We’ve designed Fundrise in order to make our portfolios available to investors of all backgrounds and experience levels. One of our central goals is to make private real estate a viable asset type for everybody, not only the privileged segment of investors that the industry has traditionally favored.

However, it’s also absolutely critical to understand that despite our platform opening real estate to virtually all investors, there are certain approaches and behaviors that can make a significant difference in how a portfolio ultimately performs. In other words, all investors can use Fundrise to invest in real estate — but some investors will see stronger results, thanks to a few key ideas.

Fortunately, like Fundrise itself, the concepts that are most likely to make a difference on our platform are available to everyone, and they’re easy to learn: for private real estate to succeed, a portfolio requires adequate time, and it often benefits considerably from further infusements beyond an initial investment.

Why? One of the major reasons is the phenomenon of compound growth — a mathematical function so influential that Einstein is said to have once called it “the most powerful force in the universe.” The core idea — that ongoing returns can be added to an investment’s principal, so future returns become exponential — can be easy to overlook, because it starts slow and only becomes explosive later… but to underestimate its ultimate impact is to miss out on one of the most consistent miracles in finance.

Of course, compound growth’s potential is a driving force for most investments that can be held long-term, but private market real estate can be especially well suited for harnessing its power, largely thanks to its historically consistent returns (reliable compounding is a key ingredient) and, once again, the natural long-term time horizon that real estate requires, allowing for compounding to take root and yield its results.

Before reading about the scenarios themselves, a quick breakdown of the extensive assumptions we’ve made for all of them:

- For the sake of simplicity, we’ve assumed a 10% total IRR, net of fees, for every year covered in the investments hypothesized below, evenly split between dividends and appreciation, at 5% each. While Fundrise performance has historically been relatively consistent and usually fairly close to this figure, delivering exactly 10% every year is purely illustrative, and even in the case of excellent portfolio performance, our investments tend to “accelerate” over time, resulting in a J-curve, where returns are often backloaded. For the sake of these examples, we’ve stuck with pure consistency.

- Appreciation and dividends in these scenarios are compounded exactly on an annual basis, whereas dividend payments and reinvestment actually occur quarterly, while appreciation is ongoing.

- These projections aren’t meant to represent real assets or properties available on our platform, though the functions of the math are meant to simulate real features on our platform, such as dividend reinvestment and periodic auto-invest.

- Each scenario assumes an initial investment of $5,000, which is considerably more than Fundrise’s minimum investment of $10 and is again only used to showcase a number with easily digestible results.

- Finally, a reminder that these scenarios are purely theoretical, intended to illustrate mathematical potential, and are not meant to represent actual results on the Fundrise platform. They do, however, highlight how potent compound growth can be.

