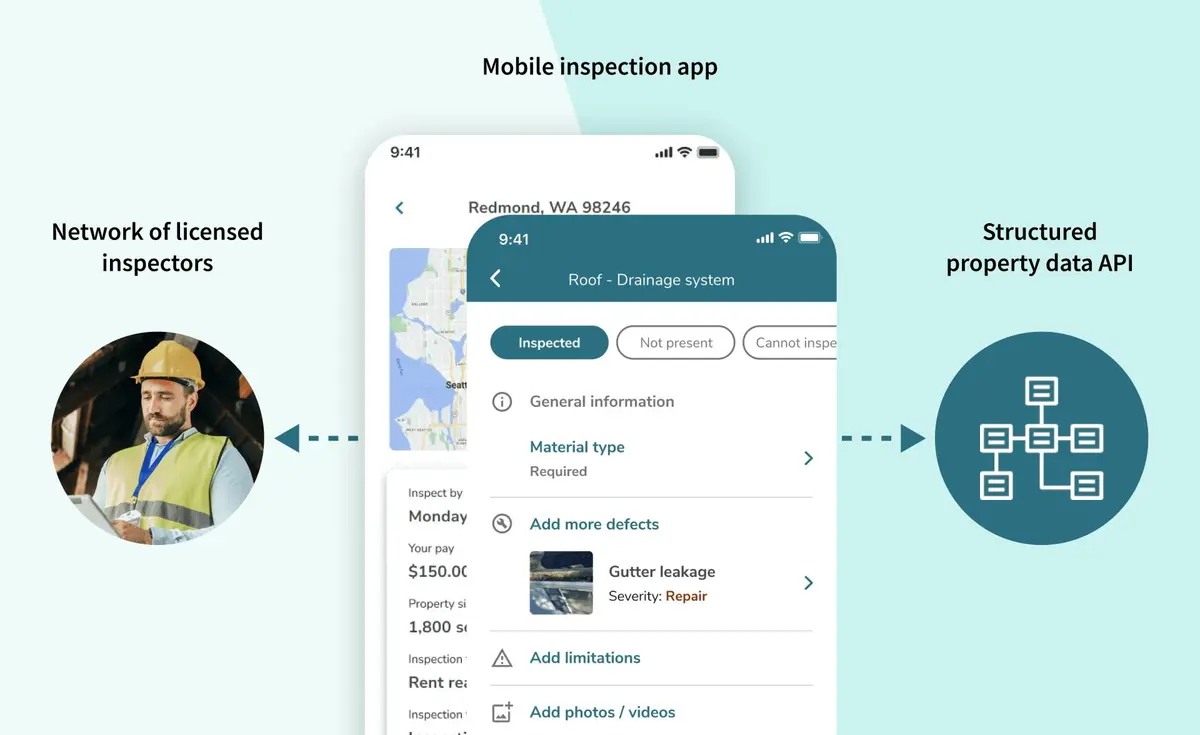

- Best-in-class software product: The Inspectify platform brings together customers and inspectors into an intuitive software ecosystem where structured data can pass back and forth seamlessly between parties. Their mobile app, which functions as the sole entry point for gathering property data, is the most advanced we've encountered and continues to leap ahead with each new version, incorporating an unparalleled set of features that work in concert to ensure the highest fidelity “digitization” of the real estate asset. The result is a superior customer experience and superior data.

- Largest partner network: Inspectify has built the largest network of inspection professionals in North America, onboarding over 15% of all licensed home inspectors and reaching 100% coverage of major metro areas in the US as well as three provinces in Canada. In the same way that ride-sharing services like Uber and Lyft are only useful if there’s a driver in your area, inspection as a service only works because of the combination of the partner network and logistics software. This Herculean effort in business development combined with an excellent partner retention experience through flexible scheduling, competitive pricing, and seamless payment, represents a major competitive moat.

- Invest value-add beyond capital: As one of Inspectify’s larger clients, we are a “power user” of their platform and expect to be able to provide useful input on product strategy to their team, as well as making introductions and providing references to potential new customers across the industry, including home builders, lenders, property managers, and other investors.

Market opportunity: the “point of sale” of real estate

Whether you’re an investor who is contemplating a new acquisition, a construction lender who wants to confirm that development is on track before you release additional funds, or a member of an in-house “turn team” who needs to assess the repairs needed on a rental unit before a new tenant can move in, you’re going to need an inspection.

These are just a few examples of the many parts of the real estate life cycle that need a timely and accurate assessment of the condition of a property, performed by a licensed professional who is trained to take a detailed inventory of the various systems that make up a building, and recognize deficiencies that range from the trivial (scuffed paint) to the potentially costly or dangerous (improperly wired electrical panel).

The status quo

When you need an inspection, you’ll usually find a local firm in the area where the property is located and coordinate scheduling via phone or email. This is fine for an individual homebuyer or a “mom and pop” investor with a handful of properties, but if you’re working with hundreds or thousands of properties at a time across multiple regions, as most institutionally-scaled investors, builders, lenders, and property managers are, manually coordinating inspections becomes a scheduling nightmare.