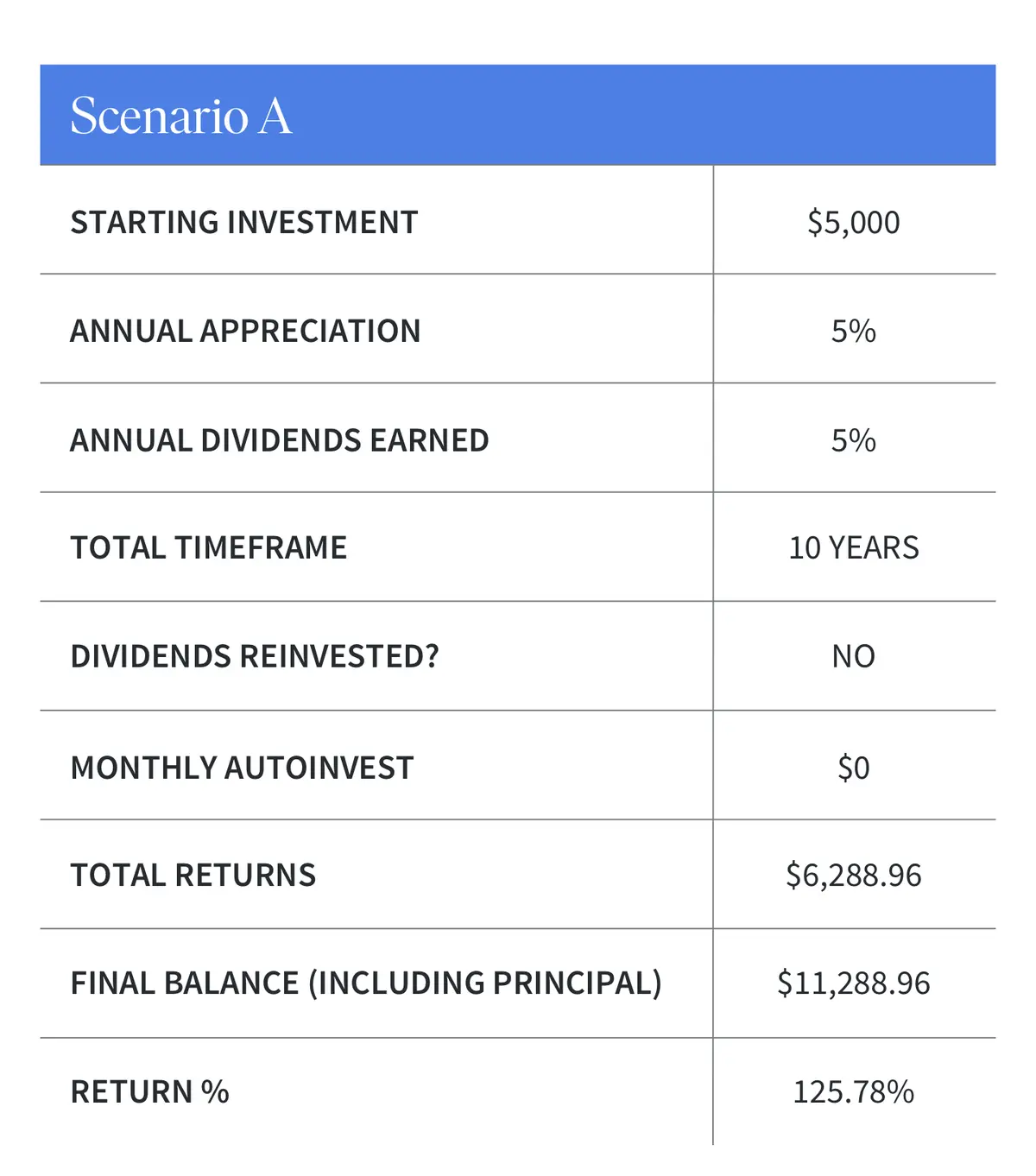

This is the simplest scenario we’ll look at — $5,000 invested and left to grow uninterrupted for 10 years. Each year, half of the annual 10% return is left to compound (the appreciation), while the other half is collected by the investor and does not contribute to future growth (this investor does not have dividend reinvestments turned on).

In this case, you can see that the results are… okay. If this were simple, repeated growth without any compounding, the returns would be exactly 100%, or $5,000 (10% return on $5,000 each year for 10 years). As it is, the extra 5% compounded each year results in a total additional gain of $1,288.96, or about 25.78%. While that is a significant bonus, it’s far from peak possible performance, if one allows for more complete compounding, as we’ll quickly see in the other examples below.

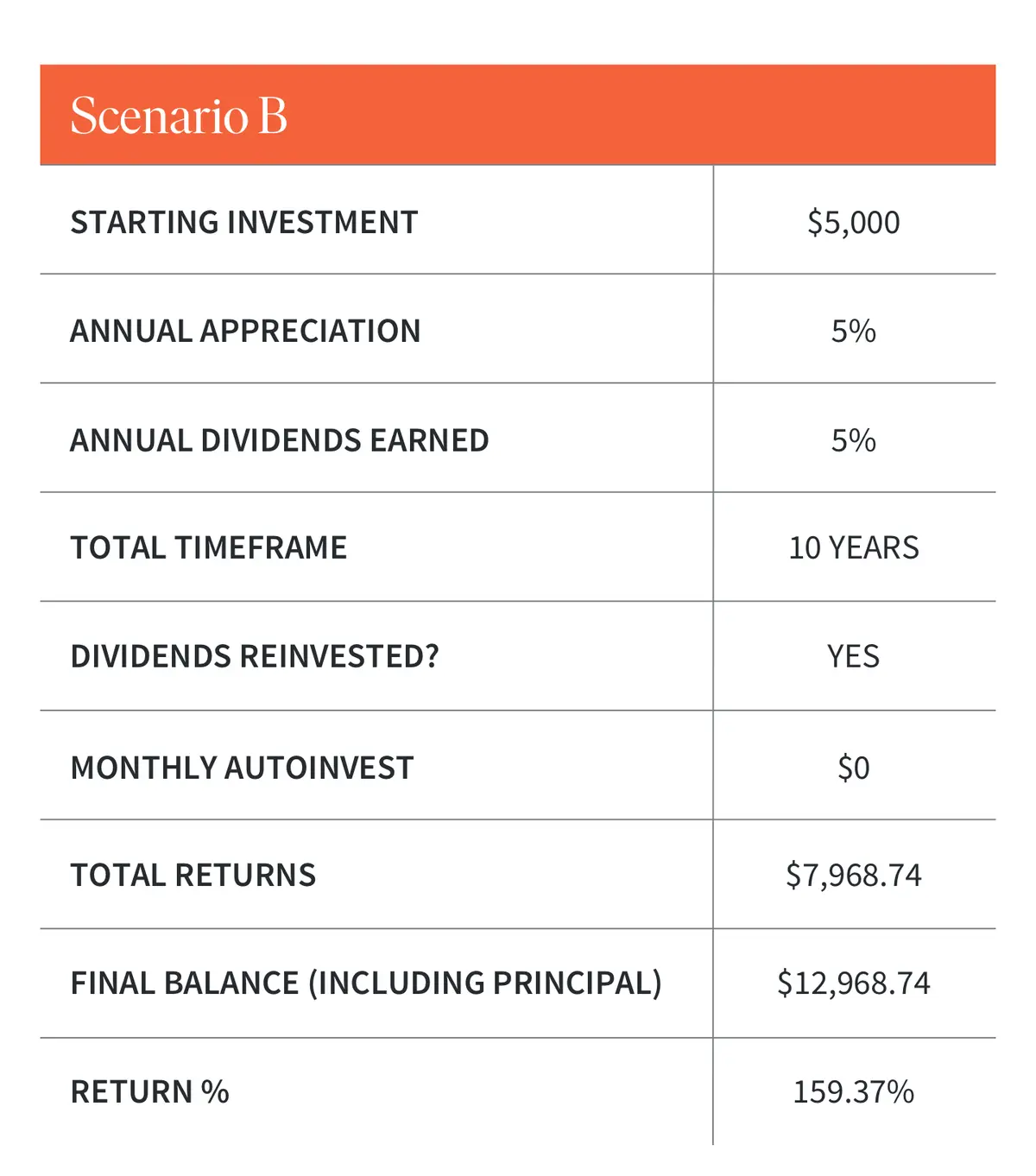

This example is identical to Scenario A, except that it incorporates dividend reinvestment. Or, in other words, it allows for the entirety of the investment’s return to have the opportunity to impact compound growth, as all of it goes back into the principal.

The effect is significant, and it begins to show just how critical the power of compounding can be. In this example, embracing dividend reinvestments results in a return of about $7,968, roughly 159% — a healthy improvement over Scenario A, where dividends were not reinvested.