Until the advent of smartphones and tablets, inspections were done with pen and paper, though increasingly inspectors have transitioned to using some kind of app on a mobile device. While this has made life easier for the inspector, it hasn’t improved outcomes for the customer.

For one, the checklist of items (i.e., the data model) covered by the inspection is typically set by the inspection company — not the customer requesting the inspection — and may vary widely from one inspector to another. To provide a fictional example, Ace Inspections in the Houston area performs an individual assessment of each of the four exterior walls of the building, while Better Inspections in Atlanta only does an overall exterior assessment. So, the customer has inconsistent data coverage on their properties, and no systematic way to ensure that the inspector has done a thorough job.

Second, the vast majority of inspection reports are still only made available as PDF files. For a company aiming to use structured data to scale their business efficiently, this is no better than receiving a paper copy in the mail.

The combination of these two shortcomings makes it impossible for a company to incorporate inspection report data into any kind of data warehouse, where it could be then be used to automate workflows (e.g., aggregate deficiencies by team and assign owners) and serve as a queryable data source that the company could use to make better decisions (e.g., use appliance inventory data combined with lifetime/failure rate data to more accurately budget for repair and replacement).

At the end of the day, without ongoing structured data there can be little accountability between parties, and zero compounding knowledge. As a consequence, inspection reports are typically looked at once and then forgotten, despite the fact that they capture a treasure trove of data that is valuable years into the future. This represents a major missed opportunity for the entire real estate industry.

Inspectify’s product (and how we use it at Fundrise)

Inspectify has solved these shortcomings of the status quo industry through a technology-driven and vertically integrated approach. To help understand just how much better it is, let’s walk through it along with examples of how we use Inspectify at Fundrise.

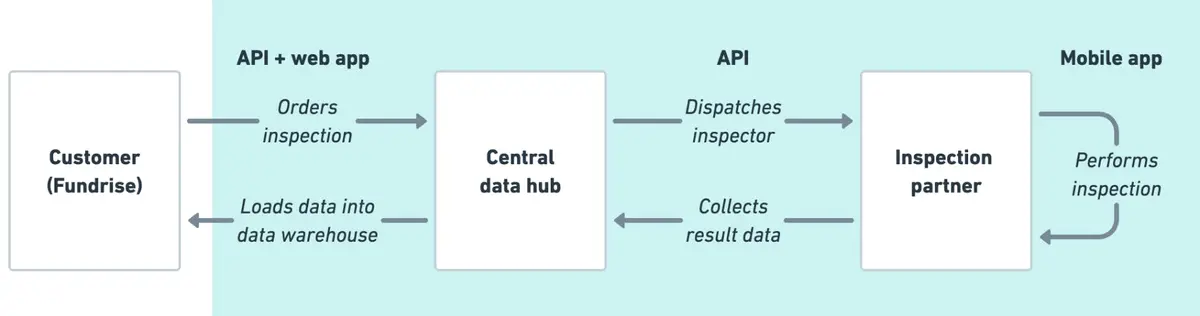

- Central data hub: At the core of Inspectify is a central data hub that both the third-party inspectors and the customers hook into as the sole means of communication between parties. This means that every one of the nearly 5,000 inspections we’ve ever ordered at Fundrise, along with cancellations, upcoming scheduled inspections, payment records, additional correspondence, etc. can all be managed in one place that’s accessible via a web app, but more importantly, via API (more on that later).

- Customizable inspection schema: Each customer can tailor one or more customized inspection data models to suit the needs of their business, that extends Inspectify’s smart defaults. At Fundrise, we’ve developed two distinct models — one for quality assurance on new construction build-for-rent homes that we perform before closing, and a second for general, community-level site walks of a potential new build-for-rent or multifamily investment. While there is a fair amount of overlap, each includes additional items based on what we want to learn given the context of the inspection. For example, the site-level schema captures community amenities such as a swimming pool or clubhouse, which are not applicable for a quality control inspection on a single house.

- Vertically integrated partner network: Inspectify has the largest network of licensed inspection professionals in the US and Canada. As a customer, Inspectify has done all of the work to identify, vet, and onboard these partners on our behalf. All we have to do is send Inspectify the property address and the desired inspection date, and a licensed inspector in-market will pick up the job and perform it using our custom schema.

- Mobile inspection app: Inspectify’s app is aware of which customer and inspection schema is being utilized for any given inspection and automatically loads that into the app when the inspector arrives on-site. It even tailors the logic so that if a deficiency is spotted, more in-depth information is required in order for the inspection to be completed.