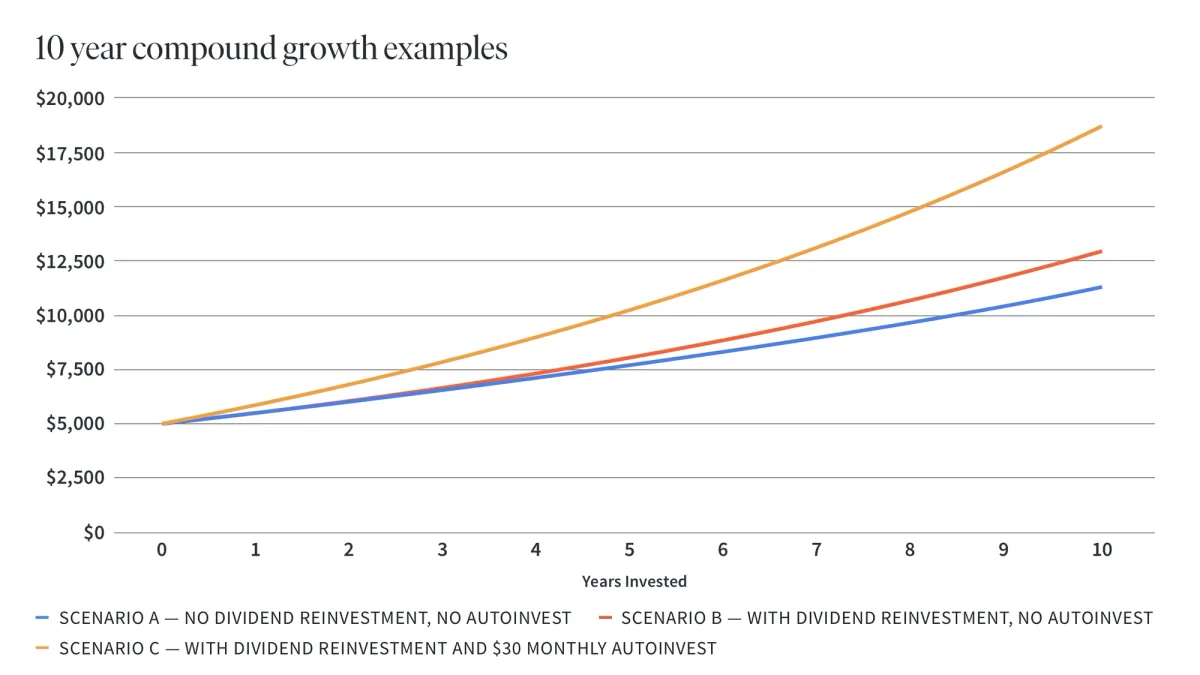

Last in our 10-year time horizon scenarios, we have a variation that introduces monthly autoinvest, a recurring amount automatically added to the principal — here, $30 (or a total of $3,600 over 10 years). While $30 per month isn’t a particularly large sum, its ultimate impact over the 10 year test period is substantial: Scenario C results in a total return of about $10,106, equal to roughly 117%.

However, it’s critical to point out that the return percentage here is significantly lower than either of the two previous scenarios, despite the larger dollar amount invested and the larger dollar amount earned. Because autoinvest is consistently increasing the investment’s principal, it’s increasing the denominator against which we judge the investment’s performance. And even more importantly, autoinvest contributions are made in regular installments throughout the duration of the entire ten years — the amount each contribution can take advantage of compound growth depends on when it was invested. A $30 infusion one year into the timeline can have a much greater impact than a $30 infusion made two months before the investment concludes.

Autoinvest is still extremely powerful — it creates an affordable way to expose more principal to an investment over time, which ultimately results in more absolute dollars earned. But as this scenario shows, by comparison autoinvest illustrates how much more powerful compound growth — and the time required for compound growth to function — can be to the bottomline creation of returns.

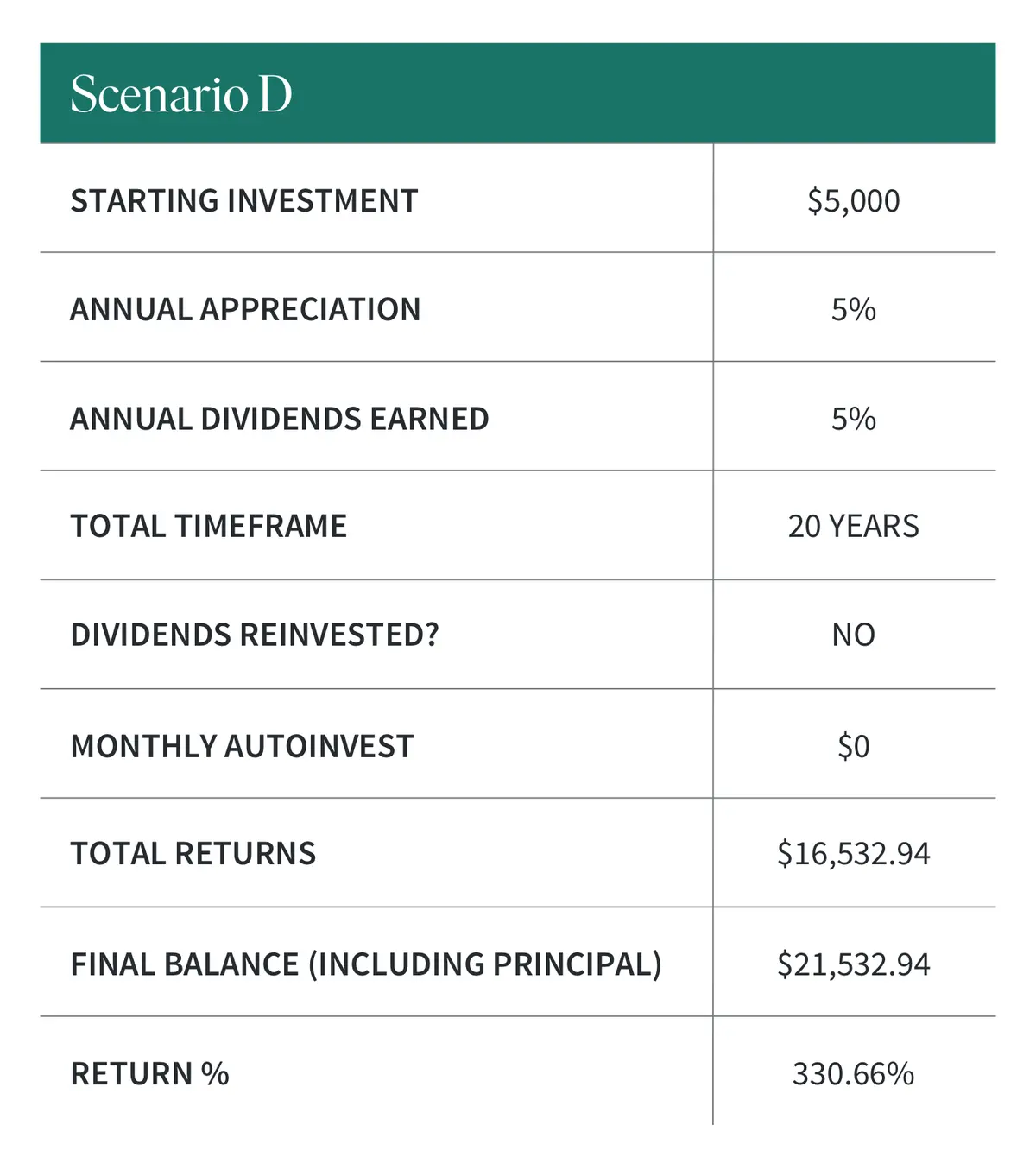

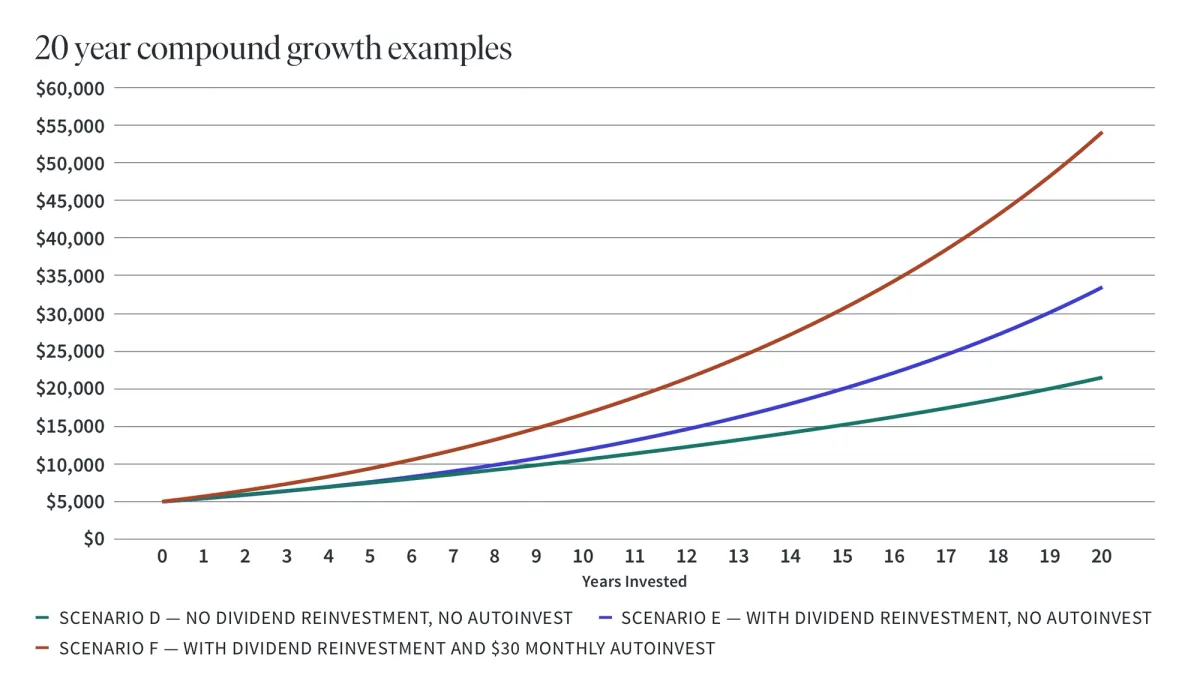

To drive this point home even further, let’s give compound growth even more time to work its magic. In the three additional scenarios below, there are replicas of Scenarios A, B, and C above, except that in each the timeline has been doubled, to 20 years. As you’ll see, thanks to the exponential nature of compounding, doubling the timeframe does much more than double the eventual results…

Back to the simplest example, with no dividend reinvestment — where only half of the annual returns have the opportunity to fuel compound growth. The result? A 164% increase in total returns over the analogue 10-year example, Scenario A — far more than double, despite only doubling the amount of time required. The extra work required? None: only the initial $5,000 investment.