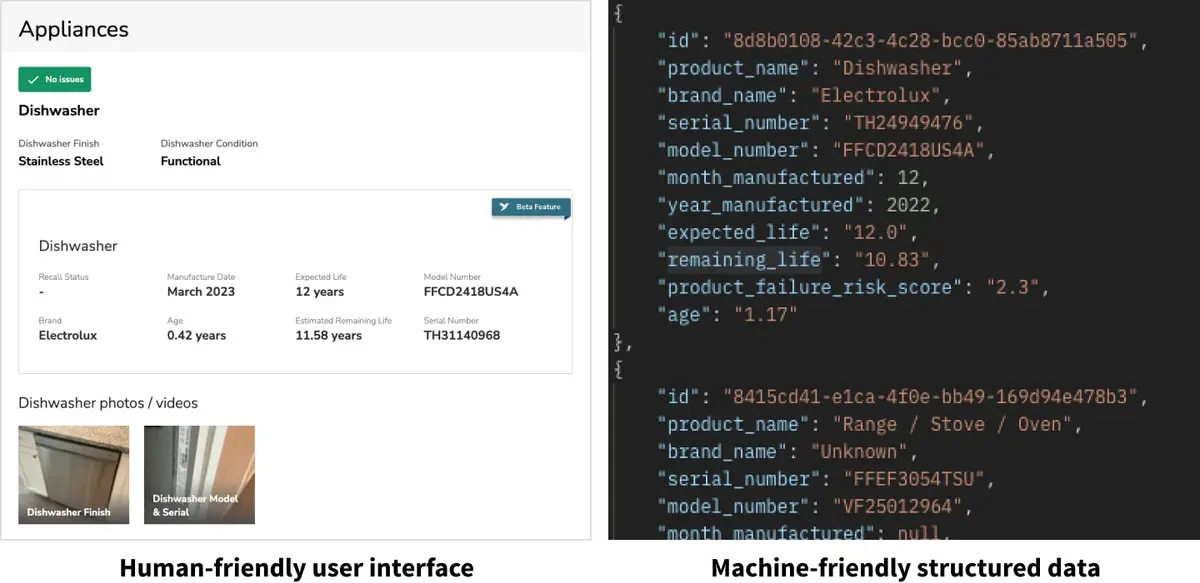

- Actionable inspection report: Inspectify has taken the traditional, static PDF inspection report and turned it into a dynamic tool that enables quicker consumption and more importantly faster actions upon the results. Navigation is seamless and reports can be filtered to enable tailored viewing to the customer. With an embedded work scoping tool, users are able to quickly build high fidelity scopes of work directly on top of the inspection reports to be able to coordinate and complete renovations and repairs faster and more accurately.

- API-driven workflows: On the inspector side, all inspection data gets posted to the data hub via API as soon as the inspection is completed. On the customer side, all core functions available within the web application are also exposed via the API. At Fundrise, we’ve built an integration to read our inspection reports into our proprietary real estate management system. The capabilities that this unlocks when inspection results are joined to the rest of our data are incredibly powerful.

What structured data unlocks for the real estate world

With properly structured data, it’s possible to power important workflows and answer nearly any reasonable business question with much less effort than would otherwise be needed. That’s the thinking as well behind the proprietary real estate management software we’ve been developing at Fundrise.

For us, the inspection report data provided by Inspectify represents a critical piece of the puzzle, at a more tactical level enabling us to systematically hold counterparties accountable to quality issues, but on a longer-term view, representing a granular yet structured inventory of the hundreds of data points that make up the physical assets themselves, in many cases including images as support. For those who are interested in the details, we’ve attached an example report on one of our homes, as well as a sample of the same data in JSON format (the format that comes over the network via the Inspectify API, which is then used to populate our data warehouse).

By joining well-structured data from Inspectify on construction materials, appliances, interior and exterior finishes, etc., together with operational, financial, and geographic data from other sources in our data warehouse, it becomes straightforward to understand how decisions made on the built product impact financial outcomes for the investor.

To provide a few examples:

- Does build quality, as measured by ongoing repair and maintenance expenses, differ meaningfully between homebuilders when controlling for other factors?

- How much more do units with premium finishes (hardwood floors, stone countertops, etc.) lease for? Is it enough to justify the additional cost to install and maintain them?

- Which HVAC systems are the most and least reliable? Beyond the repair and maintenance expense, reliable air conditioning is a major tenant quality of life consideration (i.e., lease renewal factor) in warmer climates.

While manual analysis on these types of questions by data scientists goes a long way, we believe that the long-term opportunity ultimately lies in machine learning (ML) models. With the product they’ve built, Inspectify is well-positioned to aggregate a large enough data set on the built environment to effectively train these types of models. It’s not difficult to imagine a predictive model that can provide an instant and reliable estimate of up-front and ongoing expenses based on what it knows about the subject property — and historical data from millions of others.

Looking ahead

The market opportunity for a technology-driven property inspection solution is immense. By capturing structured property data and integrating it into a knowledge graph of the built environment, Inspectify enables automation, informed decision-making, and increased efficiency for the entire real estate value chain.

Based on the impressive execution and results they have achieved in a short time, we are confident that Inspectify will continue to be at the forefront of transforming inspections and consume enough market share that they become the solution that every best-in class real estate company uses for inspections. At this scale, major unlocks that will enable the real estate industry to finally enter the world of data-driven operations and decision making. The Fundrise Innovation Fund is excited to support Inspectify's growth, and we can’t wait to see what they do next.

Onward,

The Fundrise Team