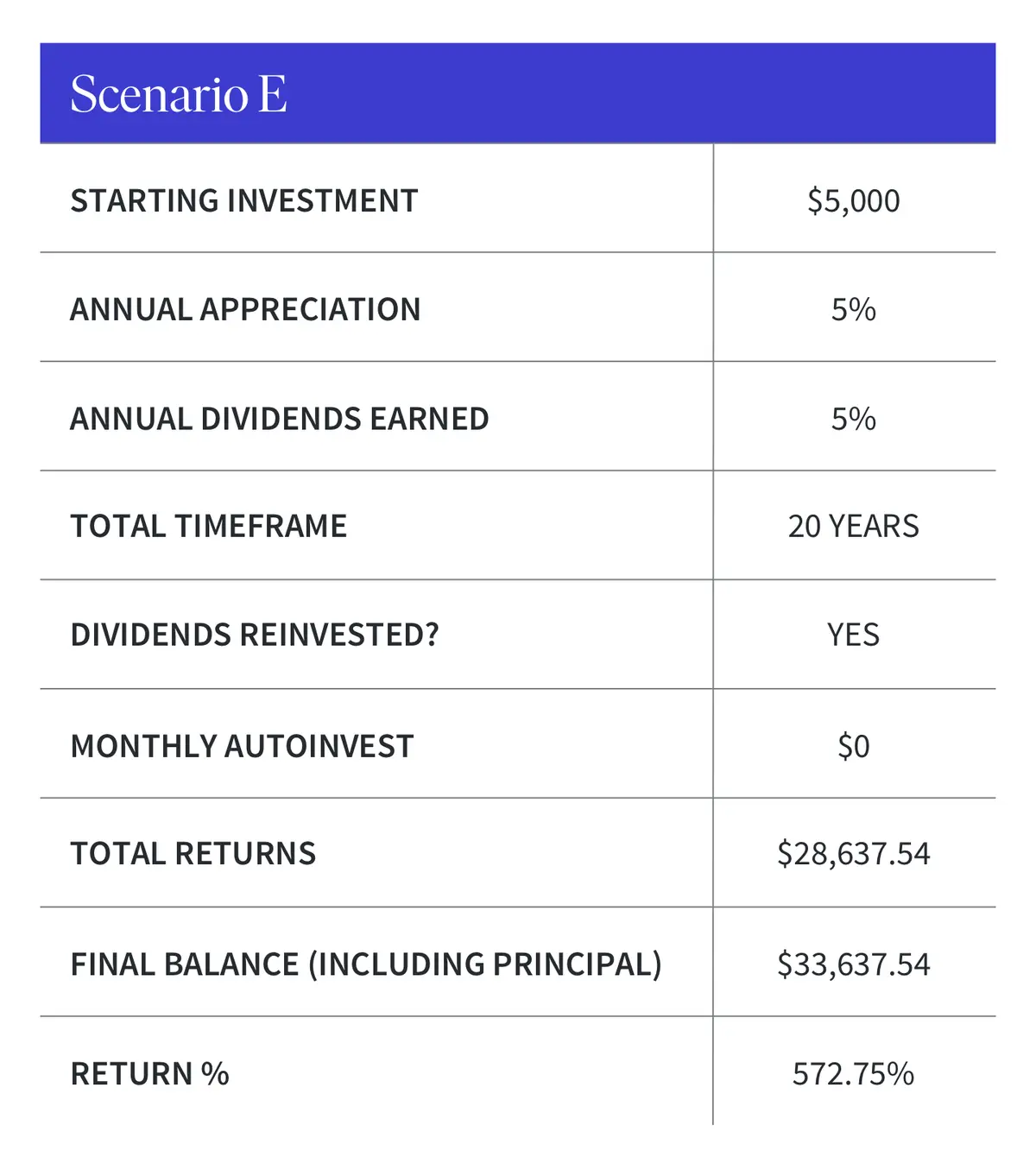

Scenario E is where the full potential of compounding really becomes apparent. Simply by turning on dividend reinvestment and allowing the full 10% annual return to compound over the entirety of the 20 year investment, our simulated investments (and unrealistically consistent performance) pocket a 572.75% return — or, $5,000 returns roughly $28,837, with no additional principal required.

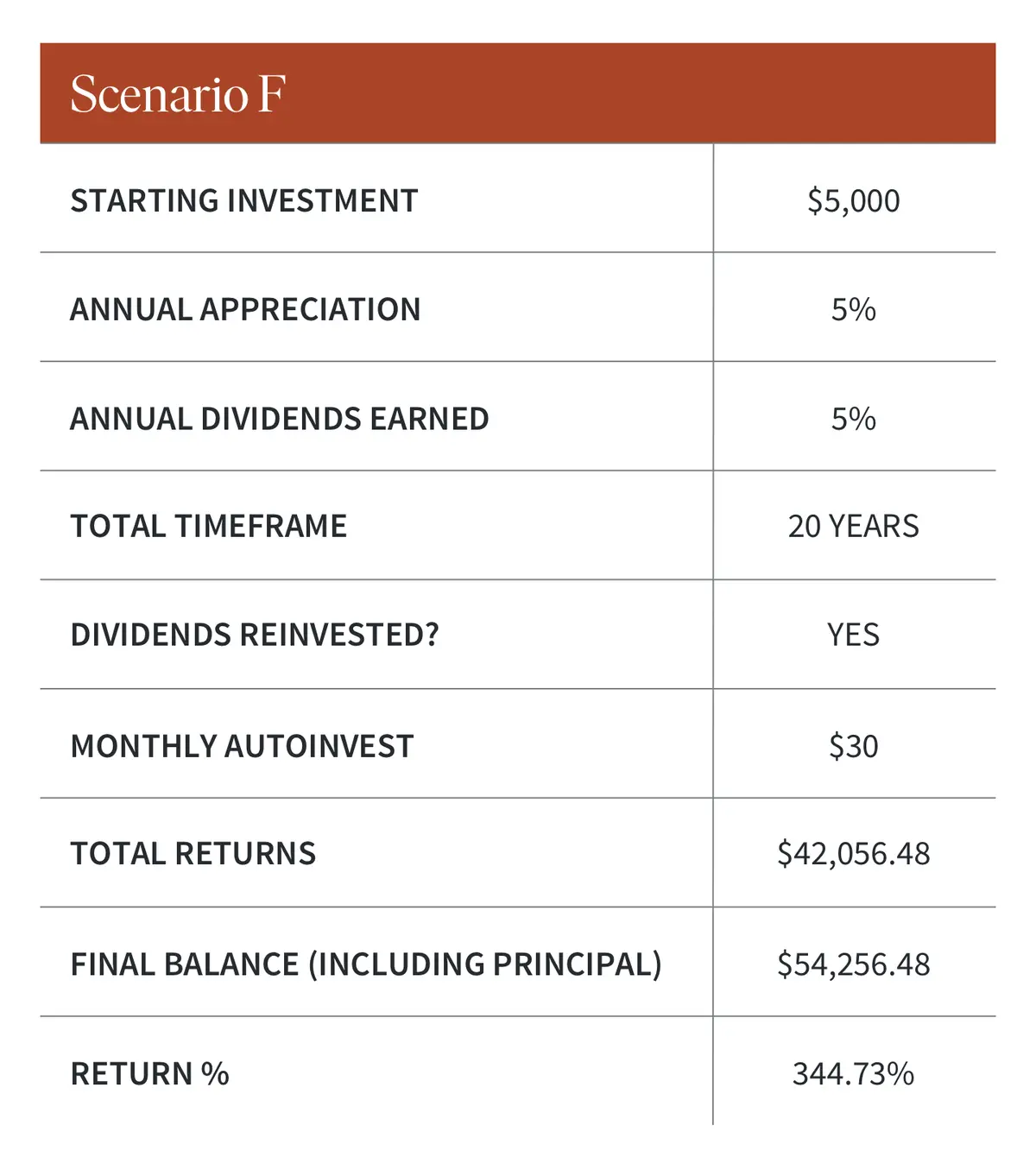

And lastly, reactivating $30 monthly autoinvest over 20 years, we see a starting investment of $5,000 grow into over $40k, albeit, once again, with a lower total return than in Scenario E. With what amounts to a $30 per month maintenance expense — the total principal becomes $12,200 by the end of the 20 year period — adding autoinvest to the power of dividend reinvestment and the explosive momentum of compound growth, the simulated investor here nurtures their initial funds into an amount truly transformative.

Long-term, powerful compound growth starts today

As it turns out, the biggest secret to compound growth is that there really is no secret — all it requires is patience, a plan to nurture your account over years (many years, if possible), the faith that math will follow its due course, and a consistent, stable long-term investment strategy.

Fortunately, with today’s accessible low-cost investment options, like Fundrise, that final element is no longer a challenge for virtually any investor. Capturing long-term compounding is not a question of knowing how to access it — it’s more a question of the investors themselves, and their capacities for patience.

Once you understand compound growth, you begin to recognize that time isn’t just a challenge that you need to wait through. It’s very possibly the most powerful tool you have in your financial arsenal. It’s no stretch to say the longer your timeline — and the more steely your dedication to your long-term plan — the greater your return potential becomes.

But, of course, the sooner you start, the more powerful your time-based leverage. As the cliche quote goes, “The best time to invest was yesterday. The second best time is today.” And, if we can add a bit more, for our compound-growth-minded investors, ready to embrace a long-term strategy: “And the next best time to invest is next month, and then the month after that, and the month after that, etc.”

Remember, it doesn’t take much to get started as a Fundrise investor. But with compounding, “not much,” invested again and again, can add up to quite a lot.